Airbus announced today that New Caledonia-based air carrier Aircalin has received the delivery of its first A320neo aircraft.

Airbus’ (EADSF) aircraft joins two A330neo already delivered under the carrier’s fleet modernization plan. With the new fleet Aircalin is expected to benefit from low operating costs.

Aircalin’s A320neo is equipped with Pratt & Whitney’s PW1000 engines and constructed in a single class layout with 168 seats. The A320neo Family offers the broadest single-aisle cabin in the sky coupled with the latest technologies leading to a 20% reduction in fuel consumption, and 50% less noise compared to previous generation aircraft.

As a result of the fleet revamp, the airline hopes to increase its flight capacity and open new routes across the Pacific region with the A320neo.

As of the of November, Airbus recorded 7,455 firm orders for A320neo aircraft from over 120 global customers.

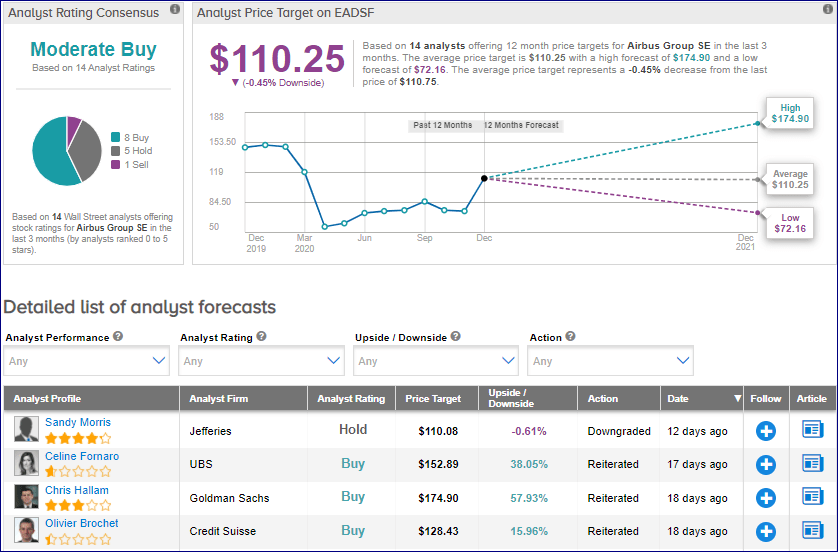

On Dec. 16, Jefferies analyst Sandy Morris downgraded Airbus stock to Hold from Buy, but raised the price target from EUR 80 to EUR 90 ($110), as she believes that the company’s near-term story is not compelling enough for a bullish rating.

It will take until fiscal 2025 before wide-body aircraft deliveries rise significantly, Morris told investors in a research note. (See EADSF stock analysis on TipRanks).

Overall, the rest of the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 8 Buys, 5 Holds and 1 Sell.

With shares, down 24% year-to-date, the average price target stands at $110.25 and implies that the stock is fully priced at current levels.

Related News:

Castellum Gets the Go-Ahead for SEK 1.7B Property Development

Verrica Resubmits FDA Drug Application For Skin Therapy; Street Sees 63% Upside

GameStop Pops 16% Pre-Market As Activist Investor Ramps Up Stake