Once again, investors are nervous, after two sessions of losses pushed the S&P 500 back below the 2,850 upper resistance level. The index’s appreciation has slowed in recent weeks, after a sharp bear market rally in the last week of March brought it back from the doldrums. Investors are wondering now if this rally is real, or if the bear will come roaring back at them.

It’s at times like these that some comprehensive stock analysis is most helpful. TipRanks has the right tool for that job: the Smart Score, which analyzes 8 separate factors from the TipRanks database, all collected and measured by AI algorithms, and uses them to generate a simple, comprehensive score for the market’s most traded stocks. The Smart Score measures the traditional factors of stock analysis, including the technical and fundamental analyses, as well as the conventional wisdom on a stock, through analyst, blogger, and news sentiment, and the collective investor views, through hedge activity, insider trading, and individual investor activity. The result is an aggregate, a single number that points out the stock’s likely forward path.

We’ve used the TipRanks database to find three undervalued stocks with “perfect 10” Smart Scores. While these shares are trading low, the perfect Smart Scores suggest that is more an artifact of the recent overall market slide – for a variety of reasons, each of these stocks has a clear path forward, toward price appreciation. Here is what makes them stand above the crowd.

Wix.com, Ltd. (WIX)

Since its founding in 2006, Wix has built a solid reputation as the place to go for do-it-yourself website construction. The platform offers users a range of tools and editors to make site building simple, even for non-experts. Wix has become wildly popular due to its ease of use, and brings in recurring revenue of $707.2 million annually. Wix’s successful platform rests on the ‘freemium’ business model. The basic service is offered for free, to all comers, while company revenue is derived by selling subscriptions, downloadable user tools, and upgrades.

Coming into 2020, before the COVID-19 epidemic, Wix’s financial state had been gradually improving. Quarterly earnings were on the way up – Q4 2019 showed $204.6 million in total revenue, up 24.6% year-over-year. The company finished the year with over $331 million in cash on hand.

Despite that strong finish to calendar year 2019, Wix shares tumbled badly in the Q1 2020 market slide. The stock hit a peak on February 19, dropped by nearly half to its trough on March 18, and while its has bounced back, WIX is still down 20%.

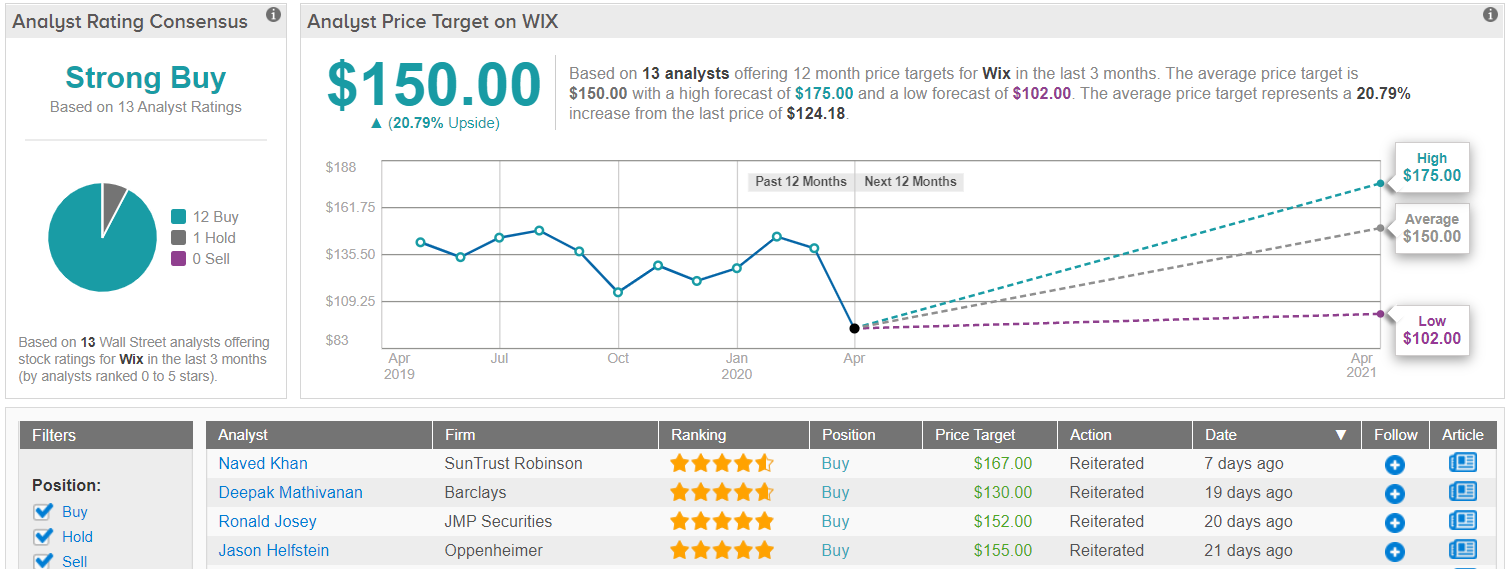

The Smart Score, however, suggests that WIX is undervalued. Wall Street’s analysts still rate the stock a Strong Buy, the financial bloggers are 90% bullish on the shares, and the news coverage of Wix has been 100% positive. Along with an increase in hedge fund purchase activity, these are strong signs that the stock retains plenty of investor confidence.

SunTrust Robinson’s 5-star analyst Naved Khan describes that confidence in clear prose: “We believe Wix’s freemium offering remains relatively resilient given its focus on providing mission critical online tools/services to SMBs. We view the company’s recent decision to pause the price hike as a prudent, customer centric move to keep churn low and expect to see a pick-up in DIY sign-ups as lockdowns catalyze demand for online services.”

Khan rates Wix a Buy, and supports that rating with a $167 price target that implies a robust upside potential of 35%. (To watch Khan’s track record, click here)

Wall Street’s analyst corps agrees with Khan – which we saw in the Smart Score review. WIX shares hold a Strong Buy rating from the analyst consensus, based on 13 recent reviews – including 12 Buys and only a single Hold. The average price target is $150, somewhat more cautious than Khan’s, but still suggesting a 21% one-year upside for the stock. (See Wix stock analysis at TipRanks)

Hudson Pacific Properties (HPP)

Our next stock is a real estate investment trust, a sector that is well-liked by income-minded investors who appreciate the high dividend yields offered. Hudson Pacific is an REIT focused mainly on office space in the Los Angeles, San Francisco, Seattle, and Vancouver areas. The company owns almost 15 million square feet of leasable space, in some of the prime tech centers in North America. HPP counts some heavy hitters among its tenants, including Alphabet, Inc. and Netflix.

HPP’s earnings grew steadily from Q2 through Q4 of last year, reaching 55 cents per share in the final quarter, beating the forecast by 12%. Full year revenues came to $818 million, with full year net income of $42.7 million. HPP used that fund a 25-cent per share quarterly dividend, which annualizes to $1 and gives a yield of 4.3%. It’s a solid foundation for investors seeking profitable investments.

And right now, HPP shares are well down from their peak. The stock hit its top value on February 14, just 5 days before the bear market started – and that bear hit HPP hard, knocking out 58% of the stock’s share value. It has had trouble regaining traction; many tenant companies are facing their own coronavirus problems, and so are having trouble meeting the rent, cutting into HPP income stream. The stock is still down 39% from its peak, severe underperformance compared to the S&P 500’s 16% net fall.

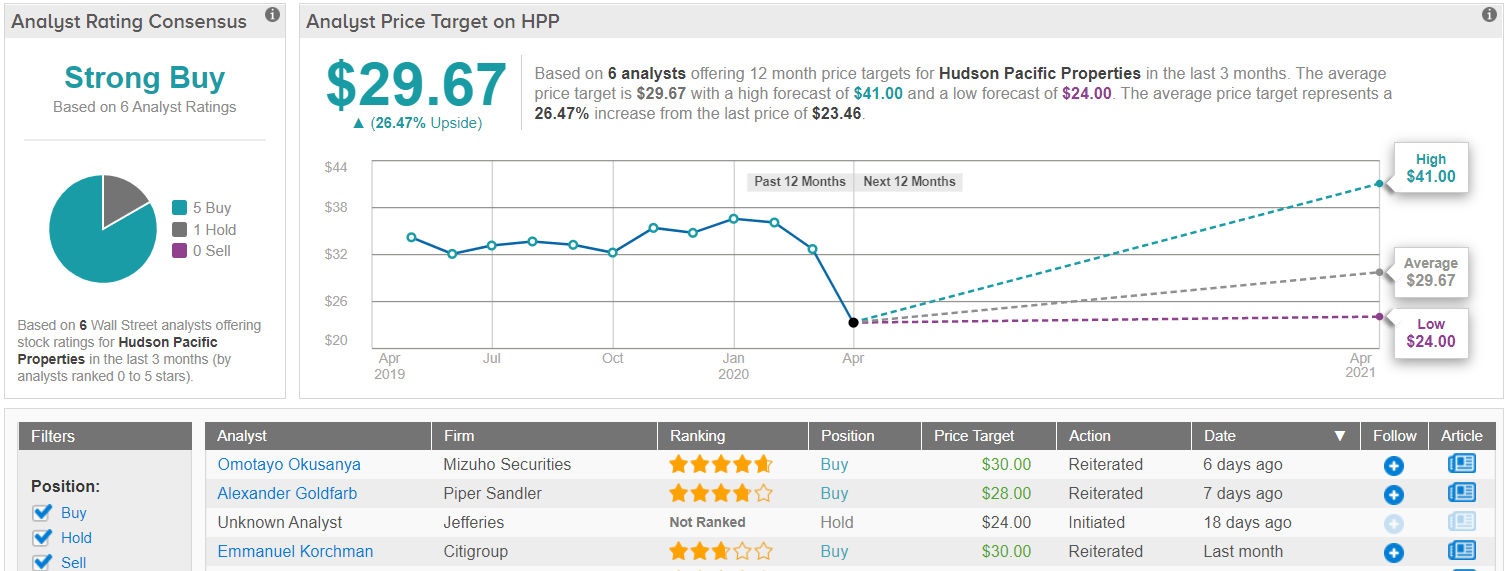

Once again, however, a look at the Smart Score shows us why we should see HPP as undervalued, rather than depressed. The stock keeps a Strong Buy analyst rating, as well as 100% bullish sentiment from the financial bloggers and news outlets. But the real key here is the insider sentiment – corporate officers have taken advantage of the stock’s low price to buy up $2.29 million worth of shares, giving the stock a strongly positive insider trading strategy. These factors add up to that ‘perfect 10’ Smart Score.

Writing from Wells Fargo, analyst Blaine Heck rates HPP a Buy, although his price target of $24.50 suggests a modest 4.4% upside. Supporting his Buy thesis, Heck writes, “HPP has done a nice job managing its unleased development pipeline exposure… HPP trades at a discount to its West Coast office peers, so if HPP can again report strong rent spreads, maintain a strong pre-leased rate on its development pipeline, and indicate that demand from tech tenants remains strong, we believe shares can outperform.” (To watch Heck’s track record, click here.)

Sentiment on Wall Street is a bit more bullish on HPP than Heck allows, perhaps influenced by the strong insider confidence noted above in the Smart Score. Of 6 analyst reviews, 5 are Buys and 1 is a Hold, making the consensus rating a Strong Buy. Shares are selling for $23.46, and the average price target, at $29.67, indicates an upside of 26% for the coming 12 months. (See Hudson Pacific stock analysis at TipRanks)

Service Corporation International (SCI)

We don’t like to think about it, but death is business, too. Funeral services, and cemetery management, are a major operation, as surviving family and friends are always deeply interested in seeing that proper care is taken of the departed. SCI, based out of Texas, owns and operates over 1,500 funeral homes and 400 cemeteries across 43 states and eight provinces in the US and Canada. The company regularly brings in over $3 billion annual revenues.

Wrapping up 2019, Q4 finished with a strong top line of $851 million, up 3.6% year-over-year, with EPS of 60 cents. The company saw earnings gain from lower expenses, while partially offset increased taxes and softness in cemetery revenues. Q1, however, reflected the impact of the coronavirus pandemic and social distancing measures. Those measures have cut back on funeral services, and SCI’s top line revenue was down 4.4% sequentially. EPS, at 43 cents, fell sequentially and missed the forecast, also by 4.4%.

SCI hit its peak in early March, after the market slide began, but when it fell, the fall was steep. SCI shares bottomed out after losing 34%, and have remained essentially flat since then in volatile trading. Despite the hit to share values, the company maintained its dividend, even raising it to 19 cents per share – the third increase in the last three years. SCI’s dividend annualizes to 76 cents per share, and offers an above-average yield of 2.13%. The reliability of the dividend is a clear attraction for the stock while share price value remains down.

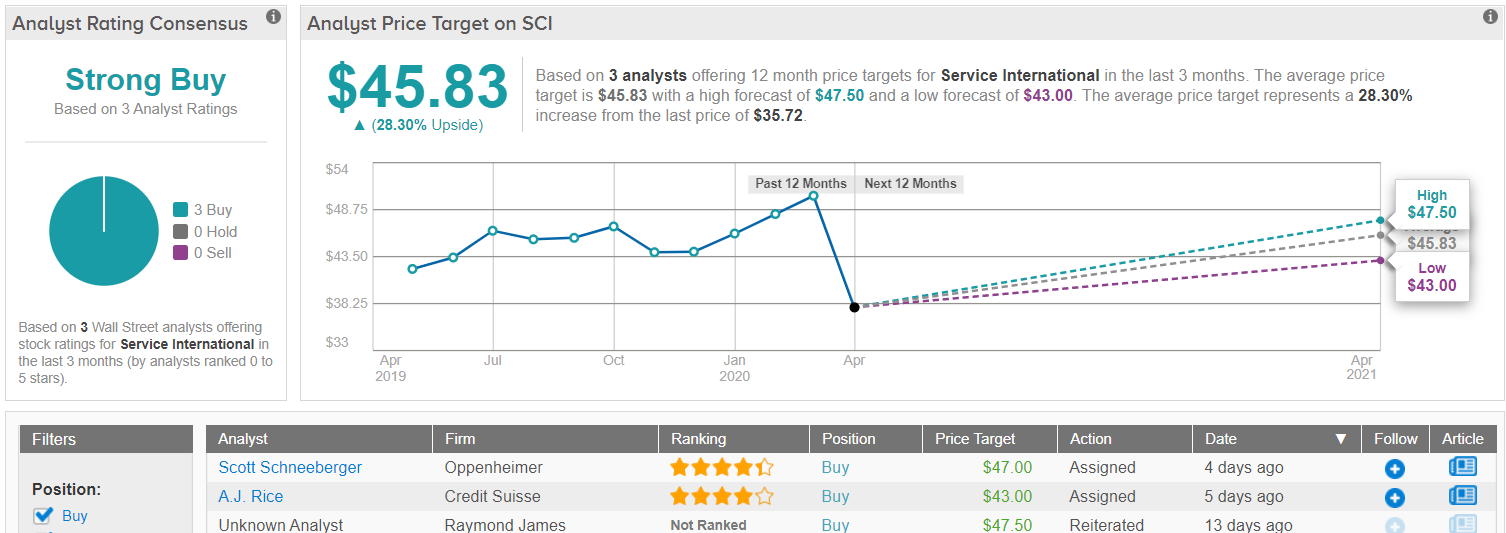

The Smart Score shows some of the reasons why this stock remains a solid buy. Wall Street’s analysts and financial bloggers are bullish, as are the hedge funds, which have bought more than 128,000 shares in the last quarter. Better, though, is the 12-month return on equity, which is strongly positive at 21.57%. This all adds up to a Smart Score of 10, topping the scale.

4-star analyst Scott Schneeberger sees a path forward for SCI, writing, “[Service International] is using technology to innovate in the current operating environment, executing expense management, remains financially sound generating ample free cash flow, and should rebound significantly as “social distancing” progressively eases.”

He gives the stock a Buy rating, with a $47 price target that implies an upside of 31%. (To watch Schneeberger’s track record, click here.)

In addition to a ‘perfect 10’ Smart Score, SCI shares also have a unanimous Strong Buy analyst consensus rating, based on 3 recent Buy reviews. SCI shares are selling for $35.72 at this writing, and the average price target of $45.83 suggests the stock has room for 28% growth in the next 12 months. (See Service International stock analysis at TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.