Elon Musk and Vivek Ramaswamy’s “Department of Government Efficiency” (DOGE) will be looking to cut through government red tape. However, they will be up against significant challenges, which include resistance from bureaucrats and even potential rules from Trump’s own policy promises. While industries like energy and finance might see deregulation, areas like healthcare and immigration could face tighter restrictions under Trump. This would create a mixed regulatory outlook, according to Dan Goldbeck of the American Action Forum.

Despite Musk’s bold suggestion on X to abolish the Consumer Financial Protection Bureau, Yahoo Finance pointed out that Trump’s first term saw an overall increase in regulations in three out of four years. As a result, Goldbeck predicts a similar pattern in a second term, especially in areas like immigration, where implementing large-scale deportation programs would create more regulations.

Musk and Ramaswamy might also run into legal and procedural hurdles. While they point to recent Supreme Court rulings in order to support their agenda, experts argue that these decisions primarily empower Congress and the judiciary, not executive actions. Goldbeck also noted the slow pace of regulatory processes and pointed out that rescinding Biden-era rules alone could take years. This could potentially hinder DOGE’s ability to deliver significant results by its 2026 deadline.

California Targets Tesla

With Musk now an influential voice in the White House, many investors and analysts have pointed out how Tesla ($TSLA) will be able to benefit significantly going forward. However, it seems like the company can also be negatively impacted. In fact, California Governor Gavin Newsom could exclude the EV maker from California’s proposed EV Tax Rebates scheme.

Although Newsom said that the move was aimed at igniting more competition and innovation in the EV space, analysts like Dan Ives said that this is “clearly a political move from Newsom.” It will be interesting to see how things will play out going forward and if Newsom actually goes through with this threat.

Is Tesla a Buy, Sell, or Hold?

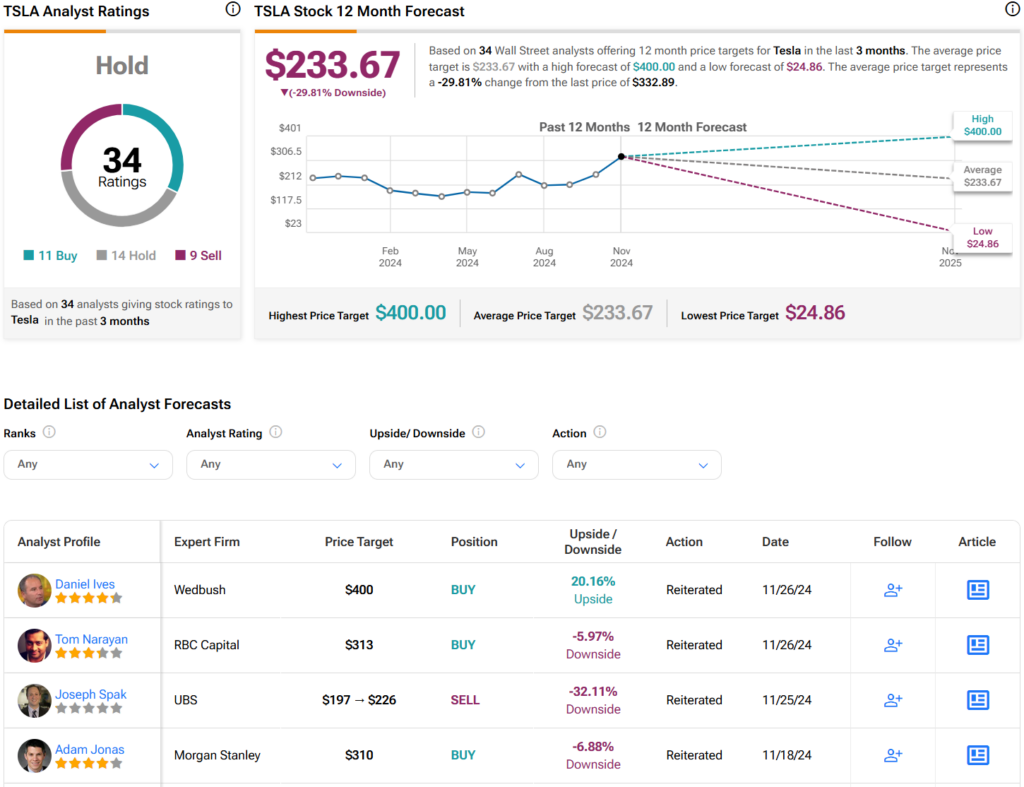

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 11 Buys, 14 Holds, and nine Sells assigned in the past three months, as indicated by the graphic below. After a 36% rally in its share price over the past year, the average TSLA price target of $233.67 per share implies 30% downside risk.