Adidas AG (ADDYY) sees steeper second-quarter sales and profit declines than in the first three months of the year as more than 70% of its global stores remain shut due to the coronavirus pandemic.

The sportswear clothing company said it expected second-quarter sales to drop more than 40% below the prior year level and the operating result to be negative. At the same time however, Adidas decided to withhold its full-year outlook for 2020 citing uncertainties, primarily around the duration of store closures and the pace of normalization once stores reopen.

Adidas provided the update as it reported first-quarter earnings. The sportswear retailer said that the strong growth of 35% in its e-commerce sales could only partially offset the material revenue decline from in-store channels. In March, the sportwear retailer experienced 55% global e-commerce sales growth, it said.

“Despite the current situation, I am confident about the attractive long-term prospects this industry provides for adidas,” said Adidas CEO Kasper Rorsted. “Consumers are developing an increased appreciation of well-being. They want to stay fit and healthy through sports. Our focus on accelerating our own-retail and digital business will serve us even better in the future.”

Net income from continuing operations in the first quarter was slashed by 97% to € 20 million. Basic EPS from continuing operations bottomed to € 0.13, a decline of 96% year-over-year.

“Our results for the first quarter speak to the serious challenges that the global outbreak of the coronavirus poses even for healthy companies,” said Rorsted. “At the moment, we are focused on managing the current challenges and doubling down on the recovery in China and the opportunities we see in e-com.”

Moreover, Adidas’ cash position deteriorated by €1.4 billion from the end of 2019 and amounted to € 1.975 billion as of March 31. Net debt amounted to € 570 million as of March 31.

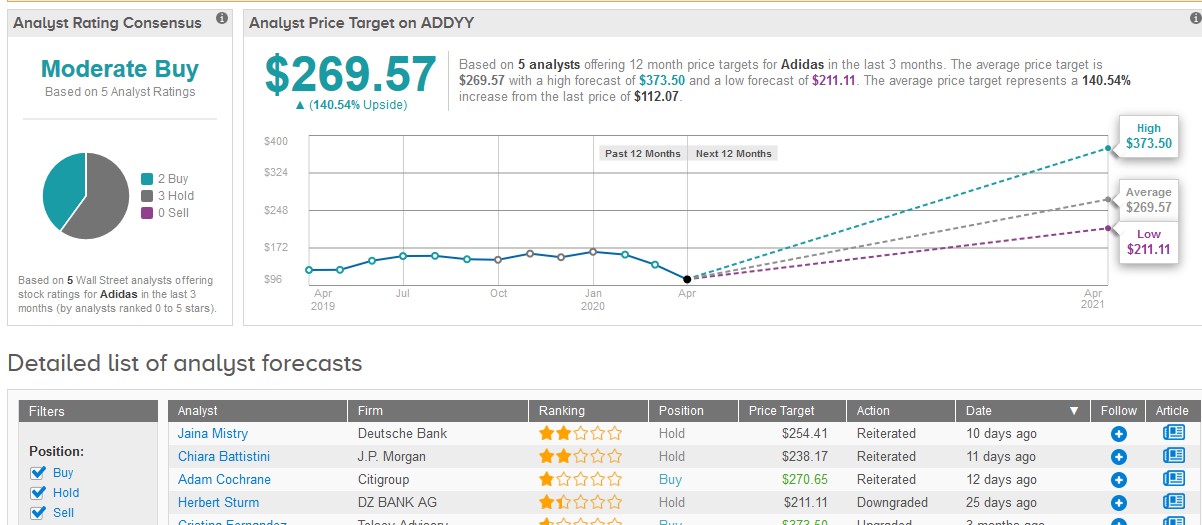

Wall Street analysts have a Moderate Buy consensus rating on the stock based on 3 Holds and 2 Buys. The $269.57 average price target implies a whopping 141% upside potential should it be met in the coming 12 months.

Related News:

Check Point Software Profit Beats Estimates Boosted By Remote Work Push

Deutsche Bank Surprises With Q1 Revenue Beat, Three Days Ahead of Schedule

What To Watch For In Pfizer’s 1Q20 Earnings Tomorrow