Acuity Brands (AYI) has reported better-than-expected quarterly earnings and revenue in the fourth quarter of fiscal 2021. The company engages in the provision of lighting and building management solutions and services.

Revenue during the quarter jumped 11.4% year-over-year to $992.7 million, surpassing the Street’s expectations of $965.6 billion. Meanwhile, adjusted earnings of $3.27 per share also came ahead of analysts’ expectations of $2.87 per share. The company had reported earnings of $2.35 per share in the year-ago quarter.

Acuity Brands Lighting and Lighting Controls’ (ABL) net sales increased 11%, as it benefitted from improved service levels and an improving economy. Sales of Intelligent Spaces Group (ISG) jumped 23.5% year-over-year due to strong demand for building and HVAC controls, energy management and location services. (See Acuity Brands stock charts on TipRanks)

Gross profit margin during the quarter expanded only 10 basis points to 42.2%, as it was impacted by higher material, labor and freight costs. This impact was mostly offset by Acuity Brands’ ongoing product and productivity improvements, increased sales volume and benefits from recent price increases.

The CEO of Acuity Brands, Neil Ashe, said, “I am proud of the progress our team made to transform our company during fiscal 2021. We improved our operations and delivered solid performance in a challenging environment. We are entering fiscal 2022 from a position of strength with a diverse and capable team, who are driven by our values to deliver results for our customers, our investors and our environment.”

Recently, Credit Suisse analyst John Walsh maintained a Buy rating on Acuity Brands with a price target of $209 (18.5% upside potential).

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 2 Buys. The average Acuity Brands price target of $212.5 implies 20.5% upside potential.

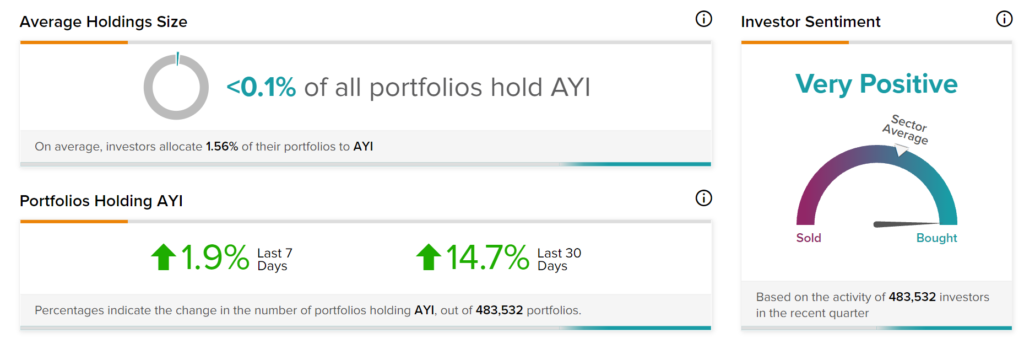

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Acuity Brands, with 14.7% of investors on TipRanks increasing their exposure to AYI stock over the past 30 days.

Related News:

Accenture Builds Industry X Capabilities with Advoco Buyout

OppFi Enhances Support to SalaryTap by Increasing Bank Credit Facility

Saratoga Investment Delivers Fiscal Q2 Results; Earnings Shrink