Apple Inc. (AAPL) and Alphabet Inc.’s Google (GOOGL) are planning to develop a contact-tracing software technology that will be added to their smartphones and seeks to slow down the spread of the coronavirus pandemic.

The rare collaboration between the two rival tech giants will enable the use of bluetooth technology to help governments and health agencies contain the spread of the virus, while user privacy and security are preserved, the two companies said in a joint statement.

More specifically, the partnership will add technology to their smartphone platforms that will alert users if they have come into contact with a COVID-19 infected individual. Once users have been alerted, they will be told to go into quarantine. For the technology to be effective, smartphone users must voluntarily opt into the system and add to their public health app if they test positive for Covid-19.

The two tech giants said that the software technology, known as contact-tracing, will be built into their iPhones and Android devices in two steps. Initially in May, the two companies plan to release software technology to enable the exchange and use of information between Android and iPhones devices using apps from public health authorities.

These official apps will then be available for users to download via their respective app stores. Second, in the coming months, Apple and Google will work on enabling a broader Bluetooth-based contact tracing platform by building this functionality into the underlying platforms, which would allow more individuals to participate.

“Contact-tracing can help slow the spread of COVID-19 and can be done without compromising user privacy,” Apple Chief Executive Officer Timothy D. Cook said in a Twitter post.

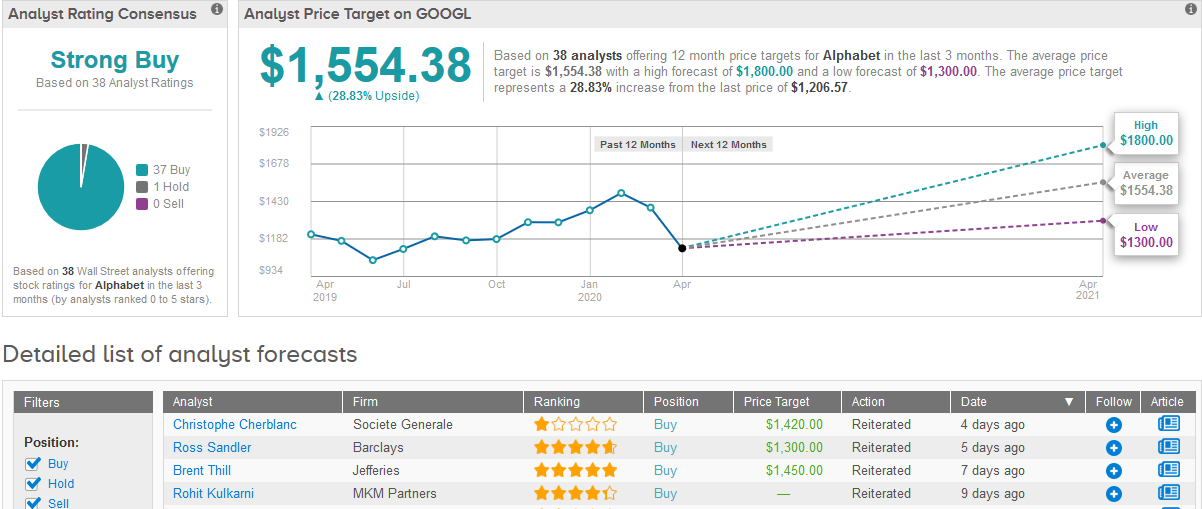

Wall Street analysts are bullish on Google’s Alphabet. In the last three months, Alphabet stock received 37 Buys and 1 Hold, according to TipRanks’ database. The average analyst price target of $1,554.38 implies 29% upside potential for investors in the coming 12 months. (See Alphabet’s stock analysis on TipRanks).

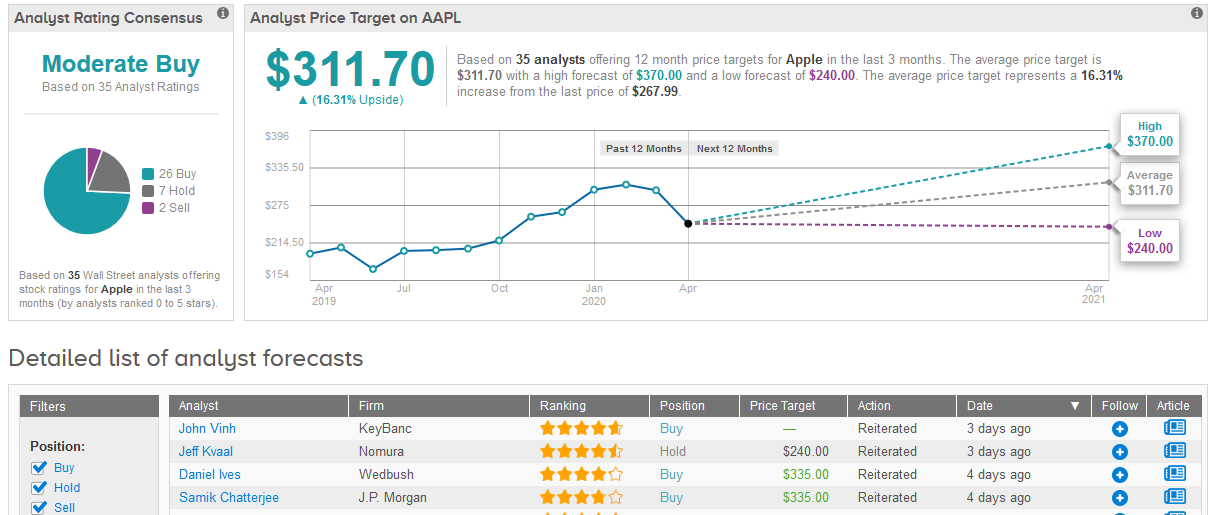

Meanwhile, Jeff Kvaal analyst at Nomura last week raised Apple’s price target to $240 from $225, citing the tech giant’s “robust” ecosystem and “strong” balance sheet. At the same time though, Kvaal is sticking to his Hold rating saying that “a looming recession and inflated supercycle expectations sufficiently undermine the bull case”.

Overall, the majority of 26 analysts have a Buy rating for Apple, while 7 have a Hold rating and 2 have a Sell rating, adding up to a Moderate Buy consensus rating. The $311.70 average price target suggests potential gain of 16% in the shares. (See Apple stock analysis on TipRanks).

Related News:

Are Lockdowns Working? Google Offers Location Data to Help Pandemic Fight

3M Sues Performance Supply For Alleged Price Gouging of its Respirator Masks

US Stock Market Takes A Break From Rally For Good Friday