Today’s “Expert Spotlight,” shines on two recommendations of the senior managing director of Evercore ISI, David Palmer, a veteran Wall Street analyst who has been in the game for more than two decades. Palmer covers the Restaurants and Food domain and has been successful in his ratings 60% of the time in his career as an analyst. He is bullish on several restaurant stocks, including these two: Domino’s Pizza (DPZ) and McDonald’s (MCD).

Following what Wall Street analysts are saying is an excellent way to identify the SWOT (strengths, weaknesses, opportunities, and threats) of companies.

TipRanks compiles the recommendations of top experts of Wall Street, which can be key to determining which stocks to invest in to maximize returns.

Expert’s Track Record

Our expert for today, David Palmer, has generated 5.9% returns per rating, and is ranked 758th among 7,949 analysts tracked on TipRanks. This rating was given by TipRanks based on a complex Star Ranking system that takes into account an expert’s success rate, average returns garnered per transaction or rating, and statistical significance, which increases with each rating.

The analyst’s most profitable stock recommendation was Chipotle Mexican Grill (CMG), between October 22, 2018, and October 22, 2019, during which time the stock gained 81.7%.

The analyst made 10 recommendations in July, among which nine were Buy recommendations. Here are two stocks that have Palmer’s Buy rating and have managed to generate positive returns per rating on average, despite the tumultuous market conditions.

Domino’s Pizza (DPZ)

Its status as the world’s largest pizzeria didn’t shelter Domino’s Pizza from the ferocity of 2022. Labor shortages, a rise in input costs, and a drop in consumer discretionary spending took a toll on the company’s margins as well as its overall Q2 performance.

Nonetheless, Palmer is bullish on the company, and maintained a Buy rating with a price target of $495 on DPZ. “Looking in 2023, there is also an opportunity for operating margin recovery at US stores (-700bp vs 2019) due mostly to food costs (-500bp) and supply chain (-170bp vs 2019) with recovering volumes,” observed the analyst.

Additionally, Palmer is optimistic about Dominos’ focus on internalizing its delivery orders and enhance delivery service. The analyst also expects Frank Garrido, Domino’s Executive Vice President of Operation, to ramp up the productivity and profitability of the company’s currently poorly managed stores.

The last couple of years have been difficult for the food and restaurant businesses. Although Palmer has 43% success with his seven ratings on Domino’s, we note that despite the rocky two years that Domino’s has been through, the analyst has ensured a 1.36% average return per rating on DPZ. Moreover, looking at the past five years, we saw an impressive 120.16% rise in the stock’s value.

McDonald’s (MCD)

As a leading foodservice retailer, McDonald’s had a few hiccups this year, including unfavorable forex impacts, inflation in input costs, and loss of business in Russia and Ukraine due to the ongoing war. Yet, the company managed to deliver a better-than-expected bottom-line and relatively healthy comparable sales results for Q2 last week.

U.S. consumer spending, especially on breakfast, is showing strong resilience, which is a boon for McDonald’s. Typically, fast-food chains are cheaper than fine-dining and other restaurants’ offers, making them do better during economic dips.

In many instances, Palmer has shown us that McDonald’s is his favorite pick. He looks at McDonald’s “as an inflation-protected staple,” which can help the company wade through the current market conditions and reach a drier patch.

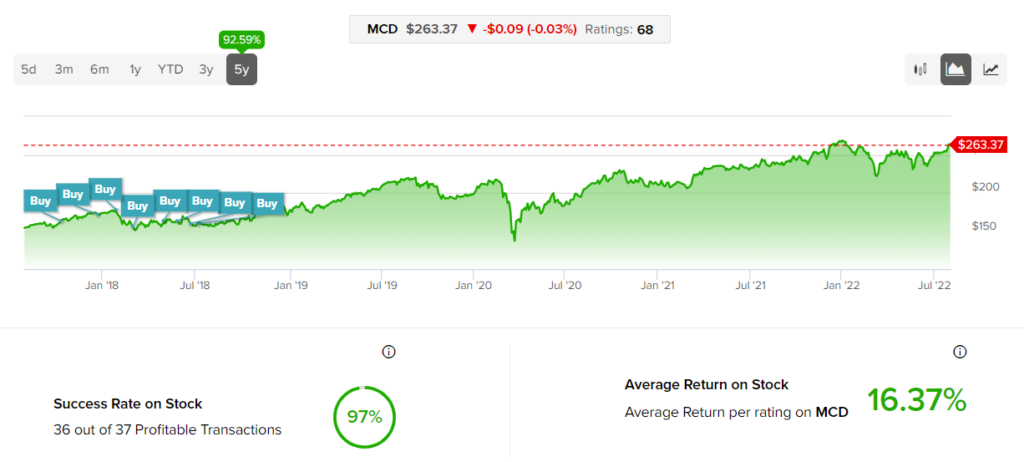

Interestingly, 36 out of 37 of Palmer’s ratings on McDonald’s have been profitable, garnering a 16.37% on average, per rating.

Bottom Line on Analyst Palmer

With a B.A. degree from Cornell University and an MBA from Columbia Business School, Palmer previously worked as a managing director with UBS and RBC Capital Markets before joining Evercore ISI in 2019.

Needless to say, his convictions on recently recommended stocks, even in the wake of a concerning economic outlook, can be used as a guide to making investment decisions.