GameStop ($GME) stock plunged 22% on March 27, triggering a short sale restriction on the New York Stock Exchange after short volume exploded 234% in one day. That’s nearly 31 million shares sold short—just shy of the chaos seen during the infamous 2021 squeeze. According to TradingView data, it was the second biggest short volume spike in the stock’s recent history.

Surge in GME Stock Shorts Triggers Trading Restrictions

The SSR rule kicked in automatically once GameStop dropped over 10% from its prior close. It wiped out a 12% bump the stock had picked up after announcing plans to buy Bitcoin. Kevin Malone, CEO of Malone Wealth, said on X, “GameStop traded 50x more shares today than last Thursday. Not statistically possible without naked short-selling.”

Analysts Slam Bitcoin Move as Gimmicky

Right after announcing the Bitcoin plan, GameStop also revealed a $1.3 billion convertible notes offering. That raised eyebrows. Speaking to Yahoo Finance, Tastylive CEO Tom Sosnoff said, “It feels a little like… I’m going to buy some Bitcoin with our excess cash because we can’t find a company that is going to be accretive.”

As Hans Akamatsu pointed out, this echoes Strategy’s ($MSTR) move in 2021. If Bitcoin or GameStop rips higher, he said, “the trade gets very interesting as we have a squeeze opportunity here.”

Is GameStop a Good Stock to Buy?

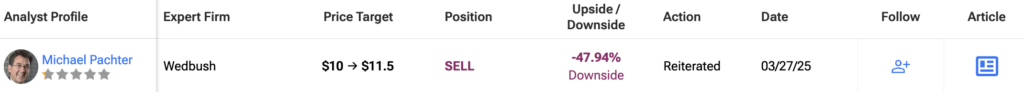

Currently there is only 1 analyst covering GameStop. Wedbush analyst Michael Pachter isn’t sold on GameStop’s strategy—or lack of one. He slapped the stock with a “Moderate Sell” rating and a $10 price target. He warned that while the company’s sitting on about $10 per share in cash, there’s “no clear plan” for using it wisely.