Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) subsidiary, Google, is restructuring to reduce costs and optimize its business. Its cloud-based game streaming service, Stadia, is being shuttered. However, there is not much to worry.

Why Stadia’s Closure Will Be Good for Alphabet

Stadia was an underperformer compared to rivals Xbox and PlayStation due to its pricing complexities and confusing interface. Taking a practical decision to shut the service and focus investments on other higher growth areas, Google announced that Stadia will be closed fully on January 18, 2023. Management will try to fit Stadia employees into other suitable teams as far as possible, but some unemployment could be on the cards.

However, looking at the bigger picture, shutting an underperforming unit could reduce unnecessary costs, especially at a time when cost pressures are mounting for tech companies. Google is constantly investing in new technologies and penetrating new markets. Such investments need a reasonable amount of borrowing, which is also becoming more expensive with the rising interest rates. Therefore, Stadia’s shuttering will redirect investments to areas that need monetary attention.

Also, Stadia was not generating the revenue that Google had envisioned. To that end, an increase in fixed costs without any growth in revenues would put additional weight on Google’s already pressured margins.

All Eyes on Made by Google

Amid all the noise, the company is slated to hold its highly-awaited “Made by Google” event on October 6, ahead of which Monness Crespi Hardt analyst Brian White remains unflinchingly bullish on Google’s longer-term view.

As White says, Google is “joining the gadget party” after Apple’s (NASDAQ:AAPL) “Far Out” and Samsung’s “Unfold Your World” launch events. The event will include the introductions of the Pixel 7 and Pixel 7 Pro smartphones, the Google Pixel Watch, and new Nest devices. Notably, the Pixel Watch will be the company’s first smartwatch to be developed leveraging its acquisition of fitness tracking company Fitbit.

Although smartphones are facing the wrath of macroeconomics lately, Android still has a dominant position in the operating system market over Apple, according to International Data Corporation’s (IDC) Q2 estimates.

Is Google a Good Investment?

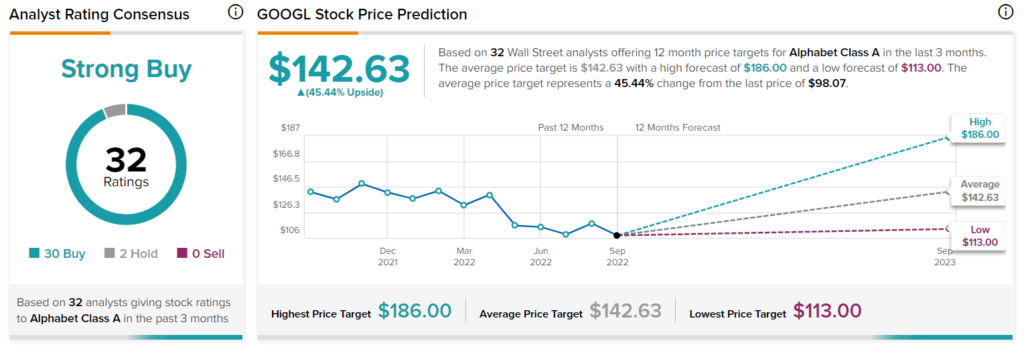

White, a known Google bull, unsurprisingly reinforced his Buy rating on the stock with a price target of $145.

Wall Street consensus is also bullish on Alphabet stock, with a Strong Buy rating based on 30 Buys and two Holds. The average price target for GOOGL stock is currently $142.63.

Bottom-line: Overall, Alphabet Can Beat the Odds

Google’s dominant position in search and digital advertising is a positive. Moreover, rapid digital transformation across industries and the shift of workloads to the cloud have prepared a solid growth runway for the company, which will help it “trade at a healthy premium to the market and tech sector in the long run,” according to White.

Granted, there are certain pain areas in its business, but nothing that is making Wall Street turn cautious.