AbbVie’s (ABBV) acquisition of Allergan has entered the final stretch, after the FTC (federal trading commission) gave its consent for the deal to go ahead. With approval from the Irish High Court the final hurdle left, following Wednesday’s hearing, the transaction should come to a close.

Apprehension surrounding the acquisition’s clearance by the FTC, concerned the possible requirement to divest AbbVie’s main growth driver – Skyrizi.

“This investor concern should finally be allayed, as the FTC appears satisfied with the divestiture of Allergan’s brazikumab (IL-23) back to AstraZeneca instead,” said Mizuho analyst Vamil Divan

Additionally, Allergan will sell Nestle two of its pancreatic enzyme preparations, Zenpep and Viokace.

As all these assets’ divestitures were expected, Divan believes these developments should come as no surprise to investors who have been monitoring the deal’s progress.

However, as part of the transaction, an unexpected agreement regarding personnel was reached. Only one Allergan Director will join the AbbVie board, while Allergan’s current Chairman and CEO Brent Saunders will “pursue other opportunities in the sector.”

“We are not concerned about this and are comforted by the fact that Allergan’s Carrie Strom (Senior Vice President of US Medical Aesthetics) will be on the AbbVie Executive Leadership Team as President of Global Allergan Aesthetics,” Divan commented.

Divan looks favorably upon the deal and argues the diversification should pay off, especially when considering the future sales of AbbVie’s drug Humira. The world’s best-selling drug has struggled on the international market since generic versions began selling in Europe in 2018. The drug faces further competition at home when biosimilars will enter the market in 2023.

Calling AbbVie, his “top large cap pick,” Divan concluded, “We believe the Allergan deal changes the AbbVie story for the better as it brings in additional growth drivers at an attractive price, including products early in their life cycle (e.g. Vraylar, Ubrelvy) and others that should be highly durable (e.g. Botox, Juvederm), as well as >$2Bn in expense synergies.”

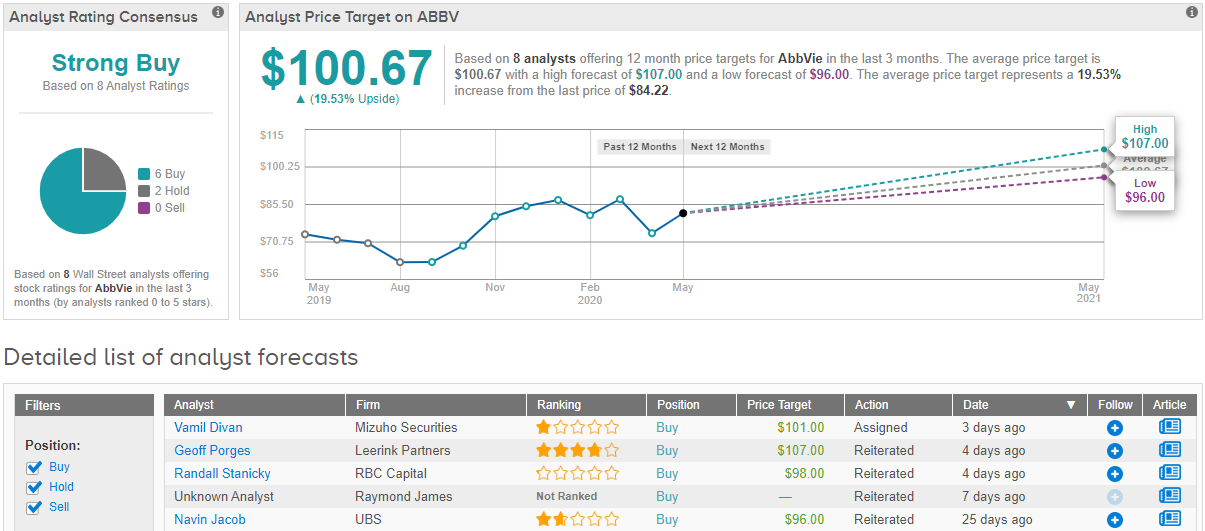

Divan keeps a Buy rating on AbbVie along with a $101 price target. The implication for investors? Upside of 20% from current levels. (To watch Divan’s track record, click here)

The Street is equally confident. 7 Buys and 2 Holds add up to a Strong Buy consensus rating. The average target comes in just below Divan’s, and at $100.14, indicates potential upside of 17%. (See AbbVie stock analysis on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.