Data security and analytics provider Varonis Systems (VRNS) scrapped its 2020 outlook due to the coronavirus pandemic, and also released preliminary lower-than-expected first-quarter revenues.

Preliminary revenue in the first quarter is expected to be in the range of $53.9 million to $54.3 million, which is below the $58.6 million consensus and down from $56.4 million in the same period last year, the software company said, citing the negative coronavirus impact and the “substantially higher” mix of subscription revenue.

Operating loss in the first three months of the year is projected to be in the range of $17.3 million to $17.6 million, according to preliminary figures, widening from the $11.1 million loss in the same quarter last year.

“We had a strong start to 2020, but with the spread of the global COVID-19 pandemic, our customers’ immediate focus turned to employee safety, which caused many to defer purchasing decisions at the end of the quarter,” said Yaki Faitelson, Varonis CEO. “Crises like this one create optimal conditions for cybercrime. In these ever-changing times, we believe the power of our platform has never been stronger and the need for our solution has never been greater.”

Varonis added that despite the negative impact from COVID-19, the fundamentals of the company remained strong supported by a “healthy balance sheet and no debt”.

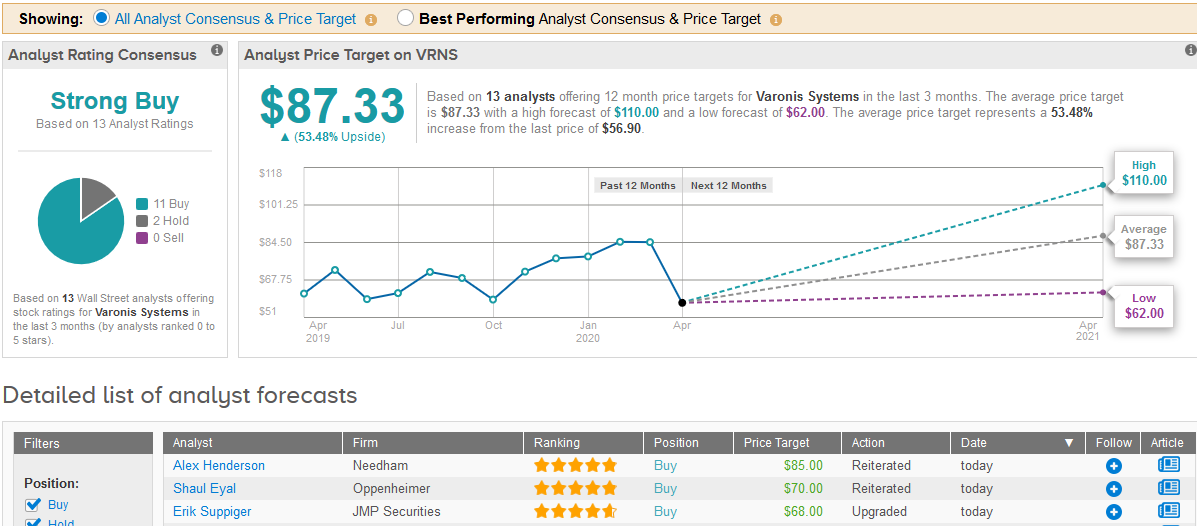

The software company, which lost about a third of its value since the start of the year looks like a Strong Buy according to a consensus of Wall Street analysts. The consensus rating is based on 11 Buys and 2 Holds. The $90.08 average price target suggests 58% upside potential in the stock in the next 12 months. (See Varonis stock analysis on TipRanks)

Five-star analyst Erik Suppiger at JMP Securities upgraded Varonis today to Buy from Hold with a $68 12-month price target, citing the company’s “relatively healthy” March results given the COVID-19 pandemic and its “strong fundamentals”.

As of March 31, 2020, Varonis had about $126 million in cash and cash equivalents, securities and short-term deposits.

Related News:

Tactile Systems Pre-Releases 1Q; Pulls FY20 Guidance on Covid-19

Cisco to Acquire Fluidmesh to Boost Internet of Things Business

Global Payments Lowers Q1 Expectations, Removes Full Year Guidance