Digitalization of payments has gained traction due to a rise in internet penetration, a higher adoption rate of smartphones, an increase in e-commerce sales, and rising government initiatives to digitize payments.

According to a Grand View Research report, the digital payment market was worth $58.3 billion last year and is expected to grow at a compounded annual growth rate of 19.4% between 2021 and 2028.

Using the TipRanks stock comparison tool, we will compare the two companies, Affirm Holdings, and PayPal, and examine how Wall Street analysts feel about these stocks.

Affirm Holdings (AFRM)

Affirm Holdings was founded in 2012 and is looking at developing a payments platform for mobile-first and digital commerce, with an extensive portfolio of products. Yesterday, the stock shot up by approximately 20% as the company partnered with Target (TGT) . Target’s online shoppers can now use Affirm’s Buy Now, Pay Later (BNPL) service for purchases in excess of $100.

Affirm has also partnered with Amazon (AMZN) to offer its flexible payment solution. Currently, it is testing out this payment option with Amazon’s select customers.

The company reported mixed results in the fiscal Q4 of FY21, with revenues rising 70.7% year-over-year to $261.8 million, surpassing analysts’ expectations of $225.3 million. The company’s net loss came in at $0.48 per share, wider than the analysts’ expectations of a loss of $0.29 per share.

Max Levchin, Affirm’s Founder and CEO said, “During the fourth quarter, we increased the number of merchants on our platform by more than fivefold, more than doubled gross merchandise volume and grew active consumers by 97% year-over-year.”

The company’s outlook for Gross Merchandise Value (GMV) and revenue in Q1 and FY22 does not include the potential contributions from its partnership with Amazon and the rollout of its Debit+ card.

Affirm expects GMV between $2.42 billion to $2.52 billion in Q1, while it is projected to be between $12.45 billion to $12.75 billion for FY22. Revenues are expected to range between $240 million to $250 million, and between $1,160 million to $1,190 million in Q1 and FY22, respectively. (See Top Smart Score Stocks on TipRanks)

Late last month, Jeffries analyst Ryan Carr attended AFRM’s investor forum and came away sidelined on the stock. The analyst has a Hold rating but raised the price target from $82 to $110 (17.7% downside) on the stock.

At this forum, Affirm’s management discussed some key products that are likely to drive customer engagement and interaction. The products included Adaptive Checkout, Debit+ and Merchant Capital.

Adaptive Checkout gives the customer customized payment options at checkout, as determined by the company’s proprietary artificial intelligence (AI)-driven algorithm. According to analyst Carr, AFRM plans “to include Adaptive Checkout across the entire platform as soon as possible.”

Through its Merchant Capital product, AFRM aims to rollout advance cash to merchants seeking capital. Carr explained that although this is a new service, it has already deployed $50 million year-to-date.

Moreover, according to Carr, “AFRM’s partnerships allow them unique insight into the health of each merchant, allowing for strong risk management.”

Debit+ is a physical debit card that offers customers the flexibility to make purchases through the debit card, and then change the payment method to BNPL after completing the transaction.

Another key announcement that Affirm made at the investor forum was its plan to allow customers to buy and sell cryptocurrencies. This would be similar to PayPal (PYPL), which also allows its users to buy, hold and sell cryptocurrency.

Analyst Carr is of the opinion that while he expects AFRM’s “robust top-line growth to persist, this may come with pressured margins, given competition and macroeconomic normalization.” Moreover, the analyst feels that the company’s robust growth prospects are reflected in its valuation.

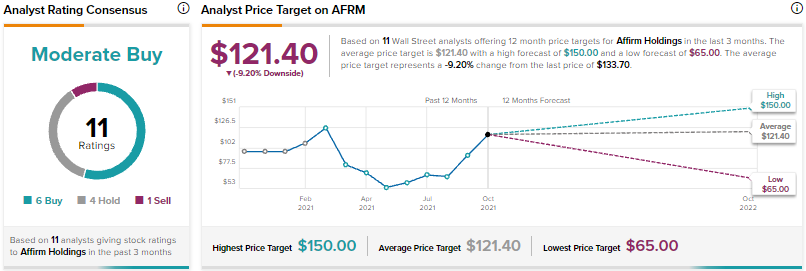

Turning to the rest of the Street, Wall Street analysts are cautiously optimistic about Affirm Holdings, with a Moderate Buy consensus rating, based on 6 Buys, 4 Holds, and 1 Sell.

The average Affirm Holdings price target of $121.40 implies 9.2% downside potential from current levels.

PayPal Holdings (PYPL)

PayPal is a digital payments company that enables person-to-person (P2P) payments through PayPal, Venmo, and Xoom products and services. The company’s Honey platform is a suite of free tools that simplifies and personalizes the shopping experience for its consumers.

In Q2, the company posted net revenues of $6.24 billion, up 17% year-over-year but falling short of the Street estimate of $6.27 billion. Adjusted earnings came in at $1.15 per share, up 8% year-over-year and surpassing analysts’ estimates of $1.13 per share. (See Analysts’ Top stocks on TipRanks)

Late last month, Bank of America analyst Jason Kupferberg hosted a virtual investor meeting with the company’s CFO, John Rainey, and came away bullish on the stock. The analyst has a Buy rating and a price target of $323 (22.3% upside) on the stock.

The analyst cited publicly proclaimed comments from eBay (EBAY), saying that the company expects to have completed more than 90% of the conversion of “unbranded PayPal volumes” in Q3. eBay spun-off PayPal in 2015, but until last year, purchases on eBay were still being processed through PayPal. This deal is likely to end this year, following the development of eBay’s own payment platform, Managed Payments.

Paypal remains optimistic, despite the conclusion of its lucrative agreement with eBay. Kupferberg said that the company’s management had “high conviction that the rate of y/y decline in transaction take rate will improve in 3Q vs. 2Q.” Transaction take rate is the percentage of transaction value facilitated by the company that PayPal can keep as revenue.

Also on a positive note, according to the analyst, PYPL’s management indicated that so far, “the early August price increase for US SMB (small and medium-sized business) merchants has been absorbed better than expected (i.e., less churn).” In May, the company made some key changes to its seller user agreement in the United States, for the first time in 21 years. Effective from August 2 this year, PYPL started charging sellers 3.49% plus 49 cents to process transactions performed via its products, such as PayPal Checkout, Pay with Venmo, PayPal Credit, and the buy-now-pay-later offering Pay in 4.

In the BNPL space, PYPL remains very bullish; the company expects to achieve $5 billion in BNPL volume this year.

The company also expects to roll-out an all-in-one personalized app, or “Super App,” by the end of this year. This app would include in-app personalized shopping tools, high-yield savings accounts, BNPL services, budgeting tools, and investment capabilities. According to analyst Kupferberg, “The on-time launch of the new app is a positive indicator of execution, in our view, as PYPL continues to juggle multiple new important organic growth initiatives.”

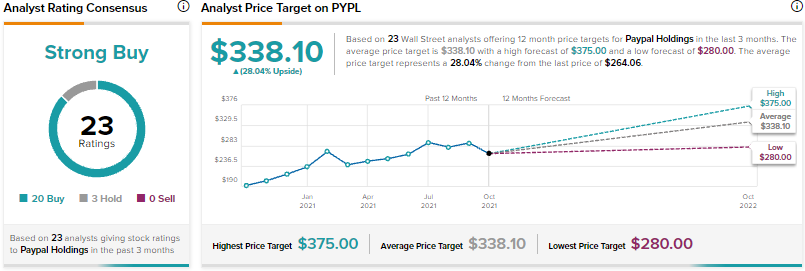

Turning to the rest of the Street, Wall Street analysts are bullish about PayPal Holdings, with a Strong Buy consensus rating, based on 20 Buys and 3 Holds.

The average PayPal price target of $338.10 implies 28% upside potential from current levels.

Bottom Line

While analysts remain cautiously optimistic about Affirm, they are bullish about PayPal. Based on the upside potential over the next 12 months, PayPal does seem to be a better Buy.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of TipRanks or its affiliates, and should be considered for informational purposes only. TipRanks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. TipRanks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by TipRanks or its affiliates. Past performance is not indicative of future results, prices or performance.