Adobe (NASDAQ:ADBE) will report its fiscal fourth-quarter results on December 15, after the market closes. The company provides digital marketing, multimedia, and creativity software products. ADBE stock has declined by about 39% so far this year.

The company is expected to report earnings of $3.50 per share in Q4, lower than its year-ago figure of $3.20 per share. Meanwhile, revenue is pegged at $4.5 billion, representing a year-over-year jump of 9.8%.

In the third quarter earnings call, the management stated that Q4 results would likely reflect the impact of FX headwinds as the U.S. dollar continued to strengthen while benefitting from “typical year-end seasonal strength in demand for our offerings.”

It is worth mentioning that the company entered into collaborations with several companies in Q4, including Hugo Boss, U.S. Bank, and Chipotle (CMG), among others. Also, it enhanced its product offerings with new capabilities, which might have spurred their demand.

Website Visits Reflect an Upward Trend

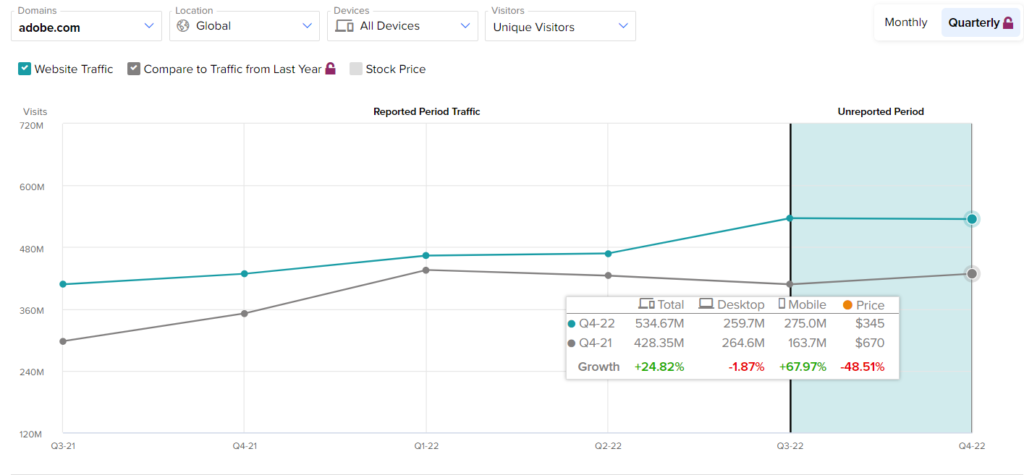

For a digital company like Adobe, total website visits are a good indicator of user involvement on its platform. As per the TipRanks Website Traffic tool, total global visits to adobe.com climbed 32.1% year-over-year in the fourth quarter.

The increase in monthly visits could indicate that demand for Adobe’s products and services remained strong during the quarter.

Is Adobe a Buy Stock?

Wall Street is cautiously optimistic about Adobe stock. ADBE has a Moderate Buy consensus rating based on 12 Buys and 14 Holds. The average stock price target of $366.59 implies over 7.1% upside potential.

Ending Thoughts

Adobe’s impressive earnings history gives confidence about its potential to surpass the to-be-reported quarter’s expectations easily. Furthermore, the acquisition of Figma, which is expected to close in 2023, can help the company’s total addressable market grow.