Recession fears seem to be overpowering holiday season optimism this year. Of late, many market strategists have lowered their S&P 500 (SPX) price targets considerably in recent months. Morgan Stanley’s (NYSE:MS) Mike Wilson — a man who’s been spot on in calling the current bear market — sees more turbulence in the new year. Wilson’s calling for a double-digit percentage drop before closing the year at 3,900. Though pundits don’t expect much in 2023, investors shouldn’t fret. In this article, we’ll check out five stocks (AAPL, BRK.B, CRM, AMZN, and SNOW) that could be gifts ahead of the holidays.

It’s big up days like Wednesday that remind us why it’s a terrible idea to sell everything in a panic. Dovish surprises and the resilience of the consumer could be upside surprises that could cause strategists (many who downgraded their S&P 500 targets through the year) to raise the bar.

Apple (NASDAQ:AAPL)

Apple’s been under pressure of late, thanks partly to iPhone delays due to lockdowns in China and more criticism from Elon Musk.

Indeed, Musk seems to want to go to war with Apple on its 30% fees. With Musk meeting Tim Cook in person, a lot of the fears seem to be easing. Musk said Cook told him Apple “never considered” giving Twitter the boot from the App Store.

This isn’t the first time Cook met with someone who’s been giving Apple a hard time. Cook met with President Trump amid his frustrations with the company. Indeed, Cook is a legend at making things right with well-known critics.

At just 24.3x trailing earnings, Apple stock looks like a fine addition. Though many Apple fans won’t receive an iPhone for the holidays due to supply woes, odds are they’ll still be loyal customers and will be buyers in the new year.

Is AAPL Stock a Buy, According to Analysts?

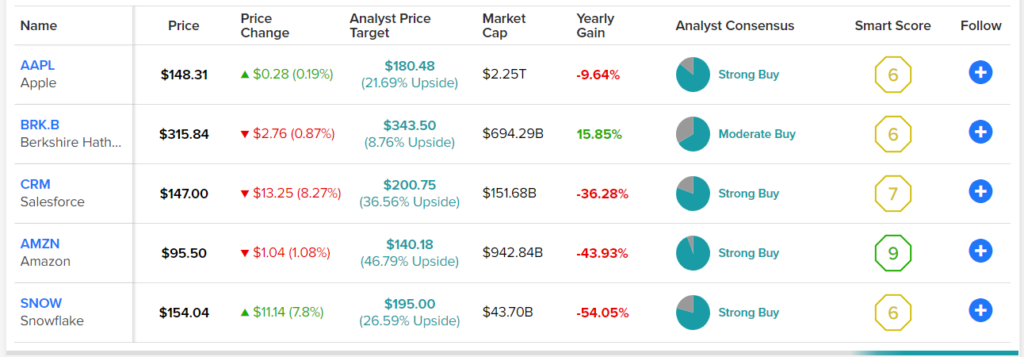

Turning to Wall Street, AAPL has a Strong Buy consensus rating based on 24 Buys and four Holds assigned in the past three months. The average AAPL price target of $180.48 implies 21.7% upside potential.

Berkshire Hathaway (NYSE:BRK.B)

Berkshire has been rock solid amid the bear market. The significant Apple shareholder has braved the turbulence, placing big bets on energy stocks, Japanese trading companies, and a Taiwanese chip giant.

As Berkshire continues to deploy capital into stocks it views as cheap, I consider the conglomerate as a far better bet than the market averages. Berkshire is finally getting its edge back and as value continues to trump growth, expect nothing less than terrific results from Warren Buffett‘s firm.

At 2.4x sales, Berkshire is still too cheap after a 21% pop off recent 52-week lows.

Is Berkshire Stock a Buy, According to Analysts?

On Wall Street, BRK.B has a Moderate Buy consensus rating based on two Buys and one Hold assigned in the past three months. The average BRK.B price target of $343.50 implies 8.8% upside potential.

Salesforce (NASDAQ:CRM)

Salesforce is a tech titan that’s been obliterated this year. The stock shed over 8% today (giving back the day’s Fed-powered gains) on some disappointing quarterly results.

Bret Taylor also stepped down as co-CEO. Marc Benioff is now the lone CEO and has a tough job as his firm sails into a recession.

It looks ugly, with the fourth-quarter outlook falling short, but the stock is getting cheap at 5x sales. For the Benioff believers, CRM stock seems like an excellent pick-up heading into the holidays and ahead of a potential Santa rally.

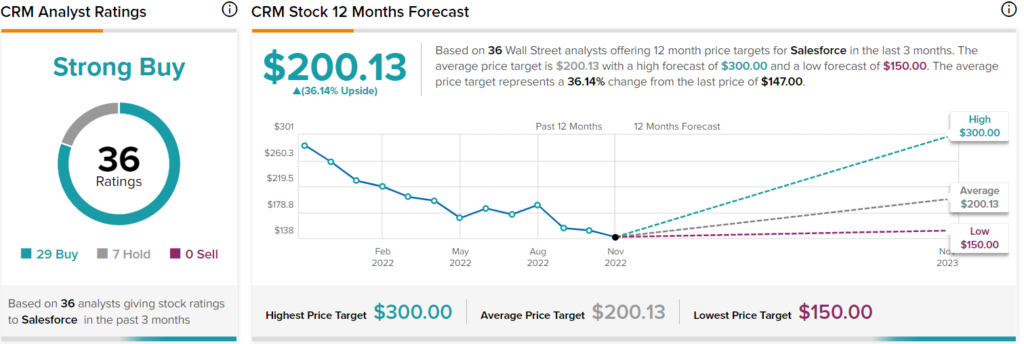

Is CRM Stock a Buy, According to Analysts?

On Wall Street, CRM has a Moderate Buy consensus rating based on two Buys and one Hold assigned in the past three months. The average CRM price target of $200.13 implies 36.1% upside potential.

Amazon (NASDAQ:AMZN)

Amazon stock has been one of the harder-hit FAANG stocks this year. With the “largest ever” Thanksgiving shopping weekend in the rearview, all eyes are on the holiday season.

Despite the good news, Amazon stock hasn’t been moving much higher than its FAANG peers.

Analysts have conservative expectations for Amazon, with a recession likely around the corner. Still, a low bar means it’ll be easier to jump over. With AMZN stock so oversold, I view the name as having the greatest upside potential in the final month of 2022.

Is AMZN Stock a Buy, According to Analysts?

AMZN has a Strong Buy consensus rating based on 33 Buys and two Holds assigned in the past three months. The average AMZN price target of $140.18 implies 46.8% upside potential.

Snowflake (NYSE:SNOW)

Snowflake is another innovative growth company that initially sunk after hours on Wednesday (before finishing the next day higher) following an underwhelming quarter and the issue of light revenue guidance. The data warehousing company sees $535 million – $540 million in sales for the fourth quarter, below expectations of $553 million.

With a usage-based revenue model, the quarterly flops and beats will likely cause significant volatility. The recent tumble is overdone and could set the stage for massive relief in the new year as demand comes back online.

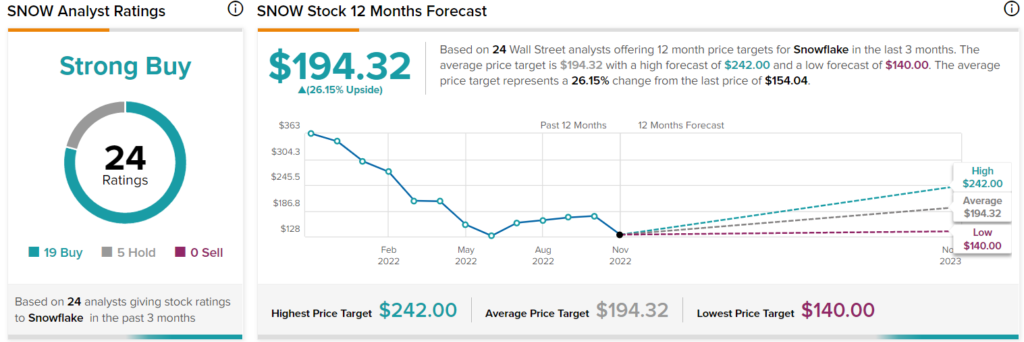

Is SNOW Stock a Buy, According to Analysts?

It’s been a hailstorm for Snowflake this year. Still, the stock is expensive at 30x sales. Despite the multiple, Wall Street boasts a “Strong Buy” rating on SNOW stock, with the average price target of $194.32 implying over 26.2% in gains from here.

The Takeaway

There are a lot of marked-down stocks ahead of the holiday season that can march higher in the new year. After a quarterly fumble, I think Snowflake is the best of the batch.