Just in time for Easter, the market delivered two consecutive sessions of gains. All three of the major U.S. stock indexes closed in the green on the last two days of the holiday-shortened trading week, rallying on the U.S. government’s additional interventions to mitigate COVID-19’s economic impact. While the most recent surge was a welcome piece of good news, it came as somewhat of a surprise as the deadly virus continues to rampage parts of the U.S. and businesses remain shut down indefinitely.

As a result, Wall Street pros argue that while we might not be out of the woods just yet, those ready to take on some risk have been presented with exciting opportunities. Specifically pointing to the biotech space, several compelling names are trading at low levels, making it affordable to snap up shares before a particular stock takes off.

Seemingly at the drop of a hat, biotech companies can see their share prices soar on a single positive catalyst like favorable clinical data or regulatory approvals.

With this in mind, we used TipRanks’ database to zero in on three biotech stocks trading for under $2 per share. After conducting our research, we found out that each is Buy-rated and boasts some serious upside potential.

Trevena, Inc. (TRVN)

Focused on developing therapies to improve the lives of patients with central nervous system (CNS) disorders, Trevena has an impressive development pipeline that could potentially help it do just that. While shares have fallen 37% year-to-date, putting the current share price at $0.51, some analysts believe its lead candidate, oliceridine, can drive massive upside.

Oliceridine, an IV injection designed as an alternative to IV morphine for moderate to severe acute pain management, could be granted approval this summer, as the FDA recently accepted TRVN’s resubmission for review and set an August 7 PDUFA date. Based on a key opinion leader’s evaluation, JMP Securities analyst Jason Butler thinks there’s a strong likelihood the drug will ultimately be approved.

While TRVN received a Complete Response Letter (CRL) in November 2018, new data from the QT trial addressed the safety concerns. Additionally, Dr. Timothy Beard, M.D., Chair of the Department of Surgery at Summit Medical Group, sees oliceridine as being an innovative drug.

Butler wrote, “Dr. Beard stated that he is very familiar with the clinical data for oliceridine and believes the drug represents a truly novel advancement in pain management. He is impressed by the pain relief achieved with the drug and views the side effect profile as differentiated. He also commented that the data from the open-label extension trial is encouraging as it included a diverse range of patient populations.”

On top of this, the candidate has demonstrated a clear role in higher-risk patients as well as the potential to improve patient experience and time to discharge in outpatient procedure centers. This is significant because performing procedures in an outpatient setting rather than in a hospital results in substantial savings for insurance companies.

With three other candidates in development, it’s no wonder Butler is optimistic about TRVN. In line with this take, the four-star analyst maintained a Market Outperform rating and $4 price target. Should this target be met, shares could be in for a 684% twelve-month gain. (To watch Butler’s track record, click here)

Looking at the consensus breakdown, it has been relatively quiet when it comes to other analyst activity. Only one other analyst has published a review recently, but it was also bullish, making the consensus rating a Moderate Buy. At $3.75, the average price target implies 635% upside potential. (See Trevena price targets and analyst ratings on TipRanks)

Zosano Pharma Corporation (ZSAN)

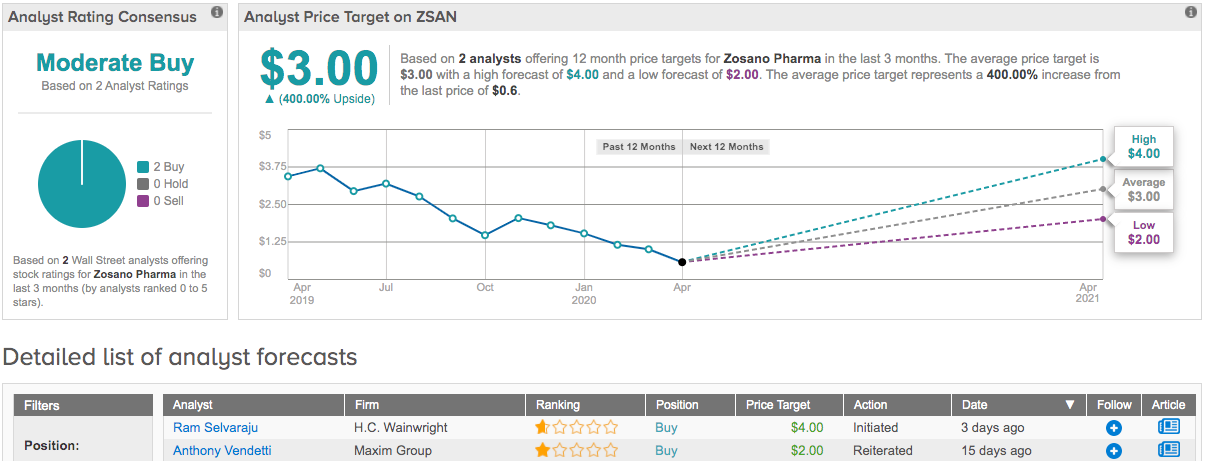

Another biotech targeting CNS conditions, Zosano has developed an intracutaneous microneedle patch system to deliver therapeutics and other bioactive molecules. At $0.60 apiece, the share price could represent the ideal time to acquire a position.

Weighing in for H.C. Wainwright, analyst Raghuram Selvaraju commented, “In our view, Zosano looks like a sleeper that investors would be wise to assess carefully—the company’s sole clinical-stage product candidate, Qtrypta, has completed pivotal development in acute migraine therapy with what we consider to be stellar results and is the subject of a potential October 20, 2020, U.S. approval decision.”

The candidate is a formulation of an existing anti-migraine drug, zolmitriptan, in ZSAN’s patented microneedle array-containing, patch-based delivery device. According to pivotal data, the drug was able to produce fast onset pain relief, with 23% of patients experiencing results within 15 minutes and more than 80% of patients within two hours. Qtrypta achieved a strong result in terms of pain freedom and works well for patients with nausea who can’t swallow oral tablets and patients with a fear of visible needles, and thus, can’t use injectable triptans.

Selvaraju added, “Only about 2% of patients in the Phase 3 trial reported triptan-like side effects (i.e., dizziness and paresthesia), indicating that Qtrypta may have a substantial safety and tolerability edge vs. other triptan-class drugs.”

With Selvaraju expecting the company to target the roughly 5,000 specialist prescribers who routinely treat migraines and predicting it will be priced comparably to Eli Lilly’s drug, he estimates that Qtrypta could generate $30 million in sales during 2021 and peak sales of almost $300 million in 2026. Adding to the good news, COVID-19’s effect on the company should be relatively limited as Qtrypta has already wrapped up pivotal testing and is under FDA review.

To this end, Selvaraju kicked off his ZSAN coverage by issuing a Buy rating. Along with the bullish call, he set a $4 price target, suggesting shares could skyrocket 567% in the next year. (To watch Selvaraju’s track record, click here)

Given that the biotech has received 2 Buy ratings compared to no Holds or Sells in the last three months, the word on the Street is that ZSAN is a Moderate Buy. Thanks to the $3 average price target, shares could potentially climb 400% higher in the next twelve months. (See Zosano price targets and analyst ratings on TipRanks)

Moleculin Biotech, Inc. (MBRX)

Last up, we have biotech company Moleculin, which has used its three core technologies to develop therapies for various forms of cancer. Unlike the other two names on our list, shares are up 143% in the last month, and at $1.14, its price tag still presents investors with an attractive entry point.

The excitement surrounding MBRX is partly related to its potential treatment for COVID-19. The company announced that the University of Frankfurt’s research indicated 2-deoxy-D-glucose, “2-DG”, reduces COVID-19 replication by 100% in vitro. Even though this is promising, 2-DG metabolizes too quickly to be delivered to patients effectively, and thus, can only be used in vitro. That’s where MBRX comes in. It designed its candidate, WP1122, as a 2-DG pro-drug that could possibly address the metabolic challenges associated with 2-DG.

Explaining the therapy’s implications, Maxim Group analyst Jason McCarthy stated, “WP1122 solves this problem with a modification to make a pro-drug which significantly increases the molecule’s stability and permeability. Once WP1122 gets into a cell, the pro-drug acetyl groups are cleaved by esterases in the cytoplasm, and the active 2-DG molecule is released. This process induces 10X-plus uptake into tissues, something that standard 2-DG cannot achieve…WP1122 could change that for viral diseases, including COVID-19, as well as cancer indications.”

Sure, additional clinical testing needs to take place, but McCarthy believes that early data is encouraging and he expects an IND filing for the candidate to come very soon. It should also be noted that MBRX has a research agreement with the University of Texas Medical Branch at Galvaston to study the efficacy of its compounds, including WP1112, in battling several viruses.

Based on all of the above, McCarthy stayed with the bulls, reiterating a Buy recommendation and $3 price target. This implies shares could soar 165% in the next twelve months. (To watch McCarthy’s track record, click here)

MBRX’s Moderate Buy consensus rating breaks down into only Buys, 2 to be exact. With a $2.50 average price target, the upside potential lands at 121%. (See Moleculin price targets and analyst ratings on TipRanks)