The 3M (MMM) board of directors have declared a dividend on the company’s common stock of $1.47 per share for the second quarter of 2020.

The dividend is payable June 12, 2020, to shareholders of record at the close of business on May 22, 2020.

Respirator-maker 3M has paid dividends to its shareholders without interruption for more than 100 years.

As of March 31, 2020, 3M had 575,196,371 common shares outstanding and 73,417 shareholders of record.

The company recently withdrew financial guidance for 2020, halted buybacks, cut capex, and reaffirmed its commitment to prioritize the dividend.

3M also revealed that it aims to double its production of N95 respirators to 2 billion by year-end to meet the escalating global demand.

“We are mindful of the fact that 3M is one of the highest-quality Multi-Industry companies, as defined by our Investment Framework, with a coveted spot among the illustrious Primes” commented RBC Capital analyst Deane Dray on April 28.

“That said, we believe that the company’s historical reputation for being a defensive “safe haven” has been eroded by its now-apparent sensitivity to demand softness and relatively limited forward visibility.”

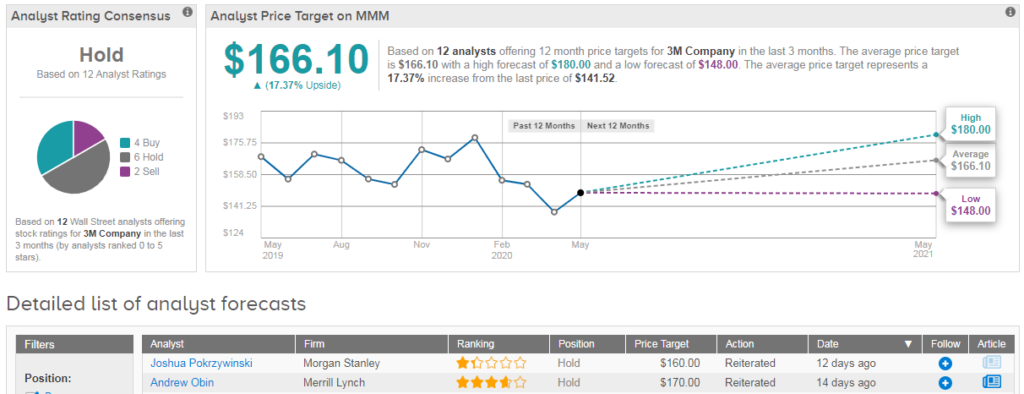

As a result the analyst reiterated his hold rating while bumping up the price target from $143 to $148. Indeed the stock has an overall Hold analyst consensus, with 4 recent buy ratings vs 6 hold ratings and 2 sell ratings.

Meanwhile the average analyst price target of $166 suggests 17% upside potential lies ahead. (See MMM’s stock analysis on TipRanks). Shares are currently trading down about 20% year-to-date.

Related News:

Datadog (DDOG) Is a Winner, but the Stock Is Fairly Valued Here, Says 5-Star Analyst

PayPal Seeks To Raise Further $4B; Fitch Affirms ‘BBB+’ Rating

Uber Rejects GrubHub’s All-Stock Proposal – Report