Fear and uncertainty have gripped the global population as the number of confirmed coronavirus cases grows daily. What started in Wuhan, the capital of China’s Hubei province, has now spread to 43,101 people in 25 different countries, according to the World Health Organization (WHO), killing over 1,000.

While 75% of the infections have occurred in the Hubei province, a worldwide effort to contain the virus, now deemed as COVID-19 by WHO, is underway. These efforts include a two-day forum to create a “global research agenda” as well as quarantining individuals returning from the virus’ epicenter for 14 days, with the first 195 U.S. citizens under quarantine being released on February 11. The Centers for Disease Control and Prevention (CDC) has confirmed that 13 people in the U.S. have been infected, with the most recent case in San Diego after a repatriated individual that originally tested negative for the virus developed symptoms.

As so much about COVID-19 remains unknown, it has become a race against the clock to find solutions. Just last week, the CDC’s test for coronavirus was given emergency use authorization from the FDA, but there currently aren’t any vaccines or therapies available. Against this backdrop, 3 healthcare companies have sprung into action, hoping to develop an effective vaccine for the virus that has put the world on edge.

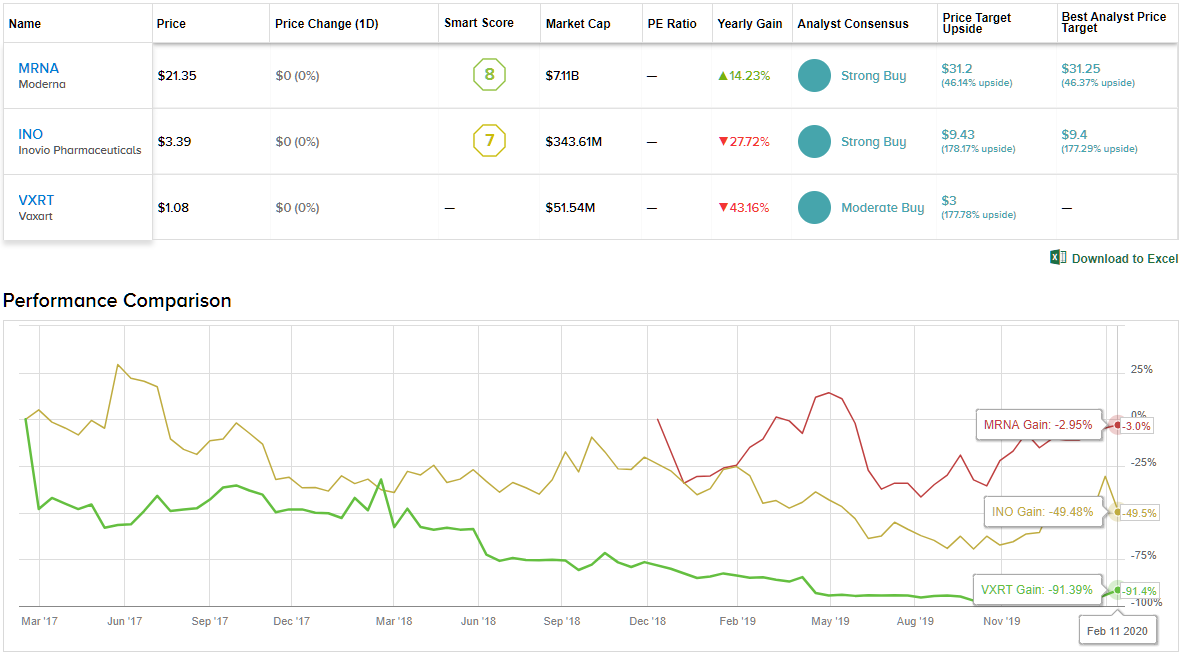

Using TipRanks’ Stock Comparison tool, we were able to evaluate these 3 Buy-rated stocks alongside each other to get a sense of what the analyst community has to say. Here’s what we found out.

Moderna Inc. (MRNA)

First on our list is biotech Moderna, whose novel approach involves using messenger RNA (mRNA), the instructions in DNA necessary to make proteins, to instruct a patient’s cells to create the proteins that could treat, cure or even prevent diseases.

In only three weeks, the company has used a funding grant from the Coalition for Epidemic Preparedness Innovations (CEPI) to design and manufacture an experimental vaccine for coronavirus. The vaccine is currently progressing through analytical testing before being sent to the National Institute of Allergy and Infectious Diseases (NIAID) for initial clinical testing. Based on the funding agreement, MRNA will work with the Vaccine Research Center (VRC) of the NIAID on the design, while the NIAID will perform IND-enabling and an initial Phase 1 study.

Roth Capital’s Yasmeen Rahimi believes that this collaboration was the right move. “In our view, this jointly-executed strategy by MRNA-NIAID is the ideal leveraging of a novel technology (mRNA prophylactic vaccines) and the flexibility it brings in vaccine design with the scaling advantages of mRNA manufacturing once an mRNA sequence has been identified,” she explained.

While noting that the Ebola virus outbreak was an entirely separate situation, Rahimi points out that it took two years for the rVSV-ZEBOV vaccine to undergo clinical testing, and wasn’t approved by the FDA until 2019. As a result, the quick manufacturing and scaling of the vaccine as well as the differentiated nature of mRNAs give Moderna an advantage when compared to players in the Ebola epidemic. It also doesn’t hurt that the biotech has clinical programs in H7N9 influenza and RSV, giving it an in-depth understanding of respiratory virus vaccines.

This prompted Rahimi to comment, “Among differentiated vaccine platforms, MRNA’s comprehensive design and manufacturing capabilities combined with development speed (40-60 days for a cancer vaccine) put it at the top of the list of biotech companies who could prove vital to a solution to this outbreak.”

It follows, then, that the Roth Capital analyst reiterated both her Buy rating and $24 price target — 50% upside from current levels. (To watch Rahimi’s track record, click here)

Meanwhile, Piper Sandler’s Edward Tenthoff believes MRNA’s technology makes it the ideal name to respond to the public health emergency. “Coronavirus is a single-stranded RNA virus. We believe Moderna’s mRNA technology is ideally suited for vaccines as evidenced by six positive Phase I studies including Zika vaccine mRNA-1893 and most recently cytomegalovirus (CMV) vaccine mRNA-1647. While not a traditional commercial market, 2019-nCoV could represent an accelerated regulatory path with potential government stockpiling,” he stated.

Taking this into consideration, the five-star analyst stayed with the bulls, leaving his Outperform rating unchanged. At the $32 price target, shares could surge 50% in the next twelve months. (To watch Tenthoff’s track record, click here)

Given the stock’s 100% Street support, the message is clear: MRNA is a Strong Buy. Not to mention the $31.20 average price target puts the upside potential at 46%. (See Moderna stock analysis on TipRanks)

Inovio Pharmaceuticals (INO)

Using antigen-specific immune response activation technology, Inovio is fighting the good fight against cancer and other infectious diseases. Following the announcement of its collaboration with Beijing Advaccine Biotechnology, Wall Street focus has locked in.

Like Moderna, INO received a grant from the CEPI to develop a vaccine against the coronavirus. With the award of up to $9 million, the company will be able to conduct preclinical and clinical development through Phase 1 human testing of INO-4800, a DNA vaccine, in the U.S. Not wasting any time, INO has already initiated preclinical testing and is gearing up for clinical product manufacturing. The hope is that the collaboration will not only allow for a Phase 1 trial in China to be performed in parallel with the U.S. study, but also accelerate the regulatory approval process in China.

H.C. Wainwright analyst Raghuram Selvaraju points out that the CEPI awarded INO a grant to develop vaccines against Lassa fever and Middle East Respiratory Syndrome (MERS) in the past. This is important as the coronavirus can cause MERS. As the early clinical data for these candidates has shown impressive results, the five-star analyst is hopeful that INO can deliver when it comes to a coronavirus vaccine.

“In our view, Inovio’s DNA medicine platform could help CEPI achieve its goal of bringing a new pathogen from gene sequence to clinical testing in 16 weeks, indicating a rapid development timeline for the establishment of an effective countermeasure against the new pandemic threat posed by 2019-nCoV (coronavirus),” Selvaraju said. To this end, he reiterated his bullish rating. Along with the call, his $13 price target brings the potential twelve-month gain to a whopping 283%. (To watch Selvaraju’s track record, click here)

Like the H.C. Wainwright analyst, Roth Capital’s Jonathan Aschoff is bullish on INO. He argues that regardless of whether the situation improves, if INO-4800 can be in the clinic in the next few months, it will show that “INO’s technology can rapidly generate vaccines once a pathogen’s genetic sequence and organization is known.” He added, “INO-4800, especially if successful, could be the first of several vaccines for emerging infectious diseases that are developed in collaboration with Advaccine. INO has demonstrated the flexibility, speed, and efficacy of its vaccine technology (including with other deadly coronaviruses) numerous times with numerous partnerships, generating tens of millions in non-dilutive funding along the way.”

Bearing this in mind, Aschoff kept the Buy recommendation as is. At $13, the price target matches Selvaraju’s forecast. (To watch Aschoff’s track record, click here)

All in all, other Wall Street analysts are on the same page. 7 Buys compared to no Holds or Sells add up to a Strong Buy consensus rating. Additionally, the $9.43 average price target implies 178% upside potential. (See Inovio stock analysis on TipRanks)

Vaxart Inc. (VXRT)

Vaxart is unique in that it focuses on developing vaccines that are delivered by a tablet rather than by injection. With its technology having the potential to be used for a coronavirus vaccine, all eyes are on this healthcare name.

On January 31, the company announced that it would be developing a vaccine candidate utilizing VAAST, its proprietary oral tablet vaccine platform technology. Even though the program is in a very early stage, H.C. Wainwright analyst Vernon Bernardino sees a large opportunity here. “We have included receipt of an initial $5 million grant in 2020 from BARDA, the office within the U.S. Department of Health and Human Services (HHS) responsible for procurement and development of countermeasures against emerging bioterrorist threats and diseases… we look for positive results with VAAST to lead to expansion of Vaxart’s CoV vaccine program with support from a multi-year grant worth $50 million to $100 million,” he explained.

On top of this, Bernardino highlights the fact that oral tablet vaccines could be better suited to fight the coronavirus as it is primarily an infection that attacks the respiratory tract. Based on data for its influenza and norovirus candidates, the analyst thinks that “a VAAST-based oral tablet vaccine may be able to generate a robust mucosal response against 2019-nCoV.”

However, it’s essential to consider whether or not containment will be an effective solution. While acknowledging that there’s limited data available, 2019-nCoV has a mortality rate of 3%, compared to SARS-CoV and MERS-CoV which both have much higher rates. “Moreover, the severity of disease is an important indirect factor in a virus’s ability to spread, as well as in the ability to identify those infected and then contain it,” Bernardino noted.

That being said, should a vaccine be the best course of action, the H.C. Wainwright analyst thinks the company has strong capabilities. It makes sense, then, that he not only maintained a Buy rating but also set a new $3 price target. This conveys his belief that VXRT shares could climb 178% higher in the next twelve months. (To watch Bernardino’s track record, click here)

Given that Bernardino is the only analyst that has published a review recently, the consensus rating is a Moderate Buy. However, if the virus continues to spread, more analysts could throw an opinion into the mix. (See Vaxart price targets and analyst ratings on TipRanks)