Microsoft (MSFT) recently knocked Apple off the top spot for the coveted title of the world’s largest company by market cap. While Apple has felt COVID-19’s sharp impact significantly disrupt proceedings, Microsoft’s main growth driver has kept it charging ahead.

What is this main growth driver? Wedbush analyst Daniel Ives believes the answer is clear. The Redmond giant’s core strength lies in its cloud offerings. The 5-star analyst implores investors to “own MSFT for the other side of this dark valley.”

The dark valley for Microsoft concerns its exposure to PCs and supply chain, where roughly a third of Microsoft’s revenue lies. But Ives argues the real meat of Microsoft’s valuation is tied to its “flagship Azure, Office 365, and core enterprise driven franchise.”

“We have seen relatively strong cloud deal activity around Azure in the field, as this current remote work from home environment is further catalyzing more enterprises to make the strategic cloud shift with Microsoft the main beneficiary,” Ives noted.

Over the next few years, MSFT’s cloud business should drive the company’s non-PC operations to growth of low to mid-teens. Ives believes that after stress testing his model, approximately 90% of the expected revenue will be of “essential/high priority for enterprises.”

Ives takes the stress test further. Even a deep recession “1-2 quarters deep” resulting in a further 10% reduction to the “cloud and enterprise growth drivers,” the cloud franchise on its own will still command a value between $900 billion to $1 trillion.

What’s more, Ives believes “Azure’s cloud momentum is still in its early days.” As Microsoft’s already huge customer base continues the shift, partly driven by the current macro environment, to cloud services, the strong tailwinds should drive it to further growth.

“As we enter into a near-term economic apocalypse will some of this growth and cloud deployments be impacted?” Ask Ives rhetorically. “Yes,” he says, “However, with this highest IT priority front and center, we believe 85%-90% of these cloud deployments have already been green lighted by CIOs, budgets are firmly in place, with a very low risk (relatively speaking) of any major push outs. We continue to believe MSFT is the core cloud name to play this transformational secular trend.”

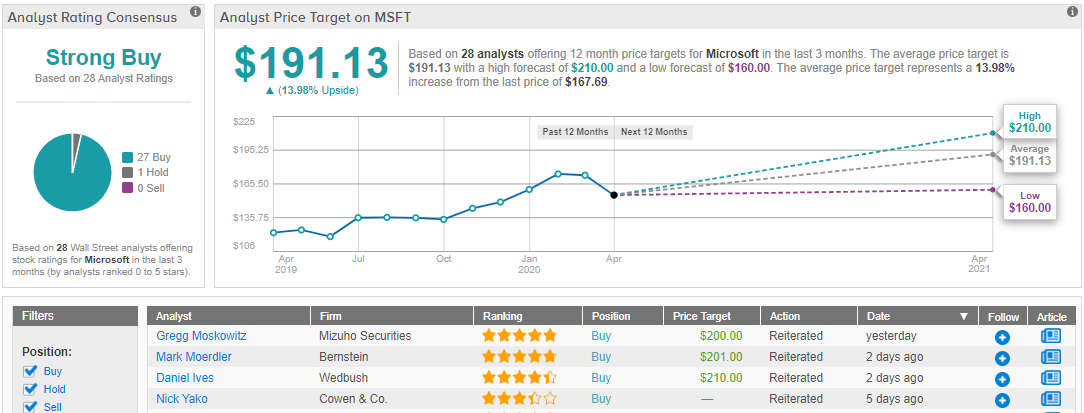

Unsurprisingly, the top analyst reiterates an Outperform rating along with a $210 price target. The implication for investors? Upside of 25% from current levels. (To watch Ives’ track record, click here)

The rest of the Street concurs. The analyst consensus rates MSFT as a Strong Buy, based on 1 Hold vs a resounding 26 Buys. The average price target comes in at $191.13, and implies potential upside of 14%. (See Microsoft stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.