Shares of Acacia Communications jumped 31.5% on Thursday after Cisco Systems improved its acquisition offer to $4.5 billion to snap up the optical interconnect product maker.

Under the revised deal, Cisco offered Acacia (ACIA) shareholders $115 per share in cash. The companies expect the deal to close by the end of the first calendar quarter of 2021.

Notably, in July 2019, Cisco (CSCO) had proposed to buy Acacia for $70 per share, which valued the deal at $2.6 billion. However, last week, Acacia had terminated its deal with Cisco, citing a delay in getting regulatory approval from China. That’s after Cisco said that it had obtained all the required regulatory approvals to move ahead with the deal. The dispute turned bitter and both the companies took legal action against each other.

Acacia said in an open letter to its customers that, “the acquisition of Acacia by Cisco will further enhance Cisco’s silicon and optics portfolios, and will help accelerate the trend toward coherent technology and pluggable solutions while accommodating a larger footprint of customers worldwide.” (See ACIA stock analysis on TipRanks)

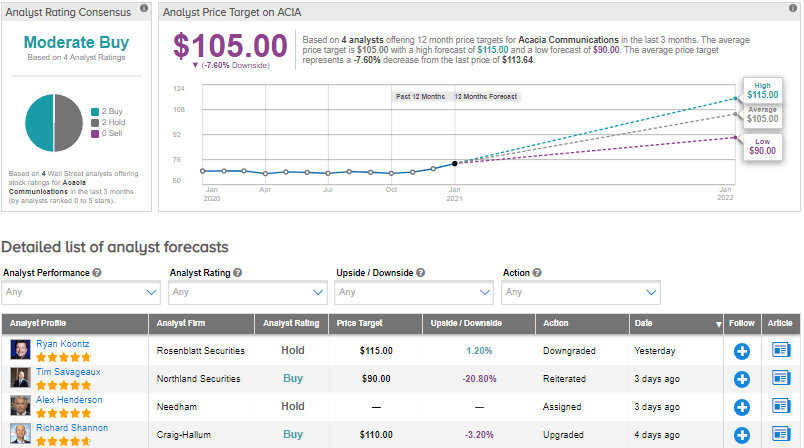

Following the revised deal, Rosenblatt Securities analyst Ryan Koontz lifted ACIA’s price target to $115 (1.2% upside potential) from $110, as the analyst believes that, “the $115/share, or approximately $4.5B on a fully diluted basis, accurately reflects the company’s valuation on its fundamentals.”

However, Koontz downgraded the stock to Hold from Buy, as he sees “a positive read-through for Neophotonics on the higher ACIA valuation and strategic value of pluggable coherent technology.”

From the rest of the Street, the stock scores a cautiously optimistic outlook with the analyst consensus of a Moderate Buy based on 2 Buys and 2 Holds. The average analyst price target of $105 implies downside potential of about 7.6% to current levels. Shares have gained by 66.2% over the past year.

Related News:

Acacia’s 4Q EPS Outlook Beats Estimates; Files Counterclaim Against Cisco

Acacia Pulls Out Of Cisco Deal

Google, Nokia Partner To Develop Cloud-Based 5G Network