Alibaba’s (BABA) stock climbed nearly 11% over the past three trading days, as investors are becoming more optimistic on the heels of a strong earnings report and positive geopolitical news. Specifically, first-quarter revenue skyrocketed 42% since last year, crushing estimates by $880 million, while EPS came in at $1.83, beating Wall Street by $0.34. The stock was also fueled higher by Trump administration’s decision to pause tariffs on Chinese goods. Though the trade war is far from over, the decision should provide some breathing room for investors and signals that the tit-for-tat will be suspended for the time-being.

Given the encouraging developments, Stifel analyst Scott Devitt maintained a Buy rating on BABA stock, while slightly raising his price target by $5, to $225.

As always, we like to give credit where credit is due. According to TipRanks, which measures analysts’ and bloggers’ success rate based on how their calls perform, Devitt has delivered to his followers a yearly average return of 20.4% with a 67% success rate. Devitt has earned an average return of 26.3% when recommending BABA and is ranked #44 out of 5,231 analysts.

The analyst says the increase in revenue and margin, which “exceeded expectations despite macroeconomic concerns,” helped push his estimates higher.

Revenue, which grew 42% and exceeded Devitt’s estimate of 38%, was propelled by an increase of 20 million active customers, up 17% since last year. Further, high-margin customer management revenue, which includes services provided to merchants, increased 27% since last year, “due to strong volume in paid clicks from strong active growth and more relevant listings.” On the non-retail side, the all-important cloud revenue saw an increase of 66% since last year, as the company managed to see more spending per customer.

On profit, Devitt says, “tightening expense management” drove better than expected results, with “EBITDA margin of 34% exceeded consensus expectations of 31% and [Devitt’s] forecast of 33%.” Smaller losses from cloud and digital media helped the company see a rise in total margin since last year.

Looking ahead, Devitt says he is “encouraged by the margin improvement as progress is being made in strategic investments,” and raising his estimates to include a 37.5% year-over-year rise in full-year revenue between this year and last. While macroeconomic challenges continue to play a role, Devitt’s concern is lessened by Alibaba’s ability to navigate it the rough waters thus far.

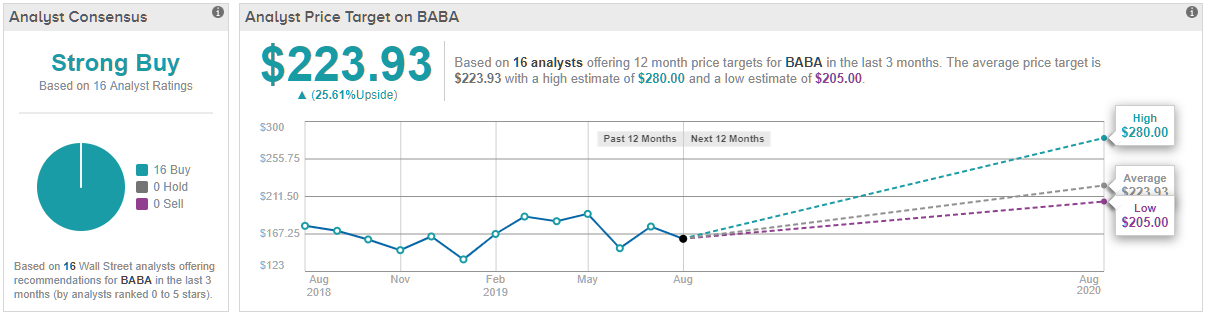

All in all, even as much of the world is concerned with the US-China and a slowing global economy, TipRanks analysis of 15 analyst ratings shows that analysts believe in Alibaba, notwithstanding the macro concerns. TipRanks shows a consensus Strong Buy, with all 16 analysts recommending Buy. The average price target stands at $223.93, which represents ~25% upside from current levels. (See BABA’s price targets and analyst ratings on TipRanks)