It’s tempting – really, it is – to just put your investment money into the big-name stocks. After all, they generate the headlines, and they generate some spectacular results. Apple, Microsoft, Amazon, and Google parent Alphabet have all broken above $1 trillion market cap. But the big names aren’t the only ones showing great returns.

It’s possible to find smaller stocks with big upsides. Small- and mid-cap companies don’t get the headlines and coverage of the trillion-dollar giants, but smart investors can find powerful returns in this category. We’ve used the TipRanks’ Stock Screener tool to sort through the database and find some of these high-potential stocks.

Setting the search filters to show us ‘Strong Buy’ small- and mid-cap stocks with greater than 10% upside potential reduced the original field from 6,500 stocks to a more manageable 350. We’ve pulled up three that are reporting earnings this month. They come from different economic sectors, and all three bring real incentives for investors. Let’s take a closer look:

Silicon Motion Technology (SIMO)

We’ll start with a semiconductor chip manufacturer. Silicon Motion designs, develops and markets multimedia chips for consumer electronics. The company’s focus is on NAND flash controllers for solid-state storage devices, along with memory chips for SSDs and USB drives. The niche is a strong one; SIMO has just reported a strong Q4.

The company released the Q4 2019 results this past Thursday, February 6. Earnings per share, at 96 cents, were up 17% year-over-year, 39% sequentially, and beat the forecast by 13%. Revenues showed even more impressive gains. At $153.2 million, sales beat the estimates by 7% and were up 39% year-over-year and 24% from Q3. Drilling down, SIMO’s SSD segment was a major gainer, with a 60% sequential revenue gain on a 25% increase in sales.

Even better, for investors, the company showed a major increase in cash flow. The quarterly release showed that company operations generated $29.4 million in cash, compared to just $4.1 million in Q3. The improved cash position is good news for the stock dividend, which was increased to $1.40 annually. At this level, the dividend gives a yield of 2.95%, 1.5x higher than the average dividend among S&P listed companies. At a 20% share appreciation in the past 12 months, SIMO has slightly underperformed – but the strong dividend helps make up for that.

Looking at the stock for Nomura, analyst Donnie Teng writes, “We believe SIMO’s UFS controllers for Micron are growing fast in terms of sales, which may be able to offset the loss from eMMC controllers for Hynix… We expect SIMO’s enterprise SSD sales to double in 2020F, with a recovery of demand from hyperscale customers… we raise our raise 2021F sales by 7% due to our stronger sales outlook…”

Teng’s Buy rating on the stock is supported by a 50% increase in his price target, to $60. This new target suggests room for a 30% upside. (To watch Teng’s track record, click here)

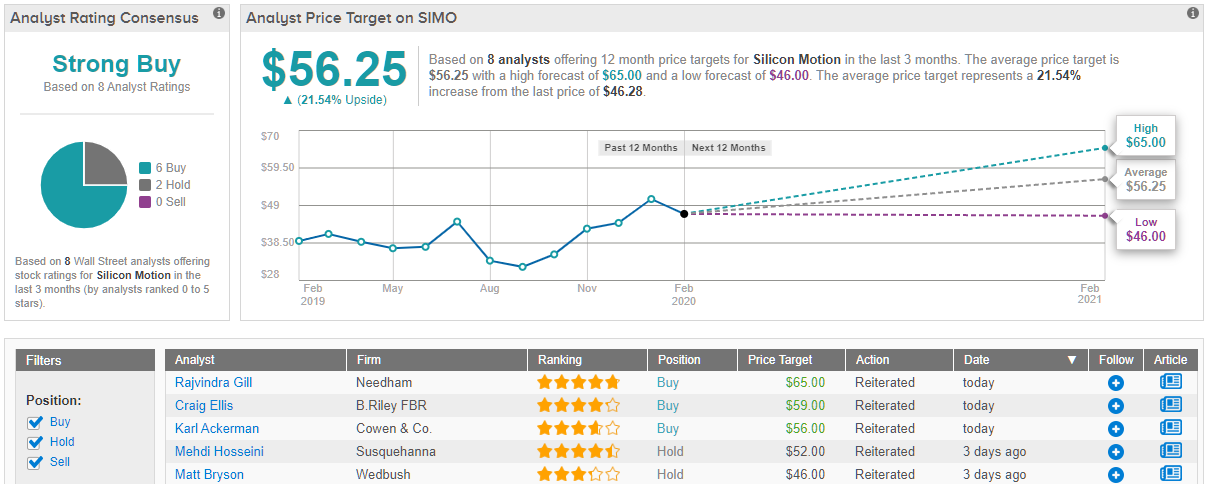

How does Teng’s bullish bet weigh in against the Street? It appears the analyst is not the only one enthusiastic on the Taiwan-based SSD firm, with TipRanks analytics demonstrating SIMO as a Strong Buy. Out of 8 analysts tracked in the last 3 months, 6 are bullish on the stock while 2 remain sidelined. With a return potential of nearly 22%, the stock’s consensus target price stands at $56.25. (See Silicon Motion stock analysis at TipRanks)

R1 RCM (RCM)

Moving on, we come to a revenue cycle management company. R1 RCM is an administrative process used in the American health care industry to track patient revenue from initial appointment through the final balance payment. R1 makes the software that provides these services to US-based health care organizations.

The company will provide Q4 results on February 20. Expectations are for an EPS of 4 cents – but R1 has missed the forecasts in both of its last two quarters. Those missed expectation, however, belie otherwise strong results. In Q3, revenues were up 20% year-over-year, to $301.2 million, driven by new customer gains in previous 12 months.

R1’s overall position is strong enough that, last month, the company was able to announce the acquisition of SCI Solutions, a competitor based in Seattle, Washington. The move, which cost R1 $190 million, promises future results as SCI bring with it a customer base worth up to $225 million in annual revenue.

5-star analyst Steven Halper, of Cantor Fitzgerald, sees reason for optimism in R1, specifically citing the SCI acquisition. He writes, “We view the SCI Solutions acquisition as a solid strategic fit. The company should strengthen R1’s capabilities within the front-end of the provider revenue cycle. R1 is building one of strongest end-to-end revenue cycle management platforms in the industry, and the shares offer solid upside from current levels.”

Halper’s $17 price target, raised by $2, indicates confidence in a 31% upside and supports his Buy rating. (To watch Halper’s track record, click here)

Overall, R1 keeps a Strong Buy consensus rating, based on a unanimous 3 Buys. Shares are a bargain, at just $12.95, especially considering that the average price target of $16.33 suggests an impressive 26% upside potential. (See R1 stock analysis at TipRanks)

Nomad Foods, Ltd. (NOMD)

With our final stock today, we move to the food industry. Nomad Foods is a frozen food distributor, based in the UK and serving customers around the world. The company has a market cap near $4 billion, and sees $2.2 billion in annual revenue.

At the end of this month, NOMD will report Q4 2019 earnings. The forecast is for an EPS of 34 cents, a 1 cent year-over-year gain, but a potential 6 cent sequential gain. The company has beaten earnings forecasts consistently through 2019. Revenue in Q3 was $600.7 million.

In recent years, Nomad has faced serious headwinds from the ongoing Brexit maneuverings. Investors were worried about increased tariffs and trade barriers in the event of tit-for-tat political fighting between the UK and the EU. The inability of Theresa May’s government did not inspire confidence. The stock’s potential has recovered somewhat since Boris Johnson’s Parliamentary victory, as the vote’s results unified the British government’s outward stance on Brexit.

Reviewing NOMD shares for DA Davidson, analyst Brian Holland cites this point as support for a Buy rating. He writes, “[We] believe that the stock has become more investable, with a layer of uncertainty removed by the vote increasing the likelihood of an orderly Brexit. Nomad has continued to generate organic sales and margin growth year-to-date in spite of the very challenging environment.”

Holland’s maintains his $25 price target on the stock, implying an upside here of 25%. (To watch Holland’s track record, click here)

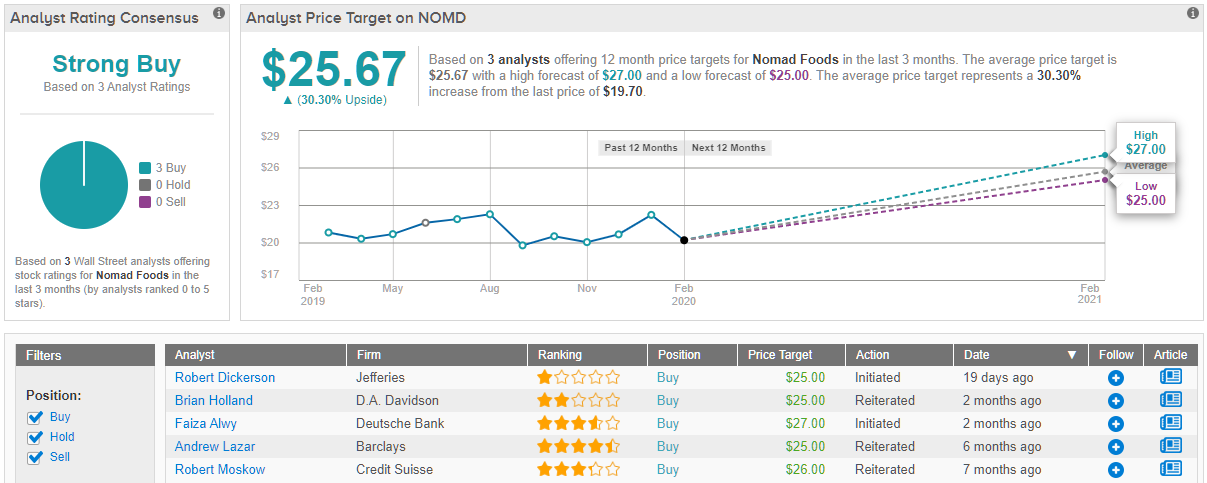

All in all, Wall Street loves Nomad Foods’ stock, rating it “strong buy” on average. It also doesn’t hurt that its $25.67 average price target implies 30% upside potential from current levels. (See Nomad Foods stock analysis at TipRanks)