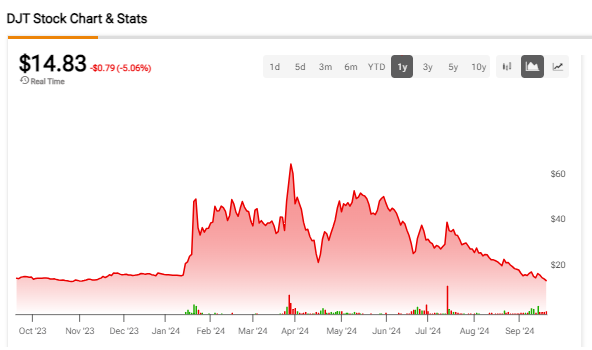

Many figured that once the lockup period expired on former President Donald Trump’s social media stock Truth Social ($DJT), the share price would bottom as the namesake shareholder sold stock to cover a growing need for cash in his Presidential campaign. The stock continued lower on Thursday afternoon, approaching a 52-week low.

Essentially, the day that many have dreaded will arrive shortly, and Donald Trump will be eligible to sell his shares of Truth Social, although he has denied that he will do so. Since Trump is majority shareholder, the fear is that he will actually take advantage of the lockup period’s expiration and flood the market with loose shares, sending their cash value on an even steeper decline.

A CNBC report noted that Trump holds 57% of Truth Social, which represents some $1.7 billion in value, about half of Trump’s estimated net worth, on paper. In this case, just the threat of Trump selling may be enough to spark an exit from other shareholders who are not bound by lockup provisions. That may explain the downward trend of DJT stock in recent months.

Holding the Line

However, the fear is likely largely overblown. Forbes recently revealed that Trump “absolutely” does not plan to sell so much as a share. Some believe that he will stick to his clearly announced plans. Others, of perhaps a more suspicious nature, acknowledge that it wouldn’t serve his best interests to say anything different.

A major condition of the lockup expiry date—which could be today—is that the stock needs to close at at least $12 a share today in order for the lockup to expire. Trump’s pronouncement that he has no plans to sell is likely to serve as a stabilizing force for the stock. While it has already fallen substantially since its March high, DJT was still trading above $14 per share on Thursday afternoon, and the lockup period could close mere hours from now when market trading ends for the day.

Is Truth Social Stock a Good Buy Right Now?

Turning to Wall Street, we find that no analyst to date offers coverage on DJT stock. The chart below displays the last five days of trading. What we find there is a stairstep pattern heading straight down, resulting in a 16.84% drop over the last five trading sessions.