What’s the most important investment metric an investor can focus on in the midst of a downturn? My vote is cash flow. It’s actually a great thing to track during any economic cycle – it just becomes especially important when a firm’s sales and profits head south when the business climate turns turbulent.

Don’t just take my word for it. A quote attributed to market guru Michael Mauboussin is that “great fundamental investors focus on understanding the magnitude and sustainability of free cash flow.”

Income-minded investors, such as retirees looking to supplement their social security checks with, could have some real opportunities to pick up bargains during the current market dip. It’s obviously difficult to determine if we already have or will soon hit bottom in the current downturn, but it’s fair to say that many companies will survive with their dividend payments intact.

Using TipRanks database, we’ve narrowed down three stocks that have well above-average dividend yields right now. In fact, the current reported yields are above 8%, or between four and five times the stock market (as measured by the S&P 500) average of closer to 2%. The sustainability of their payouts obviously depend on how long the economy remains in standby mode as social-distancing is utilized to fight off the covid-19 pandemic, but there appears to be ample cushion for the below players, based off of recent historical financials and analyst expectations.

Simon Property (SPG)

Indianapolis-based Simon Property is a bellwether Real Estate Investment Trust (REIT) and bona fide leader in leasing out mall-based retail space. It is also in the midst of acquiring rival Taubman Centers to further consolidate its leading position.

In each of the last three years Simon has generated around $3 billion in free cash flow. That’s almost unheard of in the REIT space where companies very often either spend the vast majority of their operating cash flow on acquisitions or maintaining and improving their existing properties.

Simon does pay out most of its free cash flow in the form of partnership distributions, which is its dividend. For the last three years it amounted to $2.9 billion, $2.8 billion, and $2.6 billion. But even if that were cut during the current downturn, it’s hard to see it falling significantly from current levels over the long haul. Overall, Simon pays out $2.05 per quarter. At $8.40 annualized, the dividend gives a yield of 13.53%, which is more than 5 times higher than the average dividend in the S&P 500.

Deutsche Bank’s Derek Johnson believes Simon will “navigate the continuing retail evolution while maintaining an industry leading balance sheet which is poised to withstand the COVID-19 disruption and fund the (re)development pipeline with $7.0B of incremental liquidity.”

Johnson recently upgraded his rating on Simon to Buy from Hold. He also has a price target of $120, which is more than double the current share price of $58 per share. That would be quite a share price performance, in addition to the well above-average dividend payment. (To watch Johnson’s track record, click here)

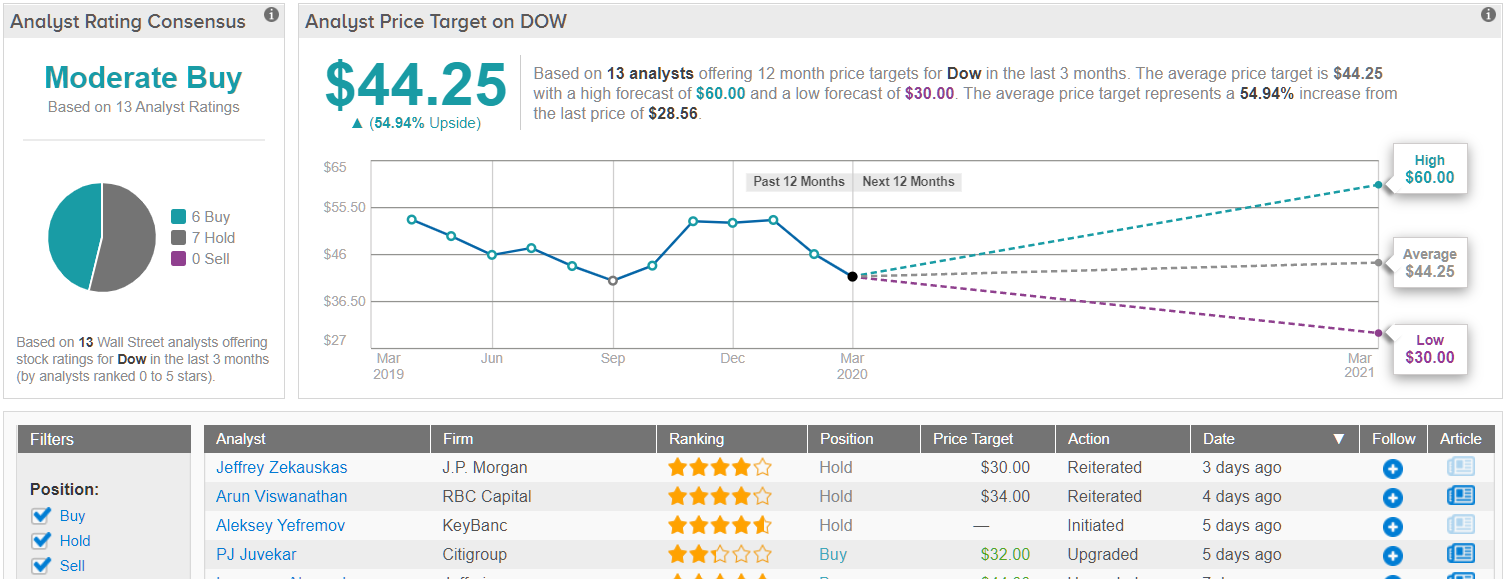

Based on 12 analysts polled by TipRanks in the last 3 months, 6 rate a Buy on SPG stock, while 6 maintain a Hold. The 12-month average price target stands at $134.25, marking a nearly 130% upside from where the stock is currently trading. (See Simon stock analysis on TipRanks)

Dow Inc (DOW)

Chemical giant and Dow Jones Industrial Average component Dow just can’t catch a break. In December 2015, it announced a transformative merger to join forces with archrival DuPont, which took two years to complete. Then, the combined firm announced a transformative deal to break into three more distinct business that took a couple of years to reach fruition. That break up was completed a little less than a year ago, meaning the company is still getting its footing while the economy is on hold due to covid-19.

Dow is one of these three children (DuPont and Corteva are the other two) and is a much leaner materials science firm focused on performance materials, industrial chemicals, and specialty plastics. Its products page lists hundreds that form the building blocks for its customers. Think additives, cleaners, binders, and lubricants for other companies.

DOW has been using its cash flow generation to maintain a strong dividend. The company’s quarterly payment, 70 cents, annualized to $2.80, for an impressive yield of 9.80%. That’s four times the average yield among S&P listed companies, and is powerful incentive for investors.

Analyst earnings estimates are quickly being cut due to the new reality. Lead analyst James Sheehan at sell-side firm SunTrust now expects EPS of $2.65 for this year, down from $3.53. His models suggest free cash flow of $5.7 billion, which, though down is far from a doomsday scenario. That should be plenty of cushion to support what should be a couple of billion dollars to maintain the dividend.

That said, Sheehan believes the negative sentiment is already reflected in DOW’s share price and valuation. The analyst noted, “We believe valuation of 5.9x 2020E EBITDA more than fully discounts these headwinds, and believe DOW’s FCF generation will entice investors as COVID-19 impacts recede.”

As a result, Sheehan reiterates a Buy rating on DOW shares along with $47 price target, which implies nearly 65% upside from current levels. (To watch Sheehan’s track record, click here)

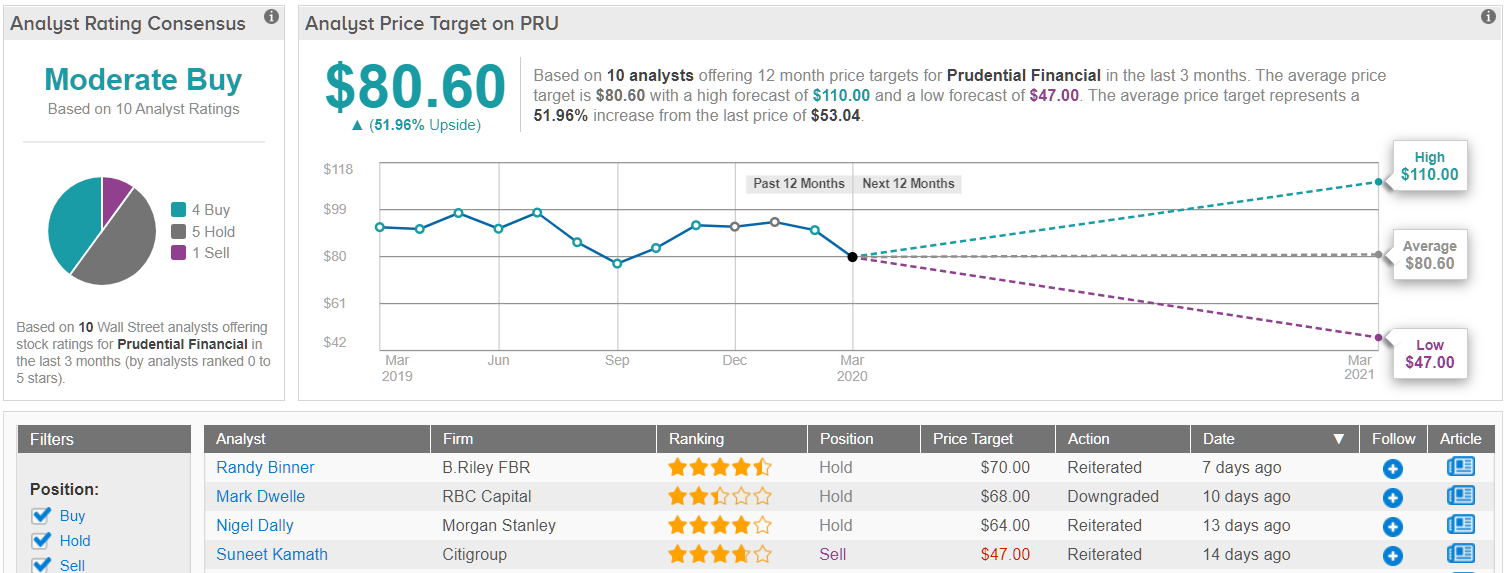

Overall, Wall Street almost evenly split between the bulls and those choosing to play it safe. Based on 13 analysts polled in the last 3 months, 6 rate DOW a Buy, while 7 say Hold. Notably, the 12-month average price target stands at $44.25, marking a nearly 55% in return potential for the stock. In other words, even the analysts that are hedging their bets have some healthy optimism reflected in expectations. (See DOW stock analysis on TipRanks)

Prudential Financial (PRU)

Insurance and asset management giant Prudential Financial’s share price has had a tumultuous few weeks, to say the least. The stock hovered just below $100 per share in early February and bottomed (hopefully) below $40 last week. The stock has since recovered slightly to $53.

Prudential provides insurance, investment management, and related financial products. One side effect of the efforts to prop the economy up while the world focuses on quarantining is interest rates have fallen further and are scraping around 0%. This hurts the prospects for insurance companies, and especially life insurers that hold many long-dated bonds. And falling financial markets means less investment fees across the board.

Calculating free cash flow for a financial firm is less straightforward, but at a recent investor conference, Prudential management detailed that cash flow is about 2/3 of earnings, which it targets to either pay out as dividends or share buybacks. That would be more than $8 per share, or quite a big cushion to pay out an annual dividend of $4.40 per share. This gives a yield of 8.05%

As you might expect, analysts are lowering their earnings estimates and price targets for Prudential. Analyst John Barnidge at Piper Sandler lowered his price target from $80 to $74 in a recent report. That still represents upside of 51% from current levels and back the analyst’s Buy rating. (To watch Barnidge’s track record, click here)

Barnidge’s full-year EPS estimate only fell a dime to $12.20, though it is down $0.90 to $13.60 for 2021. This follows management guidance on how a drop in rates will affect earnings the next couple of years.

Barnidge points out that the cushion could be way less if financial markets continue to really struggle. Another recent report is published detailed that new inflows of assets it manages held up pretty well in February. Revenue from insurance premiums and fees, as well as investment income and investment management fees could still reach $60 billion this year and next.

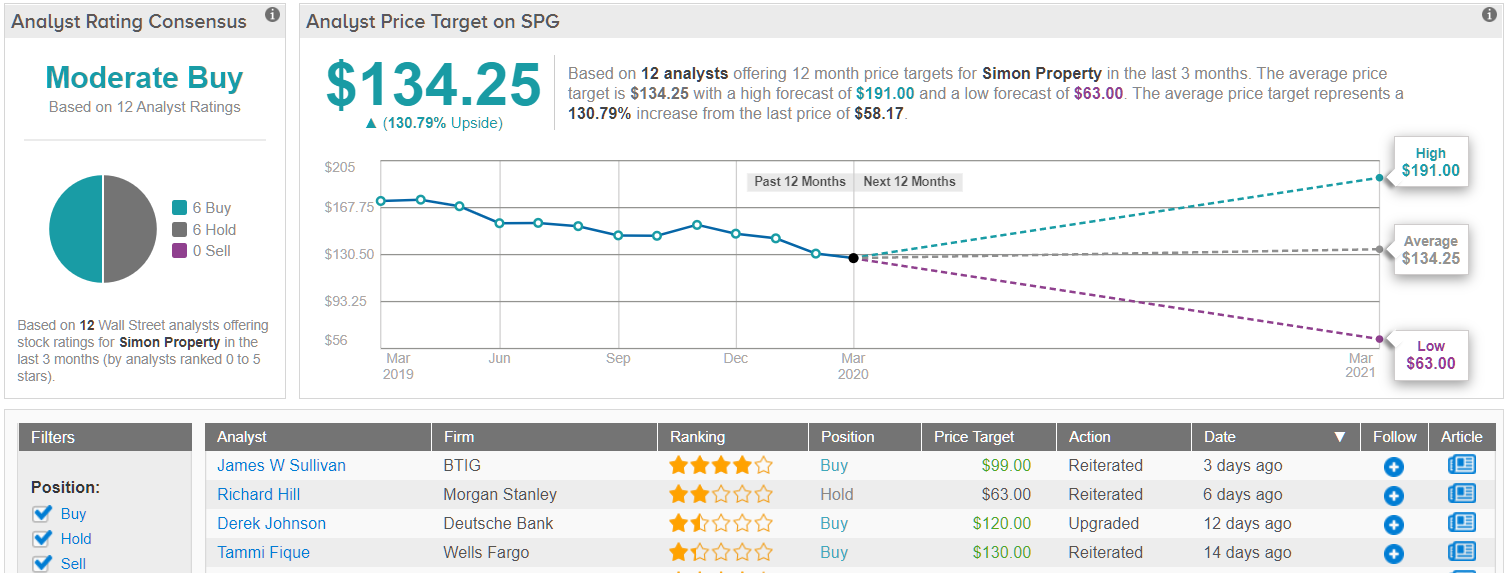

Overall, Wall Street is not convinced just yet on this insurance and investment firm, but cautious optimism is circling, as TipRanks analytics demonstrate PRU as a Buy. Based on 10 analysts polled in the last 3 months, 4 rate Prudential a Buy, 4 say Hold, and only 1 recommends Sell. The 12-month average price target stands at $80.60, marking a 52% upside potential from where the stock is currently trading. (See Prudential stock analysis on TipRanks)

Disclosure: The author is Long DOW and PRU.