Even after a sector bounce the last couple of days, the Canadian cannabis sector is down substantially for the year. The Canadian cannabis sales haven’t lived up to expectations after recreational cannabis legalization in October 2018 and the provinces over ordered product during the prior quarter. The vast majority of the sector faced returns and allowances that crushed the sector stocks during the recent Q3 reporting season.

The major problem hurting the sector is over supply in dried flower due to a general focus of the big Canadian firms on the farming aspects of cultivation. The companies likely to succeed in 2020 are the ones in ancillary markets that benefit from sales growth in Canada and not impacted by the pricing pressure under cutting actual growth in kilograms sold in the country. Even better are companies with the financial resources to invest in the sector at the lows while most cannabis companies are reeling back investments and closing facilities due to financing issues.

Despite a global market still foretasted to top $200 billion in annual sales in the distant future, investors need to dig deep to find cannabis stocks bucking the trend under the radar of the general investor. A lot of these stocks are playing into the Cannabis 2.0 rollout in 2020 along with benefiting from the eventual retail store roll-out next year.

We’ve delved into three cannabis companies that hit the mark during the last quarter and offer investors a chance to outperform the market.

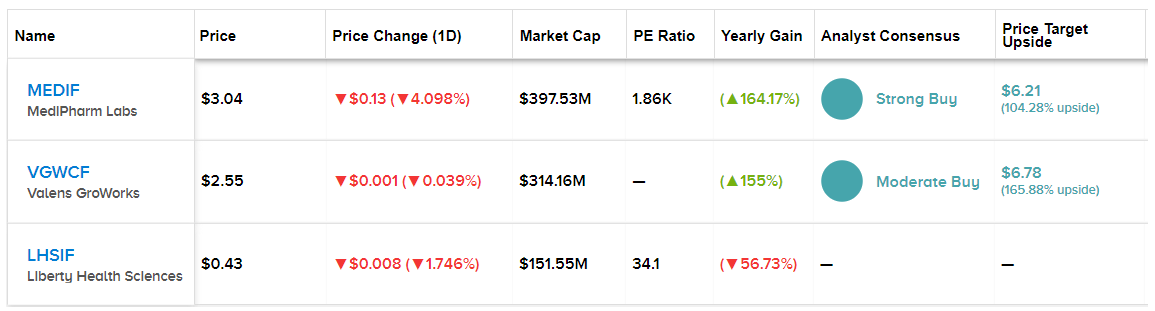

Stock Comparison Tool | TipRanks

MediPharm Labs (MEDIF)

The Canadian cannabis extraction company grew revenues substantially in Q3 providing the support for the stable stock price here. Unlike the other Canadian cannabis companies, the company generates solid adjusted EBITDA profits due to solid margins by participating in the actual growth in demand in the industry without the oversupply issues.

For Q3, revenues increased 38% sequentially to C$43.4 million. The key to the stock is that MediPharm isn’t just growing for the sake of growing. The company generated an adjusted EBITDA margin of 23% in Q3 driving C$10.1 million in EBITDA profits. For the YTD period, the adjusted EBITDA profit is C$22.1 million placing the cannabis extraction firm in a strong position as they operate in a sector offering a premium service without the high level of competition in the sector highly focused on cultivation.

MediPharm is on a major capacity expansion plan with a recent increase in annual cannabis extraction processing capacity to 300,000 kg. The importance here is expanding capacity along with demand versus outlandish goals before the market was ready.

Due to the stock only trading with a market cap of $400 million as MediPharm has slipped from the highs due to general sector weakness, the stock is a solid bargain. The company is already generating annualized revenue growth of ~C$170 million while expecting substantial growth in 2020

Based on all the above factors, Wall Street analysts are thoroughly impressed with MediPharm. TipRanks’ survey of stock analyst ratings shows that, on average, Wall Street considers the cannabis stock a “strong buy,” and capable of delivering as much as a 105% profit if it reaches its $104 price target. (See MediPharm’s price targets and analyst ratings on TipRanks)

Valens GroWorks (VGWCF)

Similar to MediPharm, Valens GroWorks works in the cannabis extraction sector. The company reported FQ3 results back in October that were highly impressive so their inclusion on the list was based on a recent investment in cannabis-infused beverages.

The company bought all of the outstanding shares of Southern Cliff Brands d/b/a Pommies cider in a cash and stock deal valued at C$7.5 million. The deal allows Valens to enter the high-growth edibles and beverages market in Canada with an estimated value of C$2.0+ billion according to Deloitte.

Valens plans to invest C$10.0 million in the facility to create a facility with beverage capacity of 40 million units allowing the company to progress with white label product offerings. The recent agreement with the cannabis division of Iconic Brewing fits perfectly into this facility.

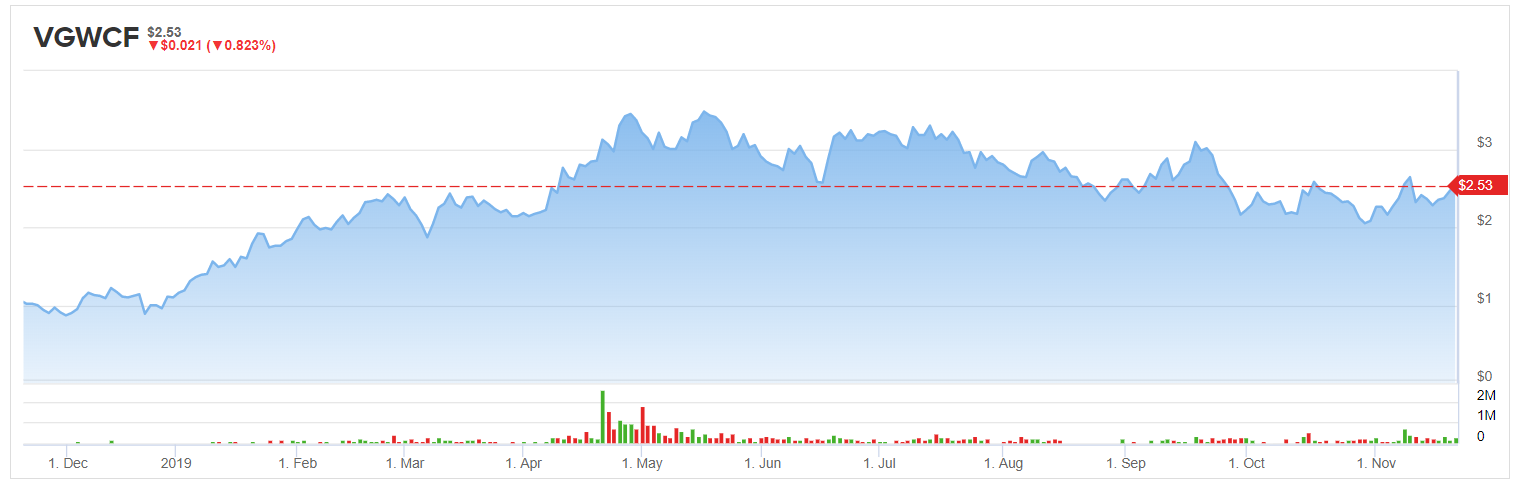

The stock has a $300 million market cap and analyst estimates for FY20 revenues of $128 million. The purchase of Pommies and the recent $50 million deal with BRNT for 2.2 million vape pens over two years should help Valens easily surpass these analyst estimates.

Valens has slipped under most analysts’ radar; the stock’s Moderate Buy consensus is based on just two recent ratings. With shares trading at $2.55, the $6.78 average price target suggests room for a 176% upside. (See Valens’ price targets and analyst ratings on TipRanks)

Liberty Health Sciences (LHSIF)

Liberty Health Sciences is the wild card of the group. The company recently reported quarterly results where revenues soared 379% to C$10.6 million. Sales were up sequentially from C$5.5 million in the prior quarter.

The Toronto based company actually focuses on running dispensaries in Florida selling medical cannabis. For the month of August 2019, Liberty Health hit monthly sales of C$4.6 million for a quarterly run rate already reaching over C$13.8 million and the state still has the catalyst of approving recreational cannabis at a future date.

The company now operates 19 dispensaries across Florida with only 16 dispensaries open at the end of the last quarter. Liberty Health plans to open another 17 retail stores with 10 having lease agreements already in place and another seven under negotiation.

The stock only has a market value of $125 million with an annual revenue run rate already topping C$55 million and plans to more than double the dispensaries open at the end of the last quarter in a limited amount of time. The position in Florida makes Liberty Health an acquisition target for a U.S multi-state operator looking to expand into one of the biggest medical cannabis markets with the potential upside of recreational cannabis approval in the future.

To find good ideas for cannabis stocks trading at fair value or better, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.