Shares of Agilent Technologies ($A) are down in after-hours trading after the medical diagnostics company reported earnings for its fourth quarter of Fiscal Year 2024, which was accompanied by a soft outlook. Earnings per share came in at $1.46, which beat analysts’ consensus estimate of $1.41 per share. In addition, sales increased by 0.6% year-over-year, with revenue hitting $1.7 billion. This also beat analysts’ expectations of $1.67 billion.

When breaking down the numbers further, Agilent’s Life Sciences and Applied Markets Group (LSAG) and Diagnostics and Genomics Group (DGG) both fell by 1%. However, the firm’s CrossLab Group (ACG) offset the declines with a 5% increase year-over-year, which led to the slight increase in overall revenue.

Interestingly, earnings per share was able to grow much faster than revenue (up from $1.38) due to an increase in operating margin. Although the LSAG and DGG margins fell from 28.1% to 28% and from 22.5% to 21.2%, respectively, the margin for the ACG segment increased from 31.7% to 32.6%. This, when combined with the segment’s revenue growth, was able to push EPS higher. It also helped that the firm repurchased $1.15 billion worth of shares during the past 12 months.

2025 Outlook

Looking forward, management has provided the following guidance:

- Q1 revenue between $1.65 billion and $1.68 billion versus estimates of $1.7 billion

- Q1 EPS of $1.25 to $1.28 compared to expectations of $1.37

- FY25 revenue between $6.79 billion and $6.87 billion versus estimates of $6.83 billion

- FY25 EPS of $5.54 to $5.61 compared to expectations of $5.66

As you can see, guidance was worse than expected, which is likely what contributed to the stock’s after-hours move.

Hedge Funds Have Been Buying

When it comes to “smart money,” money managers seem to be very confident in Agilent stock. Indeed, hedge funds increased their holdings in the stock by 2.9 million shares in the past quarter. As a result, they have a very positive confidence signal.

In addition, according to TipRanks’ data, David Blood’s Generation Investment Management LLP fund is the hedge fund with the largest position in Agilent stock and the company’s eighth-largest shareholder overall. All the larger shareholders are ETF funds. It is worth noting that David Blood is a 4.6-star hedge fund manager with over $21 billion in assets.

Is Agilent a Buy or Sell?

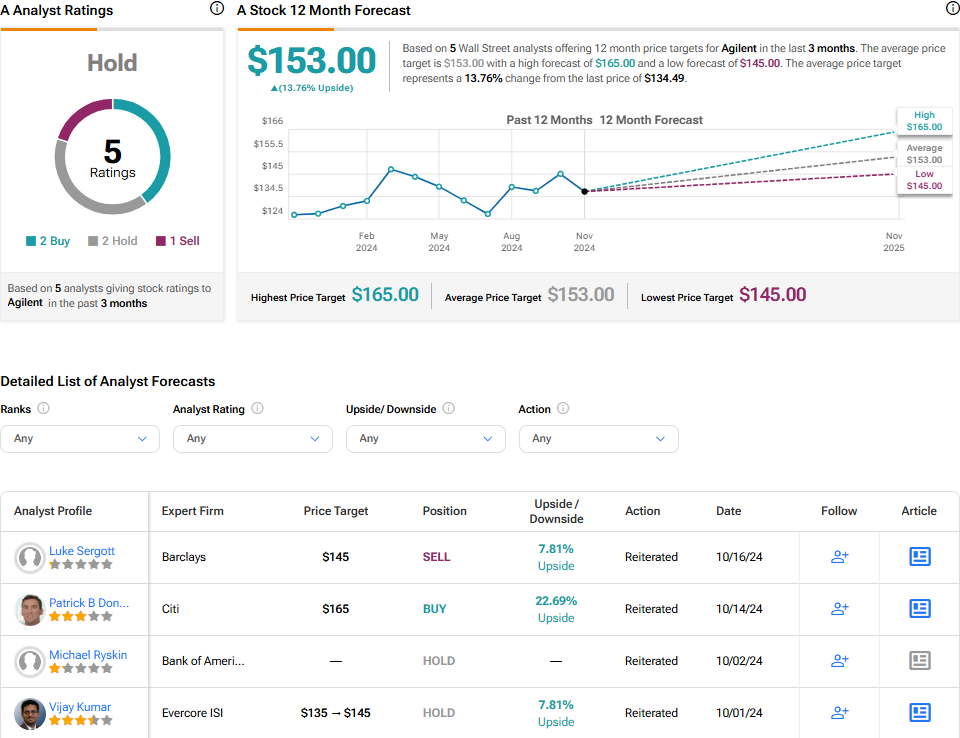

Turning to Wall Street, analysts have a Hold consensus rating on Agilent stock based on two Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After an 8% rally in its share price over the past year, the average Agilent price target of $153 per share implies 13.8% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.