New York-based Sterling Bancorp (STL) is the parent of Sterling National Bank, a community-focused financial services provider serving business and consumer markets. The company is in the process of merging with Webster Financial Corporation (WBS) in what is expected to create a banking powerhouse in the Northeast.

Let’s take a look at Sterling Bancorp’s latest financial performance, corporate developments, and risk factors.

Sterling Bancorp’s Q2 Financial Results

The company reported revenue of $248.74 million compared to $239.39 million in the same quarter last year, beating consensus estimates of $221.64 million. Adjusted EPS of $0.52 rose from $0.29 in the same quarter last year and beat consensus estimates of $0.50. (See Sterling Bancorp stock charts on TipRanks).

Sterling Bancorp’s Corporate Developments

Sterling Bancorp has secured approval from its shareholders to merge with Webster Financial Corporation in an all-stock transaction valued at $10.3 billion. The combined company will be called Webster and will have its corporate headquarters in Stamford, Connecticut. Sterling Bancorp shareholders will receive 0.463 of a Webster share for each Sterling Bancorp share they own. As a result, Sterling Bancorp shareholders will own 49.6% of the combined company. The transaction is expected to close in the fourth quarter of 2021.

Ahead of the Webster merger, Sterling Bancorp has made several strategic investments. It recently invested in Texture Capital, a broker in the private securities markets that runs its operations using blockchain technology. Sterling Bancorp also recently invested in Verdigris, the parent of BrightFi, a provider of technology-based banking services.

Sterling Bancorp’s Risk Factors

The new TipRanks Risk Factors tool shows 28 risk factors for Sterling Bancorp. Since June 2021, the company has updated its risk profile to introduce six new risk factors, all related to the Webster merger.

The company tells investors that the value of the merger consideration for Sterling Bancorp shareholders depends on the value of Webster stock. It says Webster’s stock price may fluctuate, so shareholders cannot be sure of the specific value they may receive when the transaction closes.

Sterling Bancorp says that investor lawsuits against the merger could delay or block the closing of the transaction. It goes on to caution that failure to complete the merger could adversely impact its business, financials, and stock price.

Further, Sterling Bancorp tells investors that completing the merger is subject to various regulatory approvals. It warns that regulators could impose conditions that could adversely affect it or cause the merger deal to collapse.

61% of Sterling Bancorp’s risk factors fall under the Finance and Corporate category. That is above the sector average of 58%. Sterling’s shares have gained about 24% since the beginning of 2021.

Analysts’ Take

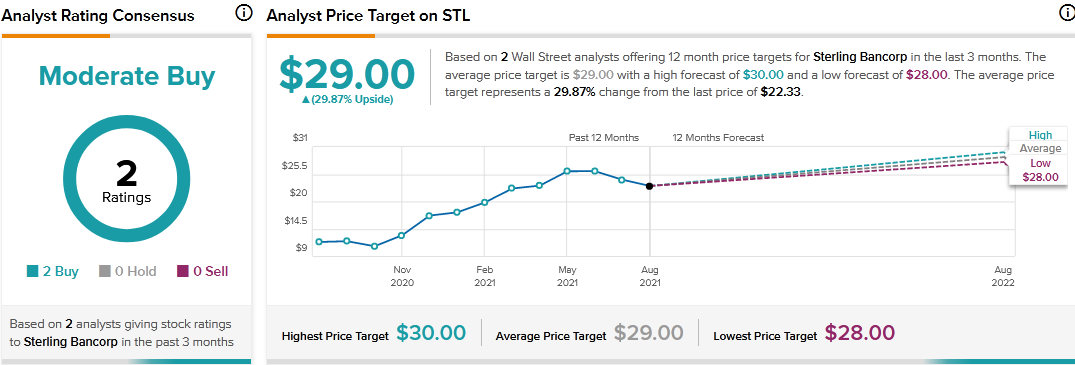

In July, Maxim Group analyst Michael Diana reaffirmed a Buy rating on Sterling Bancorp stock with a price target of $30. Diana’s price target suggests 34.35% upside potential.

Consensus among analysts is a Moderate Buy based on 2 Buys. The average Sterling Bancorp price target of $29 implies 29.87% upside potential to current levels.

Related News:

Paysafe Enhances Partnership with Betfred USA; Street Says Buy

Square Introduces Square Register in Canada; Shares Fall 4.2%

A Look at Syneos Health’s Earnings and Risk Factors