First Solar (FSLR) is an American solar technology company. Its products include solar modules.

Let’s take a look at the company’s latest financial performance, corporate developments, and risk factors.

First Solar’s Q2 Financial Results and 2021 Guidance

The company reported revenue of $629.18 million for the second quarter of 2021, compared to $642.41 million in the same quarter last year and the consensus estimate of $617.22 million. The company posted EPS of $0.77, which rose from $0.35 a year ago and beat the consensus estimate of $0.64. First Solar ended Q2 with $2.1 billion in cash. (See First Solar stock charts on TipRanks).

For full-year 2021, First Solar anticipates revenue in the range of $2.875 billion – $3.1 billion. Additionally, it expects EPS in the band of $4.00 – $4.60.

First Solar’s Corporate Developments

First Solar is building its third factory in Ohio. It recently began preparation on the 3.3-gigawatt (GW) facility that it expects to start operating in the first half of 2023. First Solar is investing $680 million into the project that it says will expand its Northwest Ohio manufacturing capacity to 6 GW annually.

The company also plans to expand its manufacturing capacity in India. It intends to add 3.3 GW capacity at its Indian factory once it secures government approvals.

First Solar’s Risk Factors

The new TipRanks Risk Factors tool shows 43 risk factors for First Solar. Since Q4 2020, the company has updated its risk profile with one additional risk factor under the Finance and Corporate category.

First Solar says that it has designated specific courts in Delaware as the exclusive forums for resolving the lawsuits that investors may bring against the company or its executives. But the company cautions that if it is forced to resolve lawsuits outside its preferred courts, it may incur additional costs that could, in turn, adversely impact its operating results.

The majority of First Solar’s risk factors fall under the Production category, with 30% of the total risks. That is above the sector average of 12%.

Analysts’ Take

Last week, Needham analyst Vikram Bagri initiated coverage of First Solar stock with a Hold rating.

Bagri observed that First Solar could increase its manufacturing capacity to 16 GW per year within three years.

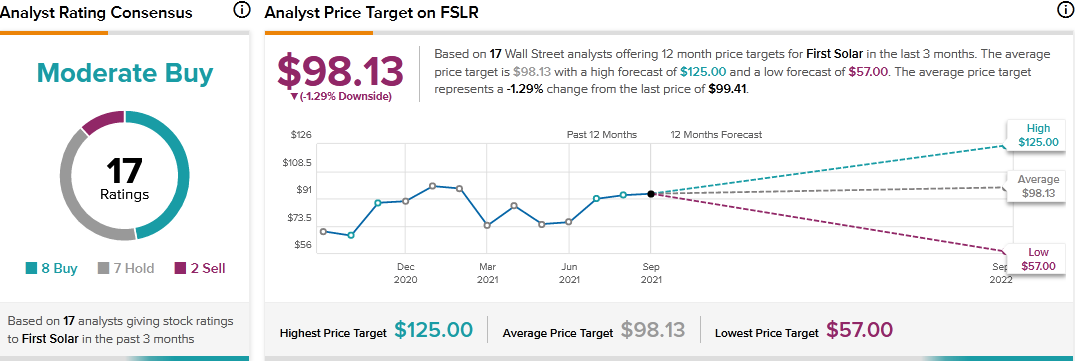

Consensus among analysts is a Moderate Buy based on 8 Buys, 7 Holds, and 2 Sells. The average First Solar price target of $98.13 implies 1.29% downside potential to current levels.

Related News:

Wells Fargo Fined $250M for Not Paying Back Wronged Customers — Report

Apple Plans to Spend Over $500M to Bolster Streaming Service – Report

What Can Investors Learn from Invitae’s Newly Added Risk Factors?