Agile therapeutics (AGRX) has had a, shall we say, crazy week in the market. On Monday, October 28, its share price was sent on a downward spiral following the release of negative briefing documents by the FDA which expressed concerns about its contraceptive patch, Twirla. The FDA’s main points of concern regarded Twirla’s “effectiveness in proportion to its safety,” as the estimated Pearl Index (PI) in the Phase 3 ATI-CL23 study exceeded the required level. Furthermore, it rejected Agile’s proposal of a limitation of use label following results which showed 2x pregnancy rate in obese women.

Well, what a difference two days makes. On Wednesday, the AdCom review caused a major upset, with a 14-1 vote in favor of supporting Twirla for approval. This sent the stock price soaring, with gains of over 370% since.

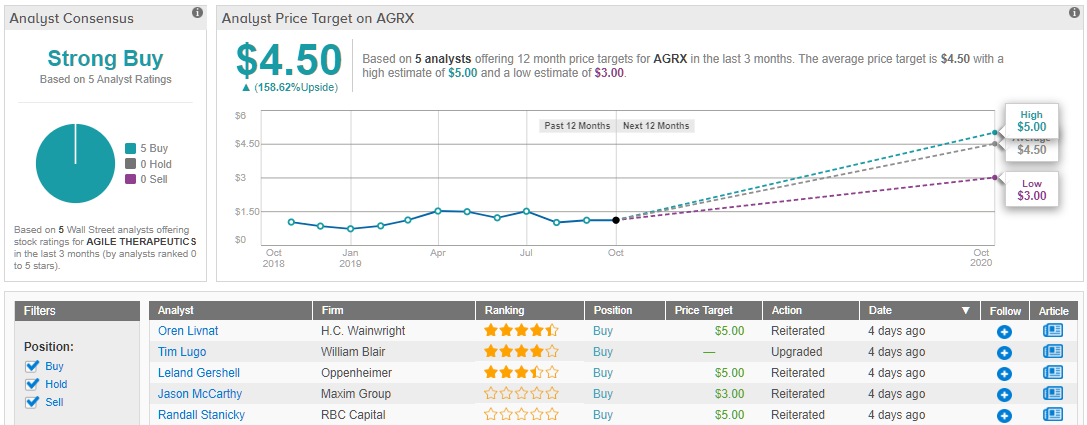

But how much further can the stock grow? H.C. Wainwright’s Oren Livnat may have the answer. Following the positive outcome, the analyst reiterated a Buy rating on AGRX stock, while raising his price target to $5 (from $4), which implies about 185% upside from current levels. (To watch Livnat’s track record, click here)

Livnat admits the FDA’s negativity initially took him by surprise, believing the FDA’s alarmist concerns were unjustified. Still, the analyst thinks there is much left to work out between Agile and the FDA, not least the product’s label. The AdCom panel agreed the label must include a “clear Limitation of Use (LOU) for obese women with BMI over 30 due to lower contraceptive efficacy.” Most on the panel are against a stricter contraindication in obese women, but the FDA might want to go that way, regardless.

“Of course, there remains material risk here, as the AdCom vote is just a non-binding recommendation, and approval clearly requires a total 180degree turn in agency thinking, and we’d be surprised if final approval is reached on the November 16 PDUFA just two weeks away. However, specific timing aside, we have to think Twirla’s ultimate approval is quite likely now, so we increase our probability of success to 70% from 60%,” Livnat said.

Maxim’s Jason McCarthy also believes the market over reacted to the briefing document, yet amidst the new found optimism, posted a note of caution, saying, “The PDUFA is 11/16 and it is important to note that while FDA typically follows the Adcom’s recommendation, it does not always do so, which really must be considered since the FDA briefing docs appeared to be against approval… We see the probability favoring Agile, but this could be considered aggressive and as such would say that risk averse investors may want to step aside.” The analyst keeps his price target at $3.00. While not quite as bullish as Livnat, this still gives AGRX upside of over 70%.

Not many sectors offer the potential for such big time gains like biotech. Especially when you’re looking at smaller clinical-stage names such as Agile therapeutics. After all, the thrill of getting a big-time approval can send a stock’s price surging. Conversely, one mishap can send shares crashing. That said, Wall Street’s confidence on AGRX speaks for itself; the stock has received a 5 ‘buy’ ratings in the last three months. Meanwhile, the $4.50 consensus price target suggests a potential upside of 160% from the current share price. (See Agile stock analysis on TipRanks)