Just when it looked like time to throw in the towel, the market pulled through and delivered a win. Stabilizing crude oil prices, a few better-than-expected earnings reports as well as the possibility of a fresh fiscal stimulus package all helped inspire confidence among investors.

While April’s rally doesn’t necessarily signal that the worst is behind us, it’s encouraging to say the least. Add in the opportunity to find exciting growth plays, and you have our attention.

According to the Wall Street pros, even amid the ongoing public health crisis, a select group has set itself up for growth to the upside, pointing specifically to the healthcare sector. Stocks falling into this category are well positioned within the industry, and aren’t just in it for the short-term. Rather, these names are poised for some serious share price appreciation through the next year and beyond.

We all know that past performance won’t guarantee future results. Still, the best place to start looking for tomorrow’s high-growth stocks is among yesterday’s winners. Using TipRanks’ database, we’ve found three healthcare stocks that saw hefty gains in 2020. Each name is well-loved by Wall Street analysts, and has received enough bullish calls to score a “Strong Buy” consensus rating.

Compugen Ltd. (CGEN)

Genomics-based drug and diagnostic discovery company Compugen specializes in developing therapeutic and diagnostic biomarker product candidates including proteins and monoclonal antibodies. With an already achieved 147% year-to-date gain and an impressive lead candidate, COM701, the analyst community sees vast potential for the company in the immuno-oncology (IO) space.

Weighing in for investment firm SunTrust, analyst Asthika Goonewardene calls COM701 “first-in-class” and the “strongest lever in a hot, new immuno-oncology (IO) cluster of potential drug targets.” “Correctly targeting this IO cluster not only takes the brakes off the immune cells (blocking antagonist checkpoints) but also steps on the gas pedal (agonist effect). CGEN’s approach may achieve this,” he explained.

Part of what sets CGEN’s asset apart is that it acts on a different component of the cluster, with current data suggesting this approach will lead to better results. It should be noted that CGEN is the only player currently targeting this mechanism, putting it two to three years ahead of its peers, in Goonewardene’s opinion. The analyst added, “CGEN recently announced COM701 showed single agent activity (tumor shrinkage) at a more optimal dose. This is a key hurdle in IO and backs our positive sentiment.”

Looking forward, Goonewardene believes that data releases slated for the second half of 2020 and the first half of 2021 should demonstrate the ideal combinations of COM701 so it can be further evaluated in selected tumor types and achieve ~$3 billion in unadjusted peak sales by 2029.

As it also has a collaboration with industry heavyweight Bristol Myers and other top players are developing candidates to target the TIGIT component of the cluster, it’s no wonder Goonewardene takes a bullish stance on CGEN. To kick off his coverage, he published a Buy rating and set a $16 price target.

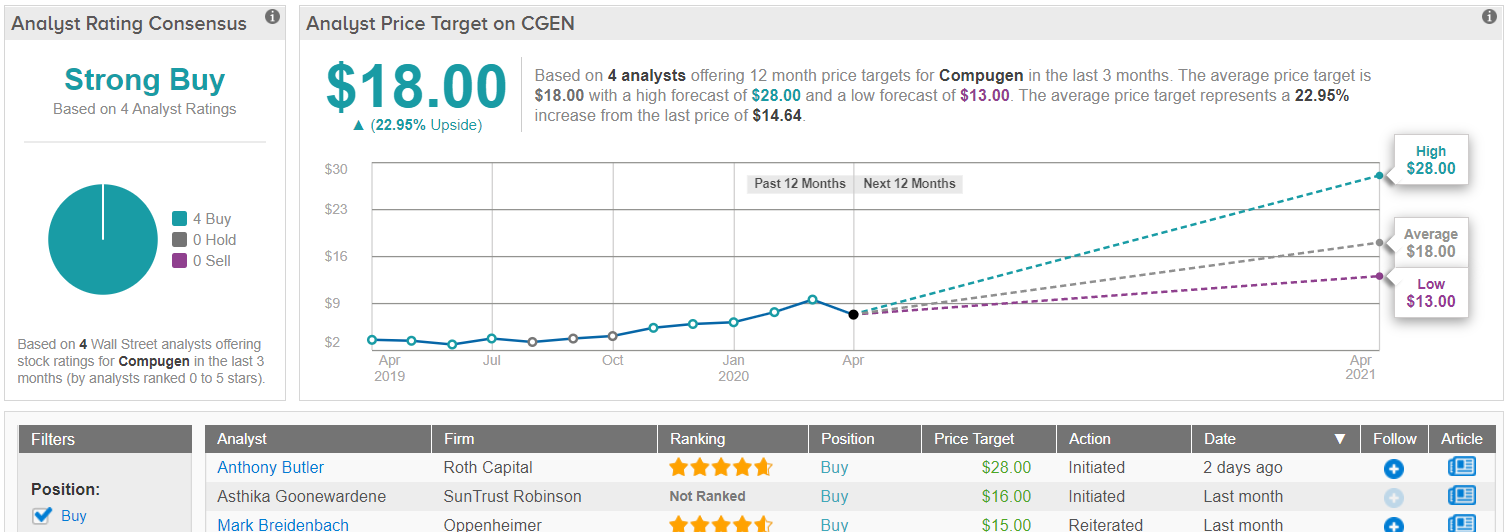

All in all, the rest of the Street echoes the analyst’s sentiment. Only Buy ratings have been assigned in the last three months, 4 to be exact, and thus, the consensus rating is a Strong Buy. At $18.00, the average price target is more aggressive than Goonewardene’s and suggests 23% upside potential. (See Compugen stock analysis on TipRanks)

Cue Biopharma, Inc. (CUE)

Hoping to provide better treatments for cancer and autoimmune diseases, Cue Biopharma is developing a novel class of injectable biologics to selectively engage and modulate targeted T cells within the body. In the last month alone, shares have climbed 88% higher, with one analyst noting that the current state of the market has set it up for even more gains.

JMP Securities’ Reni Benjamin tells clients that after a conference call with the company’s CSO and CMO, he has a better understanding of its Immuno-STAT platform and future clinical plans. With respect to the platform, the analyst found its breadth and depth promising, with it potentially being able to address multiple indications. Take its CUE-101 candidate for example. While the therapy was evaluated first in head and neck squamous cell carcinoma (HNSCC), it could potentially be used to treat any HPV16-driven cancer.

Expounding on this, Benjamin said, “Notably, prototypes for the next-generation of molecules have already emerged, with a pre-made scaffold receptive for chemical peptide conjugation (instead of fusion protein) that allows for even easier target switch, streamlined manufacturing, and potential registrational efficiencies Further, replacing the co-stimulator with a dampener (e.g., PD-L1) has the potential to drive the use of Immuno-STAT toward autoimmune-based indications…”

Additionally, a robust level of selectivity and therapeutic potency was shown by preclinical data. “Despite competitors that have engineered the ability to avoid regulatory T cells, CUE has designed a product candidate that can not only avoid regulatory T cells, but also activate antigen-specific T cell repertoires. Importantly, the Immuno-STATs are able to activate both pre-existing and naive T cells,” Benjamin commented.

It should also be noted that management has designed its ongoing first-in-human study with the goal of achieving platform validation. Combine this with a Merck collaboration advancing in type 1 diabetes and a $51 million pro forma cash position, and you get a bullish analyst review.

To this end, Benjamin kept a Market Outperform rating and $30 price target on the stock. Should this target be met, a 21% twelve-month gain could be in the cards. (To watch Benjamin’s track record, click here)

Turning now to the rest of the Street, other analysts like what they’re seeing. With 100% Street support, the consensus is unanimous: CUE is a Strong Buy. (See Cue stock analysis on TipRanks)

GenMark Diagnostics (GNMK)

Using its patented eSensor electrochemical detection technology, GenMark develops diagnostic instruments and multiplex molecular panels. While its ePlex SARS-CoV-2 (COVID-19) test has helped drive huge gains, 110% in the last month, some members of the Street believe its future is only getting brighter.

Back in March, the company announced that its test had been granted FDA emergency use authorization (EUA). The test can be run on GNMK’s ePlex system, and each test is expected to be priced at around $110. Part of the excitement surrounding the test is related to its speed, with it able to produce results in 90 minutes. Not to mention 96 tests can be run in eight-hour shifts.

Thanks to the massive level of interest, the test was widely expected to serve as a significant tailwind for the company in 2020. Based on GNMK’s preliminary Q1 2020 results, this appears to have been the case. In its preannouncement, GNMK reported Q1 revenue grew 80% year-over-year to hit $38.7 million, flying past the Street’s $26.4 million (23% year-over-year growth) estimate. Adding to the good news, the company is slated to see some serious gross margin expansion. We’re talking about 40% here.

Even though these figures are certainly impressive, BTIG analyst Sung Ji Nam notes that there are a few important factors to consider. First and foremost, RP demand had more of an effect on revenue than the COVID-19 tests. “While we expect continued tailwind for COVID-19 testing near-term, we are more encouraged by the strong ePlex placements in the quarter which bode well for GNMK’s core syndromic panel testing business both in the near term and longer-term,” he stated.

As for the second, Nam commented, “Full year revenue guidance was raised to 27-39% growth vs. 14-25%, previously: While the full-year revenue guidance was raised by the 1Q beat, GNMK has better visibility than most for its business near term and is well-positioned for the remainder of the year, in our view, given the strong momentum for the RP panel and COVID-19 testing. GNMK is also currently developing an ePlex RP2 Panel that will include the SARS-CoV-2 viral target with funding from BARDA (up to $749,000), which the company expects to have available for the next flu season.”

With GNMK continuing to expand its test menu in sydromic panel testing and its solid standing in a rapidly growing segment of the IVD market, the deal is sealed for Nam, as he reiterates a Buy rating on the stock. (To watch Nam’s track record, click here)

Like Nam, the rest of the Street has high hopes for this stock. GNMK’s Strong Buy consensus rating breaks down into 4 Buys and 1 Hold issued in the last three months. (See GenMark stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.