Hedge funds have become increasingly popular over the past decade since they often have low correlations to traditional portfolios of stocks and bonds, thus adding diversification to any portfolio. Many hedge fund investment strategies aim to achieve a positive return regardless of whether markets are rising or falling.

While searching for which hedge fund is the best to monitor, the average investor is overwhelmed by the amount of selections available and so making a decision of which hedge fund to follow can be confusing. Often, they track the portfolios of managers that receive the most public exposure, but does high exposure mean high returns? TipRanks recently tested this and the results were surprising.

What is a Hedge Fund Manager?

Hedge funds are similar to mutual funds in that both pool together investors’ money and create large portfolios that are valued on their net asset value, yet hedge funds can engage in trading activities that are often unavailable to mutual funds. This includes high risk leveraged positions for both long and short positions, or the use of high frequency trading and other aggressive investment practices. Furthermore, hedge funds invest in less traditional opportunities such as futures contracts or options.

Any hedge fund managing over $100M is required to submit a 13F form to the Securities and Exchange Commission (SEC) which lists their current holdings up to 45 days after each fiscal quarter. While most investors following fund managers only take the 13F forms into account, TipRanks also aggregated 13D and 13G forms (reports required by shareholders owning 5% or more of a company) to measure performance elements that are otherwise overlooked by other financial services that track hedge funds activity.

SEC Form 13F Example

And the top Hedge Funds to follow are…

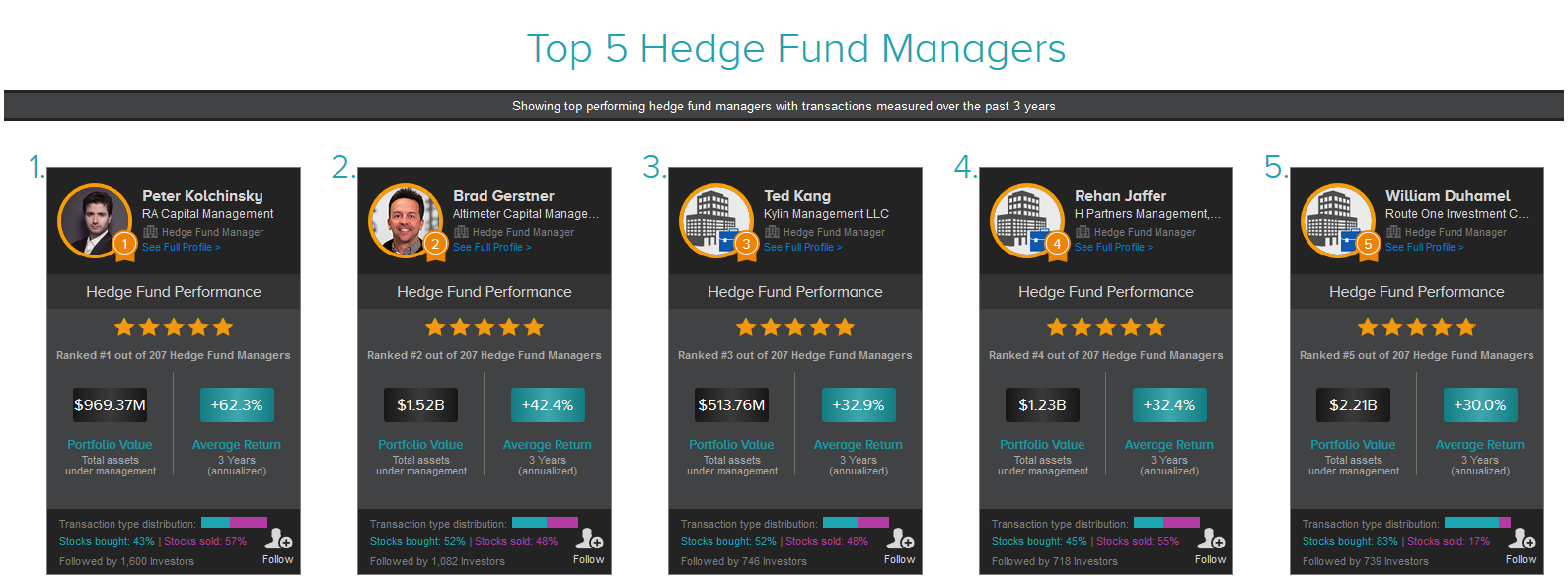

While Warren Buffett, George Soros, and Carl Icahn are household names to many, there are lesser-known managers that yield higher market returns. TipRanks analyzed over 200 hedge funds that generated the highest annualized return based on their stock portfolio over the last three years, and discovered that the best managers were not necessarily the most well-known. Below is the full list:

- Topping the list is Peter Kolchinsky who generated a +62.3% average return.

- Brad Gerstner comes in second place for generating a +42.4% average return.

- Next is Ted Kang who generated a +32.9% average return.

- Rehan Jaffer is in fourth place for generating a +32.4% average return.

- Lastly, William Duhamel generated a +30% average return.

These same managers also made up the top five in our previous look in August, albeit in a slightly different order.

Access the performance of over 200 Hedge Fund Managers

Performance is measured based on the hedge funds managers’ long positions as reported by 13F forms and 13D/13G forms. The measurements do not incorporate short positions nor positions that were opened and closed within the same quarter in cases where the hedge fund was not required to submit a 13D/13G form.

TipRanks allows investors to review the hedge fund holdings from the most recent quarter and recent activity tracked via 13D and 13G forms. This includes the number of shares held, gains since the last quarter and the percent of stock in the hedge fund’s portfolio. Follow the Top 25 Hedge Fund Managers with the best portfolio returns to receive instant email notifications the moment a holdings form is filed to the SEC, giving the advantage of being first to act.

As the world’s first financial accountability engine, TipRanks helps investors make better decisions by providing them with an accurate performance, measurement, and average return rate of over 200 hedge fund managers covering over 5,000 stocks. Additionally, shareholders can search and access stock pages detailing the specific performance and recommendations of top Wall Street analysts, bloggers, and corporate insiders.

Click here to create your own TipRanks account and follow the top experts today!

To learn more about investing in hedge fund managers, click here.