Adobe (NASDAQ: ADBE) managed to sustain its double-digit growth during Fiscal 2022, and it appears well-positioned to sustain this pace this year and possibly over the medium term.

Adobe’s growth momentum, combined with shares still trading ~46% lower from 52-week highs and at a relatively compelling valuation, could suggest that the stock has some noteworthy potential. Accordingly, I am bullish on the stock.

Durable Momentum Despite Headwinds

Adobe’s growth momentum was sustained quite admirably over the past year despite the tough macroeconomic environment. With companies reducing expenditures and the advertising industry suffering, which could potentially mean lower demand for Adobe’s creative suite, many investors reasonably expected that Adobe’s revenue growth would lag.

Add the fact that the company has a strong international presence, which translates to strong FX headwinds as the dollar soared during 2022, and you can easily see why some even expected no growth at all. Yet, Adobe continued to positively surprise shareholders and analysts alike, retaining its top-line growth in the double-digits.

For Fiscal 2022, Adobe achieved another year of record revenues, which landed at $17.61 billion, up 12% year-over-year or up 15% on a constant-currency (CC) basis. Growth was supported by strength across the board, as, apparently, demand for producing media keeps hitting new highs. Well, this makes sense in a world where a growing number of creators strive for high-quality content in high volumes.

Specifically, the company’s Digital Media segment revenues were $12.84 billion, posting a year-over-year growth rate of 11%, or 16% in constant currency, while Document Cloud revenues reached $2.38 billion, representing a year-over-year growth rate of 21%, or 24% in CC.

Adobe’s momentum is not only likely to be sustained moving forward, but revenue growth could actually accelerate, considering that the dollar has been on the decline during the first couple of months of its Fiscal 2023 period. Management’s initial outlook for the year targets revenues between $19.1 billion and $19.3 billion, implying year-over-year growth of 9% at the midpoint.

However, management mentioned that this outlook reflects heavy FX headwinds, implying they expected the dollar to remain close to its Q4 2022 levels. With the dollar already down about 12% since its September highs and Adobe’s guidance historically being rather conservative, double-digit revenue growth in Fiscal 2023 is more likely than not.

Growing Profits Against a Valuation Compression

Adobe’s shares underwent a heavy valuation compression while losing plenty of value from 52-week highs. In the meantime, however, Adobe has continued to grow its profits. The combination of a declining stock along with growing earnings has resulted in Adobe’s P/E falling to more reasonable levels than before.

The truth is, Adobe had always traded at a steep premium due to its high-quality recurring revenues, unbudging moat, and consistent growth. Thus, the recent normalization in the valuation is something you should take note of if you were previously reluctant to overpay for Adobe shares.

For context, Adobe’s adjusted operating profit grew by about 9.5% to nearly $8.0 billion, while adjusted earnings per share hit a new all-time high of $13.71, up 9.9% compared to Fiscal 2021. Also, management expects adjusted earnings per share of $15.30 at the midpoint of their outlook in Fiscal 2023, implying growth of 11.6%. It’s worth noting that besides management’s outlook being rather conservative, as mentioned earlier, it also suggests an acceleration in growth and potentially higher margins this year.

In any case, this estimate suggests that Adobe shares are now trading at a forward P/E of around 24.8. That’s not a crazy high multiple, given Adobe’s qualities and double-digit earnings-per-share growth. It’s certainly quite more reasonable than the high 30s and low 40s, where the stock used to trade a couple of years back.

Stock Buybacks to Grow Increasingly Accretive

It’s worth noting that Adobe’s current valuation levels will improve the impact of stock buybacks in terms of helping the company’s earnings per share expand. Adobe’s management knows this, which is why share repurchases amounted to $7.0 billion in Fiscal 2022 compared to $4.7 billion in the previous year, even though earnings grew by a much lesser amount.

With shares still trading at the lower end of their past-decade range, buybacks should continue to be notably more accretive to earnings-per-share growth versus the previous years.

Is ADBE Stock a Buy, According to Analysts?

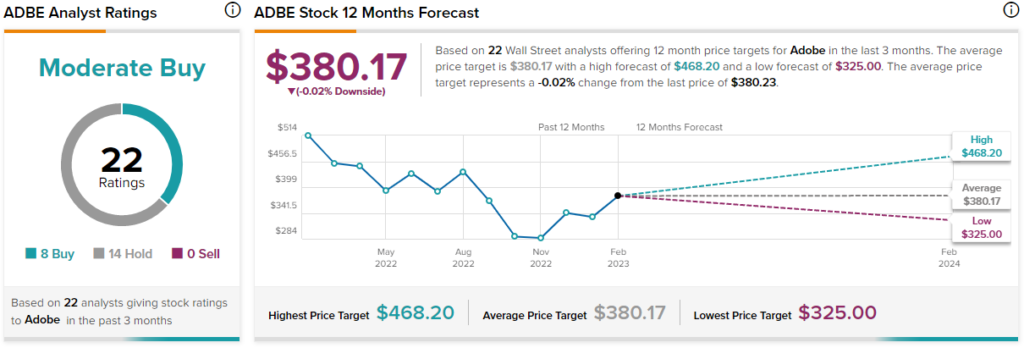

Turning to Wall Street, Adobe has a Moderate Buy consensus rating based on eight Buys and 14 Holds assigned in the past three months. At $380.17, the average Adobe stock forecast suggests a flat share price over the next 12 months.

Takeaway: An Investment Case with an Improved Risk-Reward Ratio

Adobe delivered a robust performance last year, while revenue and earnings growth are likely re-accelerate this year in the absence of severe FX headwinds. Combined with shares currently trading significantly lower compared to their 52-week highs, the stock presents a relatively attractive investment opportunity with a better balance of risk and reward.