The market is very focused on the negative ramifications of the global economic shutdown from the coronavirus outbreak. The cannabis sector will be hit as hard as any sector if retail stores are closed in certain, but some states such as California have already identified medical cannabis as essential.

The U.S. cannabis sector could be hit harder with all of the companies in growth mode while facing liquidity issues. The sector remains trapped outside the traditional financing avenues due to government regulations with cannabis being illegal at the federal level.

Despite all of these headwinds, the U.S. cannabis market saw several states generate substantial growth in the last few months and quarters. U.S. multi-state operators (MSOs) positioned in the right states are riding waves of substantial growth due to either the legalization of medical cannabis in Pennsylvania, recreational cannabis in Illinois or the ongoing ramp of medical in Florida.

Pennsylvania is estimated to have grown Q4 revenues 50% sequentially to $130 million with additional growth in January to reach an annual run rate of $515 million. Illinois sales are expected to more than double in Q1 after the start of recreational cannabis sales on January 1. The state saw impressive medical sales of $79 million in Q4 alone and analysts estimate the market top $2 billion in annual sales.

Even Florida sales are booming. The MSOs working in these states will benefit from the addition of recreational sales. Remember that MSOs haven’t even reported Q4 numbers, much less provided guidance for Q1.

We’ve delved into these three companies with solid potential for rewarding shareholders as coronavirus related fears disappear from the market in the weeks ahead. Using TipRanks’ Stock Comparison tool, we lined up the three alongside each other to give us an idea of what the Street thinks is in store for the trio in the year ahead.

Cresco Labs (CRLBF)

Investors probably can’t go wrong with most of the stocks in the MSO space, but one favorite is Cresco Labs. The company has leading market positions to benefit from legalization of recreational cannabis sales in Illinois and booming medical cannabis sales in Pennsylvania.

Cresco Labs has seen their market cap collapse to below $1 billion while the business remains relatively strong. The coronavirus fallout is very unknown with a lot of states seeing medical cannabis facilities as essential to remain open for public health so the worse outcome of all stores closing probably is off the table.

The company has one of the top market share positions in both Illinois and Pennsylvania and has plans to implement curbside services in addition to deliveries. The strong sales in these states should help Cresco meet targets, possibly even with the economic slowdown from the virus outbreak.

Analysts forecast sales topping $500 million this year and up to $830 million in 2021. The stock is down more than 50% from just the highs of 2020. Cresco Labs has a 52-high back above $14 showing how hard even the best stocks in the sector have been hit.

As of March, the company will have pro-forma cash of ~$115 million after completing the Tryke Companies deal and raising money with sale-leaseback deals in Illinois and Ohio along on top of debt financing.

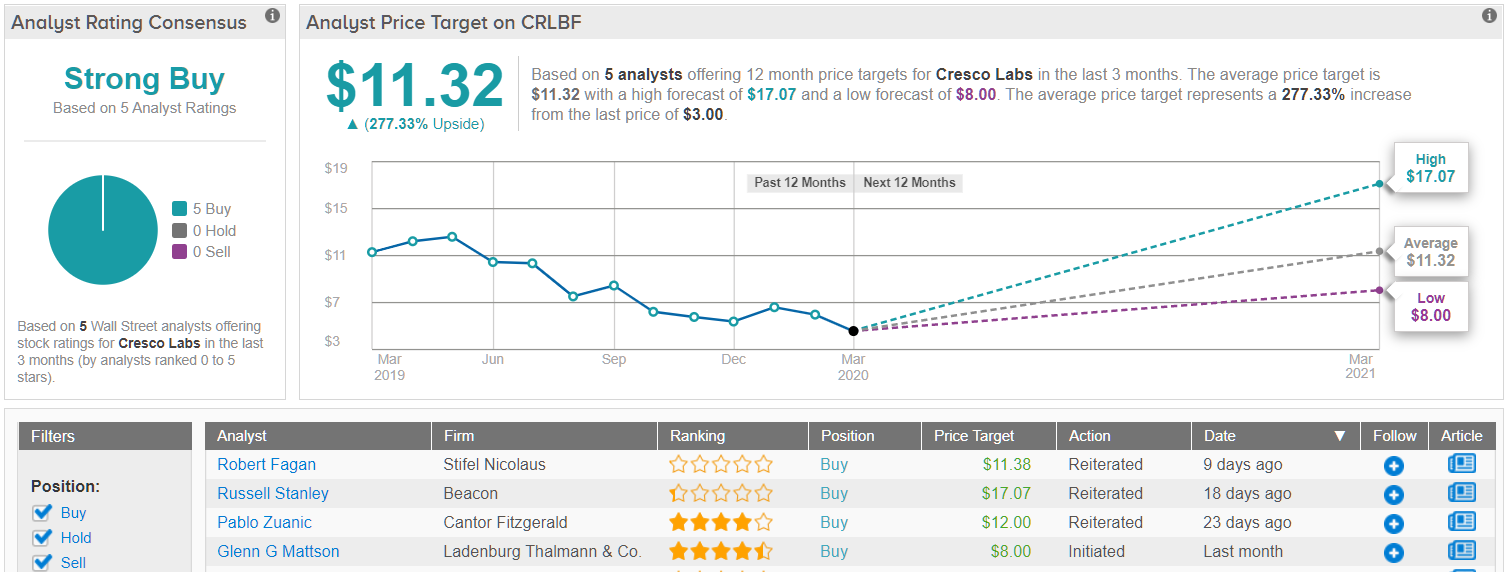

All in all, this cannabis player is without question a Wall Street favorite, considering TipRanks analytics indicate Cresco Labs as a Strong Buy. Out of 5 analysts polled by TipRanks in the last 3 months, all 5 are bullish on the stock. With a return potential of nearly 280%, the stock’s consensus target price stands at $11.32. (See Cresco Labs stock analysis on TipRanks)

Green Thumb Industries (GTBIF)

Similar to Cresco Labs, Green Thumb Industries is a leading player in both Illinois and Pennsylvania. Unlike Cresco Labs, the company isn’t aggressive in the acquisition market and isn’t reliant on pending acquisitions or carry the risks of integrating deals.

The company has operations in 12 states including key locations of California, Florida, Illinois, Massachusetts, New York, Ohio and Pennsylvania. Green Thumb has 13 production facilities, 41 open stores and 96 retail licenses for substantial expansion plans ahead even before the majority of these states add recreational cannabis in future years.

Green Thumb reported $68 million in Q3 revenues and is expected to see over $70 million in Q4 revenues when the company reports after the close on March 26. The company just completed a sales-leaseback with Innovative Industrial Properties (IIPR) to provide $9 million in cash plus another $41 million to complete improvements to a processing facility.

Similar to other cannabis stocks, Green Thumb is down about 50% from highs just a few months ago. The stock had a 52-week high above $16 and now trades down in the $5s.

With 214 million shares outstanding as of back in September, Green Thumb has a market cap of $1.2 billion. Analysts expect the cannabis company to generate 2020 revenues of $457 million so the stock isn’t the same bargain as Cresco Labs.

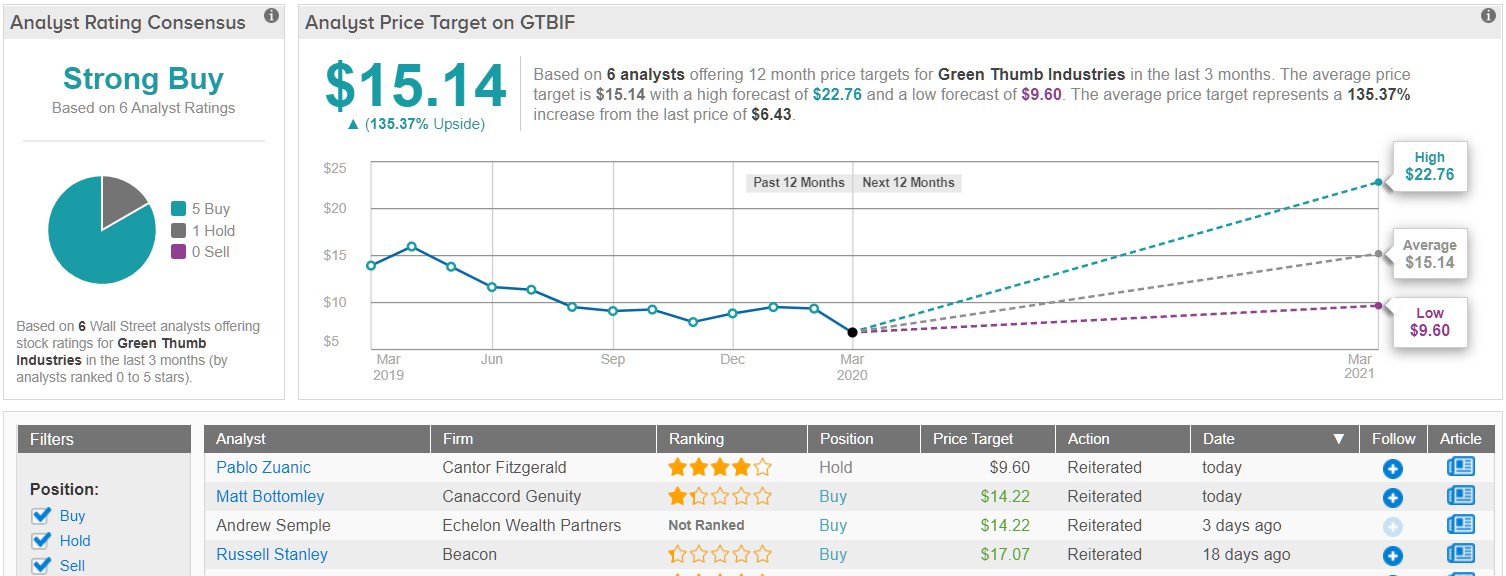

Overall, most of the Street have not given up on this cannabis player just yet, as TipRanks analytics showcase Green Thumb as a Strong Buy. Out of 6 analysts tracked in the last 3 months, 5 are bullish on the stock, while only one remains sidelined. (See Green Thumb stock analysis on TipRanks)

Trulieve (TCNNF)

The safety play in the sector is Trulieve Cannabis. The company is highly focused on the Florida medical cannabis market and generates substantial EBITDA margins due to dominating one market due to a first mover advantage.

The cannabis company has over 40 dispensaries in Florida and has commenced operations in California, Massachusetts and Connecticut to provide a growth plan beyond just Florida. Trulieve can slowly utilize 40+% EBTIDA margins to slowly fund expansion outside of the Sunshine state.

The company ended November with over $100 million in cash and appears to have sailed right past the negative Grizzly Research report. The market cap is near $800 million now with revenue estimates of $400 million in 2020 and up to $500 million in 2021.

A big key to investing in Trulieve is the future optionality of recreational cannabis approval at a future point. A similar boost as with Illinois would lead to total cannabis sales in the state doubling and tripling current targets providing substantial upside.

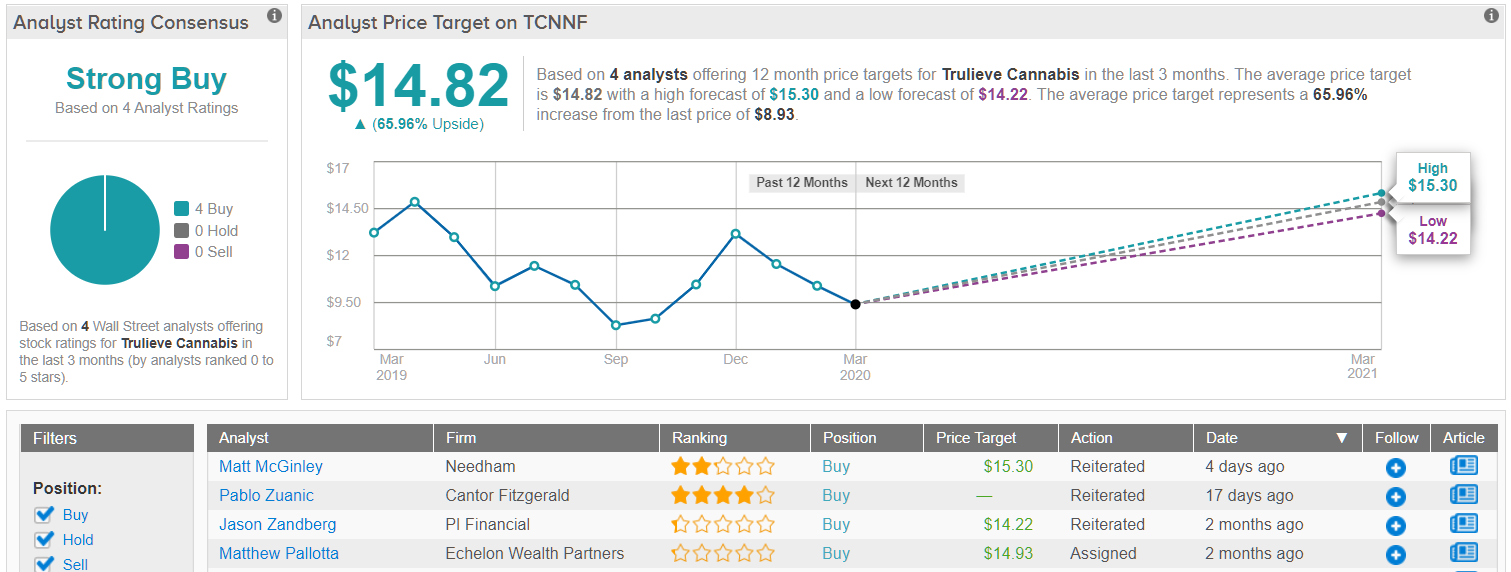

We can see from TipRanks that Trulieve has regained its “Strong Buy” rating. In the last three months, the stock has received 4 Buy ratings and no Holds or Sells. Based on these ratings, the average $14.82 price target on Trulieve stock translates into upside of over 60% from the current share price. (See Trulieve stock analysis on TipRanks)