NorthWest Healthcare REIT (TSE:NWH.UN) has been a decent performer in the past when including dividends, but the stock has really taken a tumble recently. NWH.UN is a real estate investment trust that holds a portfolio of income-producing healthcare properties. It operates in Canada, Brazil, Germany, and Australia/New Zealand and has been rewarding investors via monthly dividends since 2010. Its current dividend yield comes in at around 8.4%, and analysts see solid upside potential ahead, making it worth considering. The stock also looks undervalued, trading at a ~32% discount to its net asset value (NAV).

Is NWH.UN Stock’s 8.4% Dividend Safe?

As mentioned above, NWH REIT has a ~8.4% dividend yield that is paid monthly. However, its dividend per unit has stayed flat since 2010, so you shouldn’t expect any growth. Some even argue that NWH may be at risk of cutting its dividend since it generated adjusted funds from operations per unit (also known as AFFO/unit, a cash-flow metric used by REITs) of C$0.15 in Q3 versus its payout of C$0.20 per unit. Nonetheless, the company expects earnings to be in line with its past quarters, going forward, which could keep it from cutting its dividend.

Going back to Q2 2022, its payout ratio was 95%, which again proves that there’s little room for dividend hikes. Therefore, this stock likely isn’t suitable for investors looking for dividend growth.

NorthWest Healthcare REIT is Undervalued

NWH REIT’s valuation presents an interesting opportunity. This is because its NAV/unit was C$13.97 as of Q3 2022, up 2.7% year-over-year. With a share price of C$9.51, this leaves plenty of upside potential before the stock reaches its fair unit value. If another bull market comes eventually, the stock can reach its net asset value again, as it has in the past.

One thing to keep in mind is that its NAV/unit may potentially drop in the short term because rising interest rates are causing property values to fall, which somewhat justifies the discount. However, there’s a large margin of safety, and a drop due to interest rates is likely to be temporary in nature, in our opinion. Still, investors should note that NWH’s NAV/unit fell from C$14.19 in Q2 to C$13.97 in Q3.

Is NorthWest Healthcare REIT Stock a Buy, According to Analysts?

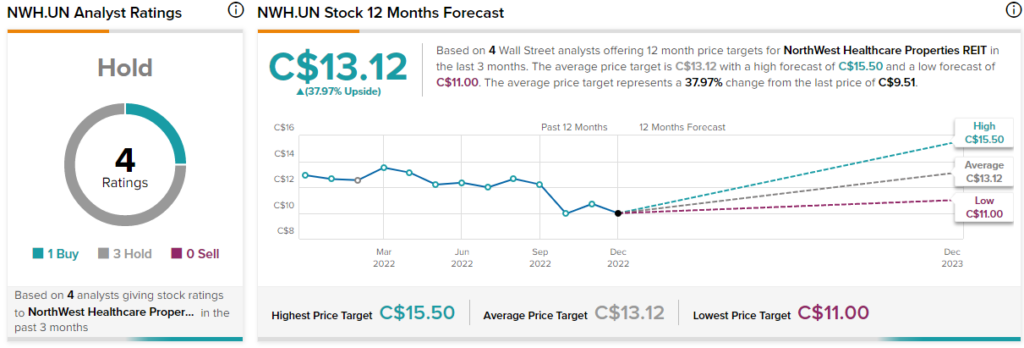

According to analysts, NWH REIT stock earns a Hold consensus rating based on one Buy and three Hold ratings assigned in the past three months. Nonetheless, the average NWH.UN stock price prediction of C$13.12 implies 38% upside potential. Analyst price targets range from a high of C$15.50 to a low of C$11.00.

The Takeaway: Undervalued but Slightly Risky

NWH.UN stock is objectively undervalued based on its market price being much lower than its last-reported NAV/unit. However, this company isn’t perfect. It doesn’t have a solid track record of growth, which is why its dividend hasn’t been hiked once since going public in 2010, and there’s also some risk of a dividend cut. The company’s NAV/unit can also trend lower if it fails to create value for shareholders. Still, the high 8.4% dividend yield combined with the valuation discount could be enough to entice value investors.