Major gaming companies are enjoying a significant increase in demand as people have been forced to spend more time at home due to the ongoing pandemic. Meanwhile other forms of entertainment like sporting events and movie theaters are operating under restricted conditions or have had to shut down entirely.

As per The NPD Group, US consumer spending on video gaming increased 30% Y/Y and 7% sequentially to $11.6 billion in the second quarter.

Against this favorable backdrop, using the TipRanks’ Stock Comparison tool we will place gaming companies Activision and Electronic Arts alongside each other to see which stock offers a more compelling investment opportunity.

Activision Blizzard (ATVI)

Activision Blizzard owns famous gaming franchises like Call of Duty and Candy Crush. After a challenging 2019, the company has strengthened its position in a highly competitive market by launching new additions and adapting to evolving trends in the industry, including mobile gaming, free-to-play models and e-sports.

Thanks to its strategic initiatives and a spike in demand amid the pandemic, Activision ended the second quarter with 428 million active users compared to 327 million at the end of 2019’s second quarter.

In the second quarter, the company’s revenue surged 38.4% Y/Y to $1.93 billion with revenues from its Activision division revenue rising 270% to $993 million primarily due to Call of Duty: Modern Warfare and Warzone.

The free-to-play battle-royale extension Call of Duty: Warzone reached over 75 million players since its launch in March. Activision’s second-quarter EPS increased 53% to $0.81. One of the most notable aspects of the second quarter was a 494% jump in free cash flow to $755 million.

The company has a strong pipeline (including games in the Call of Duty franchise) and sees significant prospects in mobile gaming. It predicts revenue of $7.28 billion in 2020 compared to $6.49 billion in 2019.

On September 4, Activision announced the launch of its remastered combination game Tony Hawk’s Pro Skater 1 and 2. Early signs of success for this game might motivate Activision to remake more old titles.

Activision stock has risen 28.2% year-to-date and the average analyst price target of $94.13 implies an upside potential of about 24% over the next 12-months.

On September 8, Credit Suisse analyst Stephen Ju reaffirmed his Buy rating and $96.00 price target for Activision as he is increasingly optimistic about the company’s longer-term secular growth prospects. The analyst believes that the pieces are in place for the company to offset some of the inevitable drop-offs in engagement and spend. (See ATVI stock analysis on TipRanks)

Ju explained, “We maintain our Outperform rating and our investment thesis remains predicated on the following factors: 1) the ability to produce and maintain high quality franchise content, 2) management execution consistency, and 3) strong positioning in the long-term sector transition from CPG to online, as well as to mobile.”

The Street’s Strong Buy consensus for Activision is based on 22 Buys, 1 Hold and 1 Sell rating.

Electronic Arts (EA)

Electronic Arts is known for its popular gaming franchises FIFA, Madden, Apex Legends, and The Sims. These and other popular titles helped the company drive more engagement in the first quarter of fiscal 2021, which ended on June 30.

The fiscal first-quarter revenue surged 20.7% Y/Y to $1.46 billion driven by new launches and higher live services revenues due to strong engagement. Player acquisition for FIFA grew over 100% and 140% for Madden NFL.

Electronic Arts derives a significant portion of its revenue from Live services, which includes revenue from sales of extra content while playing, licensing revenue from third-party publishing partners, subscriptions, and advertising. Live services revenue increased 16% Y/Y to $1.1 billion and accounted for over 75% of the overall first-quarter revenue.

The company continues to build its base with new launches. In the fiscal first quarter, Electronic Arts delivered more than 30 new content updates, including two major game expansions, and over 50 mobile updates. Electronic Arts expects revenue of $5.63 billion in fiscal 2021, which reflects a 1.6% growth.

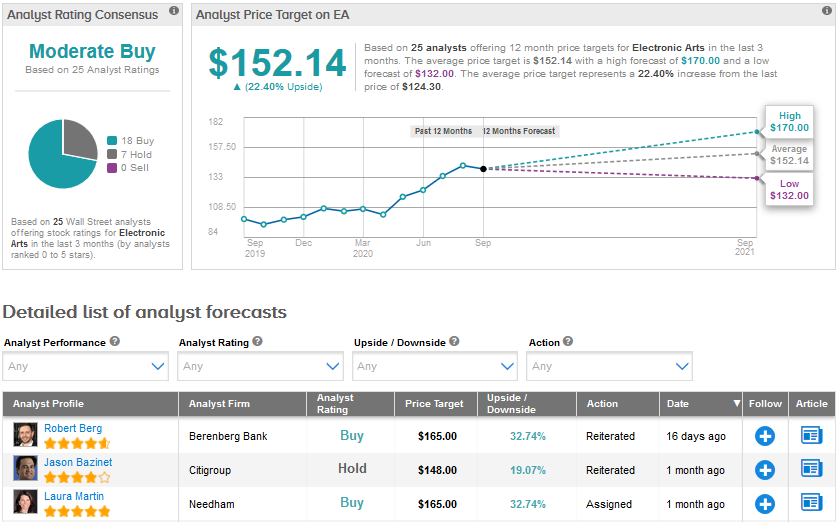

On August 11, Needham analyst Laura Martin raised EA’s price target to $165 from $150 and maintained a Buy rating citing the company’s ongoing pivot toward annuity revenue streams as well as the “rapidly accelerating” video game industry growth with higher Lifetime Customer Value, or LTV, during the COVID-19 outbreak.

Martin is optimistic that the company will benefit over the near and the long term from the rapid rise in hours played, more new games tried, higher in-game spending, and limited competition from live sports during the pandemic. (See EA stock analysis on TipRanks)

A Moderate Buy consensus for Electronic Arts is based on 18 Buys and 7 Holds. The stock has surged about 16% so far this year and has the potential to advance 22.4% over the next 12 months as reflected in the average analyst price target of $152.14.

And the winner is…

The launch of new game consoles in the holiday season is expected to boost the top-line of both Activision Blizzard and Electronic Arts.

However, Activision’s stronger presence across all gaming platforms, especially in the mobile gaming space makes it a better ‘Buy’ compared to Electronic Arts. Also, Activision rewards its investors with dividends unlike Electronic Arts which does not pay dividends.

Activision stock has outperformed Electronic Arts stock year-to-date and the Street’s current average price target reflects greater upside potential ahead.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment