E-commerce giants Amazon (NASDAQ: AMZN) and Alibaba (NYSE: BABA) both experienced massive growth during the pandemic, but that has now come to an end. Following the reopening, consumers hit the high road again, and the economic downturn has also impacted growth. In a sense, the slowdown was to be expected; the number of new people turning to e-commerce driven by the stay-at-home mandates was bound to recede with the resumption of normality.

However, both companies have also faced other headwinds. The pair have invested heavily for the future, and that has taken its toll on their profitability. Both are also facing increasing scrutiny from regulators, although this is an issue currently more serious for Alibaba, being watched over by the Chinese authorities. Not to mention, inflation has also played its part in consumers scaling back spending.

All of the above have also impacted the stock performance, with both down over 20% on a year-to-date basis. This brings us to the main question: which of these giants represents a better investment choice right now? Let’s check in with the TipRanks database to see what the analysts make of their prospects.

Amazon

Amazon famously started out as an online bookseller in the mid-90s, when the internet was still in its nascent stage. With the canny idea of founder Jeff Bezos, the company quickly outgrew the bookseller tag to turn into an e-commerce force. However, that was only the beginning; since then, Amazon has branched out in every direction – from cloud services with AWS to entertainment with Prime Video to smart home devices to groceries and logistics. We could go on – you name it, Amazon has probably got its fingers in it.

Online retail might be considered Amazon’s forte, but as the segment’s growth has taken a breather, its higher-margin cloud business has been growing at a fast pace.

In Q2, Amazon generated revenue of $121 billion, amounting to a 7% year-over-year increase (10% ex-FX) whilst coming in ahead of the Street’s $119 billion forecast. AWS revenue increased by 33% y/y to reach $19.7 billion. Boosted by AWS’s strength, operating income came in at $3.3 billion, higher than the Street’s prediction of $1.75 billion, while an EBIT margin of 2.7% also beat the 1.5% consensus.

With EPS of -$0.20, Amazon sprung a negative surprise on Wall Street, as analysts expected that figure at $0.14. However, the company’s outlook was solid, as it guided for revenue between $125 and $130 billion in Q3, a touch above consensus expectations (at the midpoint) for $126.5 billion.

The AWS growth supports Morgan Stanley’s (NYSE: MS) Brian Nowak’s thesis; he thinks the segment’s success will have a positive impact on other parts of the business.

“Demand remains strong as AWS’s booking backlog accelerated to ~13% Q/Q growth. AMZN is also stepping up investment in AWS (capex/D&A coming through, sales people and product engineers) as AMZN intends to lean in to drive share even through a cooling macro backdrop,” Nowak noted.

“This is bullish long-term AWS growth and, in our opinion, should also be a signal about AMZN’s confidence in retail profitability to come… given 1) we know AMZN’s share price matters to employees, 2) shares have lagged and 3) we don’t think AMZN would choose to lean into investing its AWS profit pool (that arguably has been supporting the stock through retail’s struggles) unless it has confidence the retail business is likely to deliver,” the analyst added.

These comments underpin Nowak’s Overweight (i.e., Buy) rating on AMZN, while his $175 price target implies shares will climb 31.3% higher over the next year. (To view Nowak’s track record, click here)

What is AMZN Stock’s Price Target?

Overall, Wall Street remains firmly in Amazon’s corner; barring one skeptic, all 37 other recent analyst reviews are positive, naturally culminating in a Strong Buy consensus rating. The average Amazon price target is just a smidgen above Nowak’s; at $177.05, the figure represents potential one-year gains of 32.85%.)

Alibaba

Often saddled with the tag “the Amazon of China,” the cliché is not without reason. Alibaba remains the dominant force in the Chinese e-commerce industry, driven by its domestic Taobao and Tmall platforms, while its retail marketplace, AliExpress, is used by consumers across the globe. It is also the leader of China’s cloud infrastructure services industry, with Alibaba Cloud taking the bulk of the market share.

That said, in contrast to Amazon, whose profitability profile is driven by the success of its cloud business, Alibaba still heavily relies on e-commerce sales to offset cloud losses. The problem is that the Chinese economy’s growth has hit a brick wall, and that has taken its toll on the company.

After nearly two decades of continued expansion, in its latest quarterly report, for Fiscal Q1 2023, the company’s revenue growth went into negative territory for the first time.

Revenue dropped 0.1% compared to the same quarter last year to reach $30.69 billion, although it should be noted that Wall Street had expected that figure to be worse, having called for sales of $30.16 billion. Despite its ongoing investments, the company also posted a surprise on the bottom line; Non-GAAP EPADS of $1.75 bettered analysts’ forecast of $1.56 a share.

Alibaba has had other issues to contend with; it has regularly tussled with domestic regulators while the prospect of Chinese stocks getting booted off U.S. exchanges has also hung over its head.

Nevertheless, it is the improving fundamentals that have elicited praise from Truist’s top analyst Youssef Squali, who believes the company is moving in the right direction.

“We remain constructive on BABA, which despite posting its first negative Y/Y revenue quarter as a public company in F1Q23, it reported results which exceeded expectations on the top and bottom lines, as fears of a Chinese macro slowdown have weighed materially on sentiment,” the five-star analyst said. “We are encouraged by the company’s commentary on July trends improving from May/June, and we believe that BABA’s more disciplined attitude towards organic investments should lead to a return to more profitable growth in F2H23.”

Along with a Buy rating, Squali has a $135 price target for Alibaba shares, providing room for ~53% growth in the year ahead. (To see Squali’s track record, click here)

What is BABA Stock’s Price Target?

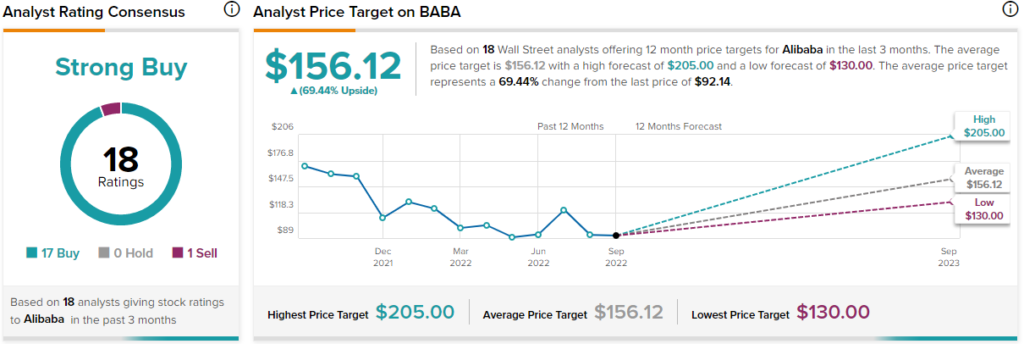

Alibaba’s ratings are almost unanimously positive. One Sell rating is countered by 17 Buys, all coalescing to a Strong Buy consensus rating. The average Alibaba price forecast of $156.12 implies 69.4% upside potential from current levels.

Conclusion: BABA Stock May Have More Upside Potential

So, which stock ultimately represents a better opportunity at present? It looks like the Street’s experts think you can’t really go wrong with either, but purely from a returns perspective, with the potential upside standing at 69.4% for BABA compared to 32.85% with AMZN, the Chinese behemoth is the one to go for right now.