Granted, legacy automaker Ford ($F) has had a rough go of things with its electric vehicle aspirations, but a new plan targeting dealerships may be just what the doctor ordered. A new pilot program is potentially landing dealerships several thousand dollars for ordering F-150 Lightning pickups, and Ford shares were up fractionally as a result.

Under the terms of the new deal, dealers who order an F-150 Lightning through one of Ford’s Retail Replenishment Centers—as a new report from Electrek noted—can land up to $1,500. In fact, over the next month, Ford dealers can land as much as $22,500 in incentives for ordering in new electric vehicles.

Ford offers $1,000 for every F-150 Lightning ordered, whether it is an XLT, a Lariat, a Flash or a Platinum version. Those ordering at least nine get that base number increased to $1,500 per vehicle. And, until November 15—when the deal expires—dealers can walk away with the aforementioned $22,500 in total for ordering 15 total vehicles. Ordering more appears to be allowed, but the incentives stop at $22,500.

Oh, and Stop Using the Tesla Adapters

While Tesla’s ($TSLA) move to make its charging system the North American standard was something of a coup for its time, it has not come without some issues. In fact, Ford recently announced that its customers should not use the Tesla Supercharger system, or the adapters that their cars came with, at least until new chargers can be sent out.

A report from Inside EVs warned owners about a “potential issue” with the adapters. What that issue was, however, was unclear. But the consequences of the unknown issue are anything but unclear, starting with something as simple as increased recharge time or even outright damage to the charging port. Replacements, meanwhile, are forthcoming, which is good news for anyone who owns a Ford electric vehicle due to the sheer prevalence of the Tesla Supercharger network.

Is Ford Stock a Good Buy Right Now?

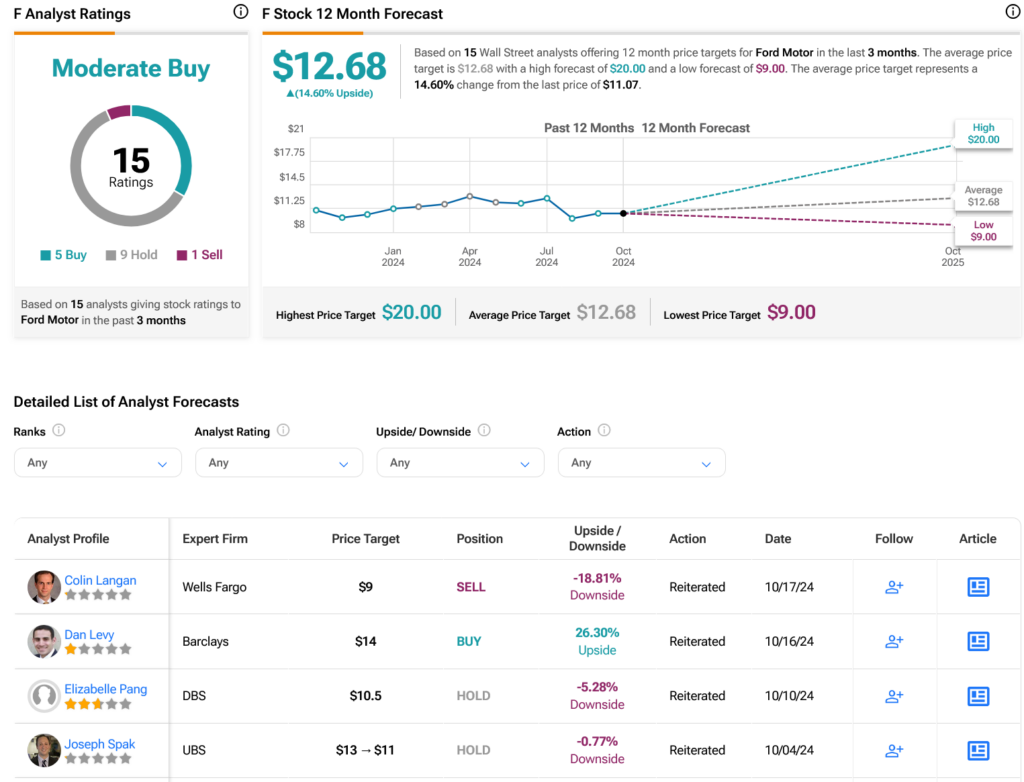

Turning to Wall Street, analysts have a Moderate Buy consensus rating on F stock based on five Buys, nine Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 3.12% rally in its share price over the past year, the average F price target of $12.68 per share implies 14.6% upside potential.