Financial stocks were among the ASX’s biggest gainers, after the central bank delivered a softer than anticipated rate rise, sending market signals that aggressive fiscal tightening may be easing.

The S&P/ASX 200 Financials (XFJ) index rose 4.2% on the back of the announcement yesterday. Pinnacle Investment Management Group Limited (ASX:PNI), Netwealth Group Ltd. (ASX:NWL), and Magellan Financial Group Ltd (ASX:MFG) were among the best performing financial shares.

Why the softer RBA rate hike was welcomed by financial stocks

The Reserve Bank of Australia (RBA) increased its benchmark interest rate by only 0.25%, instead of the 0.50% that many analysts expected, somewhat easing future recession fears.

Financial companies that provide loans can make more profit in a high interest rate environment. However, a rapid increase in rates can cause a recession and hurt lenders, as borrowers default on their loan repayments.

Let’s take a closer look at the best-performing ASX financial stocks.

Pinnacle Investment Management share price target suggests over 33% upside

The company offers an array of financial services and business support. Pinnacle Investment Management shares surged 9% after the RBA announcement ringing their gains over the past three months to over 20%. However, the stock trades more than 40% below where it began the year. According to TipRanks’ analyst rating consensus, Pinnacle stock is a Moderate Buy. The stock’s average price target of AU$11.91 suggests over 33% upside potential.

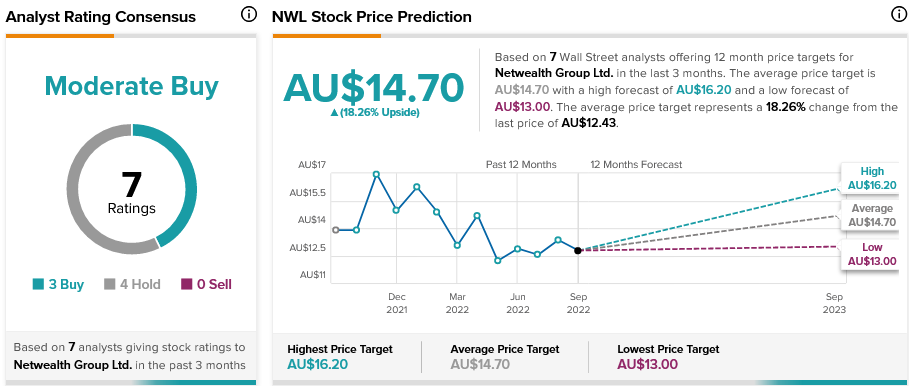

Netwealth share price forecast implies 18% upside

The company serves financial intermediaries and investors, providing services such as managed funds, portfolio management, and superannuation administration. Netwealth shares jumped more than 5% yesterday, but they are still down about 33% year-to-date. According to TipRanks’ analyst rating consensus, Netwealth stock is a Moderate Buy. The stock’s average price forecast of AU$14.70 implies over 18% upside potential.

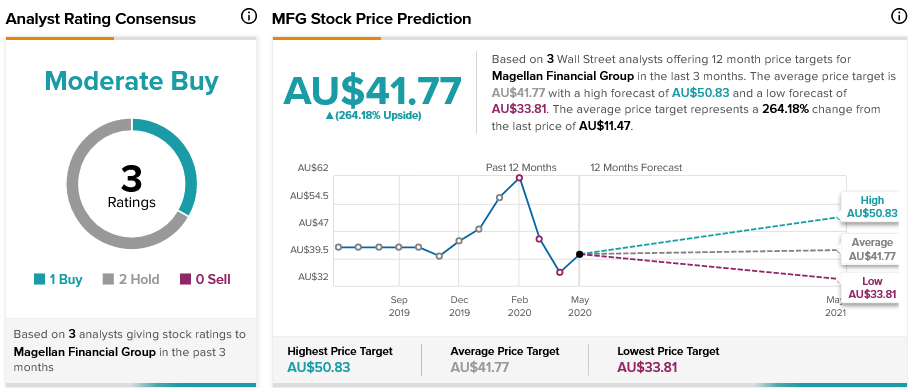

Magellan Financial share price prediction indicates 260% upside

The company provides funds management, serving individual and institutional investors. Magellan Financial shares gained about 5% on Tuesday, but they are still down 40% year-to-date. According to TipRanks’ analyst rating consensus, Magellan Financial stock is a Moderate Buy. The stock’s average price prediction of AU$41.77 indicates over 260% upside potential.

Concluding thoughts

The RBA plans to continue raising rates as it attempts to stifle inflation, however gradual and less aggressive rises are likely to benefit financial companies. That’s because less rapid rate hikes may solve the inflation problem, without causing an economic downturn.