It’s good times in the US right now. A new Gallup poll shows that Americans, by a wide margin, see themselves as better off now than four years ago. The economy is growing, and the Fed’s current hands-off policy has cleared the field to let businesses grow. And investors are feeling adventurous; the stock markets are at or near record highs.

So, if you’re thinking trying out a ‘high risk, high reward’ stock strategy, now would be the time. A strong economy and rising markets will provide the buffer needed in case an investment doesn’t pan out, while the general growth trend will provide the lift for otherwise marginal investments to take off. In other words, this is the time to buy cheap stocks.

Cheap stocks – and here we’re talking about shares priced under $6 – get that way for a reason. Investors have sold them off in bulk, and that doesn’t happen unless the company, or its industry, has flashed some serious warning signs.

But once a stock falls down to that price level, the equation changes. Not all of these companies are down and out. While they’ve been sold off, their current low prices may now represent an incentive to buy – a low cost of entry that reduces the risk for investors. The key is finding low-cost stocks that also have a clear path toward future success. Because should one of these companies break out, the rewards are significant.

Using the TipRanks Stock Screener tool, we’ve found several cheap stocks to fit the profile. There are over 6,500 stocks in the TipRanks database, but by setting the Screener filters to show us only mirco- and small-cap companies, with Strong Buy consensus ratings and over 20% upside potential, we’ve narrowed the field down to 198, a far more manageable number to research. Here are three that investors should take note of.

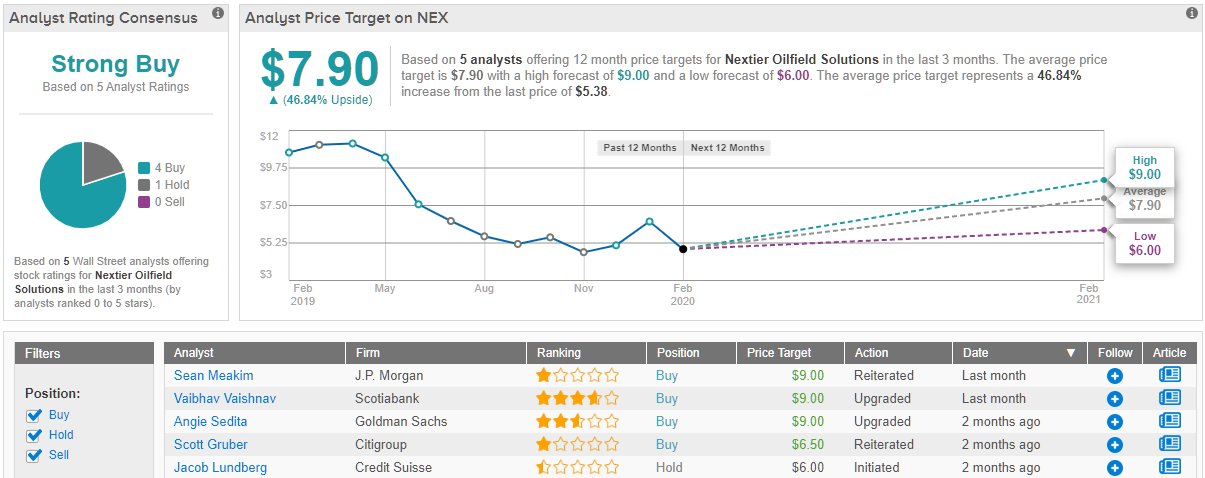

NexTier Oilfield Solutions (NEX)

We’ll get started where so much of the US economic boom has gotten started, in the energy sector. The first stock on our list is NexTier Oilfield Solutions, a provider of the support services that have made the fracking boom in the oil patch possible over the past decade. The company services include rig services, well completion, pumps and piping for fracking operations, and fluid management and disposal.

NexTier is a new-old company, formed through the corporate merger of Keane Group and C&J Energy Services during Q3 2019. NEX inherited Keane’s past performance legacy, and the name change of the combined entity reflects the merger-of-equals aspect of the move. The combined company is able to achieve cost efficiencies from scale unavailable to either of the original parts.

NEX reported better than expected earnings and revenue in Q3, beating the estimates, but is looking at a dip in Q4. Analysts expect a net loss of 2 cents per share. It’s important to note that Q4 includes the worst of winter weather, and that the winter quarters do show a tendency to underperform. Even so, the company still expects to see revenues in the range of $640 to $660 million, slightly higher than previous Q4 guidance.

Writing for JPMorgan, analyst Sean Meakim sees NEX as well-positioned to beat expectations for Q4. He believes the company will meet its new guidance – and since conventional wisdom is tracking lower, he believes that NEX will reap credit for outperforming. Meakim writes, “We think recent underperformance may be overdone and sets the shares up for a positive reaction. We believe NEX is likely to deliver guidance exceeding 1Q20 consensus estimates and benefit from demonstration of its ability to execute on the merger…”

Meakim backs his Buy rating with a $9 price target on NEX shares, suggesting a 67% upside potential. (To watch Meakim’s track record, click here)

All in all, NEX shares hold a Strong Buy from the analyst consensus rating, based on 4 Buys and 1 Hold. The stock is priced at just $5.33, but the upside potential is excellent: the average price target is $7.90, implying room for 47% growth in the next 12 months. (See NexTier’s stock analysis at TipRanks)

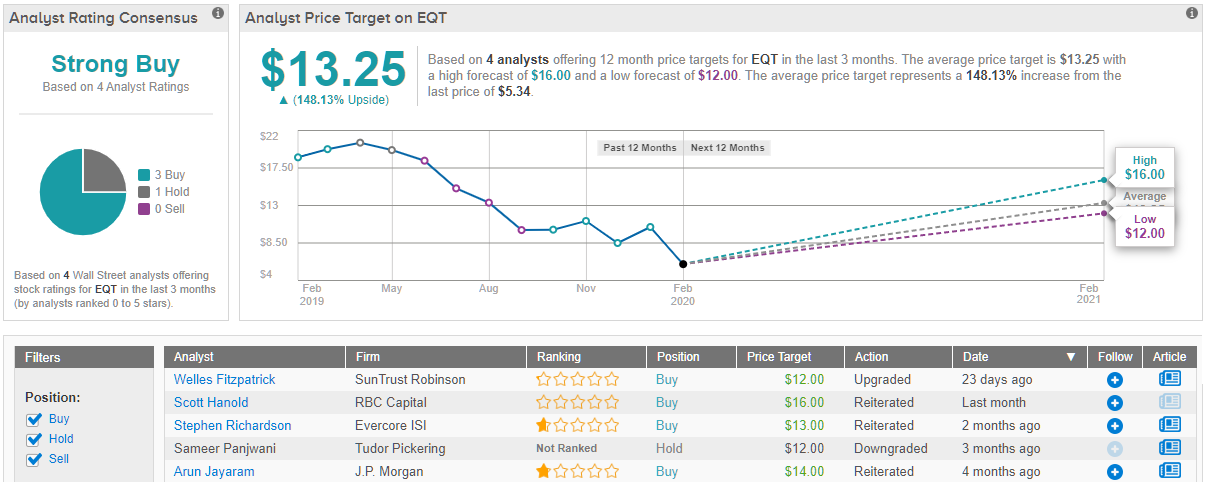

EQT Corporation (EQT)

With our second stock on the list, we’re staying in the energy sector. EQT is a major supplier of natural gas, owning or leasing exploration and extraction rights on over 1 million acres of land in Pennsylvania, West Virginia, and Ohio. The company’s holdings contain over 19.1 trillion cubic feet of proven reserves. In mid-2018, EQT spun off its midstream operations (pipelines and related transport assets) into Equitrans, allowing the parent company to focus on drilling and extraction.

EQT shares have faced pressure from the company’s earnings losses in recent quarters. With prices running low for both oil and natural gas, EQT posted net losses in both Q2 and Q3 of last year. Looking forward, however, analysts are predicting a strong fourth quarter, and expect a net-positive EPS of 9 cents. The company is set to release earnings on February 27, before the markets open.

Positive earnings will be a welcome shift, and not just for the inevitable impact on share value. EQT pays out a small, but highly reliable, dividend to shareholders, and with net earnings losses, the payout would not seem sustainable. The dividend is only 3 cents quarterly, but the 12-cent annual payment gives a yield of 2.27%, which is above the average found among S&P listed companies, and three-quarters of a point higher than treasury yields. EQT has maintained its dividend payment for the past seven years, and last raised it in November 2018.

Scotiabank analyst Holly Stewart sees EQT in a difficult place right now, but with a path out. She writes, “EQT has been nimble, tapping the high yield market as a window opened, pushing out its very near-term maturities. Our update with management confirmed that progress is being made through cost reductions, operational efficiencies, contract renegotiations, and of course refinancings. While we expect near-term challenges for the shares given the commodity’s ability to impact FCF, leverage and asset sales targets, we believe a rate change story will emerge over the months ahead.”

In line with her optimism on the stock, Stewart gives it a Buy rating and a $12 price target. Her target indicates confidence in a 127% upside potential! (To watch Stewart’s track record, click here)

Arun Jayaram, from JPMorgan, agrees with Stewart’s analysis. In his note on EQT last month, he said, “We expect a relatively neutral set-up to the print as the company preannounced upbeat 4Q19 results and reiterated its 2020 guide… Given weak natural gas fundamentals, we anticipate an acute focus on the company’s deleveraging program and incremental progress to simplify its services contracts with key midstream partners…”

Jayaram’s price target, $12.50, back up his Buy rating and implies an upside of 136%. (To watch Jayaram’s track record, click here)

Overall, EQT’s four most recent reviews include 3 Buys and 1 Hold, giving this stock its Strong Buy consensus rating. The shares are selling for just $5.28, and the average price target of $13.50 suggests room for a whopping 150% upside potential. (See EQT’s stock analysis at TipRanks)

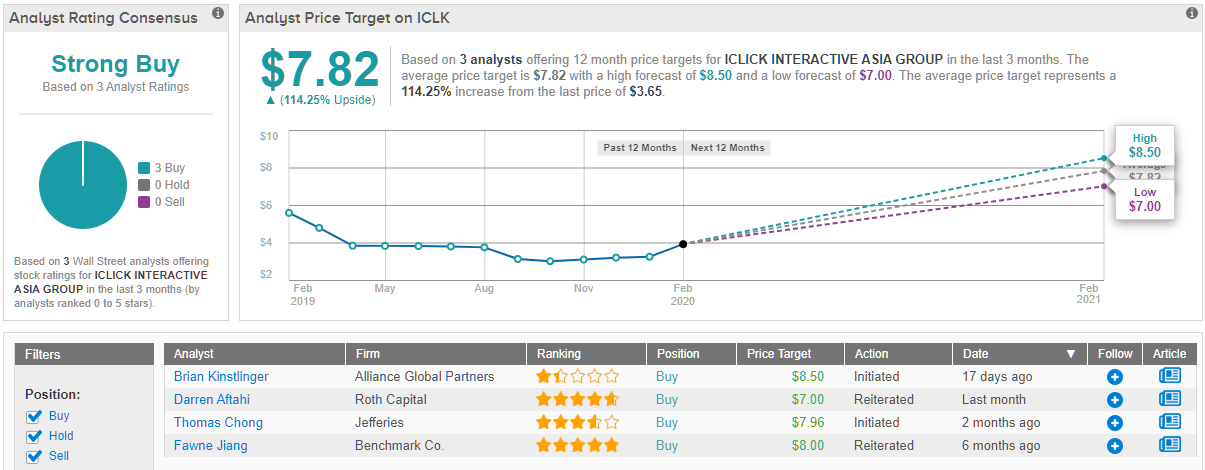

iClick Interactive Asia Group (ICLK)

Last up on today’s list is iClick, an online marketing tech platform, based in Hong Kong. The company’s platform provides customer solutions in digital marketing, data analysis, and software development. iClick’s services are applicable to ad exchanges and network, mobile apps and social media, and web publishers and content sites. The company reaches out to a world-wide customer base.

Shares in ICLK have languished below $4 in recent months as the company moved to gain access to credit while also taking on a new CEO. In a November announcement, the company issued a $20 million convertible note, payable over three years and bearing 5% annual interest. And in December, the company underwent a top management shakeup. iClick announced Jian Tang as CEO in mid-month, with the change effected on New Year’s Day. It’s interesting to note that, even as all of that was going on, ICLK also managed to beat expectations on Q3 earnings. Like many digital tech companies, it operated at a loss – but that loss was only 2 cents per share, against the 7 cents expected.

Looking ahead, Wall Street expects to see ICLK match that 2-cent loss in Q4. It’s important to note here that the company has beaten the forecasts in three of the past four reported quarters.

5-star analyst Darren Aftahi, of Roth Capital, puts an unequivocal Buy rating on ICLK shares. Supporting his stance, Aftahi writes, “4Q results should likely come in near the top end of prior guidance, which suggests ~4-5% upside to our model. The update heightens our confidence in ICLK’s long-term outlook for achieving greater scale, which should improve its growth and profit profile going forward.”

Aftahi gives the stock a $7 price target, which implies room for an 88% growth potential going forward. (To watch Aftahi’s track record, click here)

Of the stocks on this list, only ICLK gets a unanimous Strong Buy analyst consensus rating. All three recent reviews are Buys. The average price target is $7.82, slightly more aggressive than Aftahi’s above, and indicates a 110% upside potential from the current share price of $3.72. (See iClick’s stock analysis at TipRanks)