Finally, Jack Ma resurfaced last week. The Alibaba (BABA) founder made his first public appearance since October 24, when he picked a fight with the Chinese government over the state’s attitude toward big business. Since then, the government has shown Ma and Alibaba who’s boss, by halting its sister company Ant Financial’s slated blockbusting IPO and opening an investigation into Alibaba’s alleged monopolistic behavior.

For the last 3 months, the world might have been pondering Ma’s whereabouts and what’s next for the e-commerce giant, but the drama has done nothing to dampen Alibaba’s credentials, says Truist analyst Youssef Squali. Ahead of next week’s F3Q21 results (Feb 2nd, BMO), the 5-star analyst expects a robust display.

“We remain positive on BABA as we believe that F3Q21 results will be strong, showing that the company is a primary beneficiary of China’s renewed momentum post C-19,” Squali said. “We believe the pandemic has caused major structural changes, accelerating the shift in consumption habits online, especially in lower-tier cities and in segments with lower online penetration including food/grocery, where BABA is well positioned.”

Squali forecasts net revenue of 212.7 billion RMB, amounting to a 31.7% year-over-year uptick, just slightly under consensus of 212.9 billion RMB. The analyst expects EBITA of 61.1B RMB, just above the Street’s 61.0 billion RMB forecast.

The Street’s revenue estimates differ widely, and range between 201 billion and 227 billion RMB, while EPS forecasts range between 18.61 to 23.38 RMB. Squali says the large gaps are because some analysts have not taken the Sun Art acquisition into account.

Alibaba invested $3.4 billion in the Chinese supermarket chain in October to increase its ownership to 72%. The purchase should “impact BABA’s New Retail revenue line,” with approximately 16 billion RMB from a two month contribution in F3Q21 and 20 billion RMB from a full quarter in F4Q21.

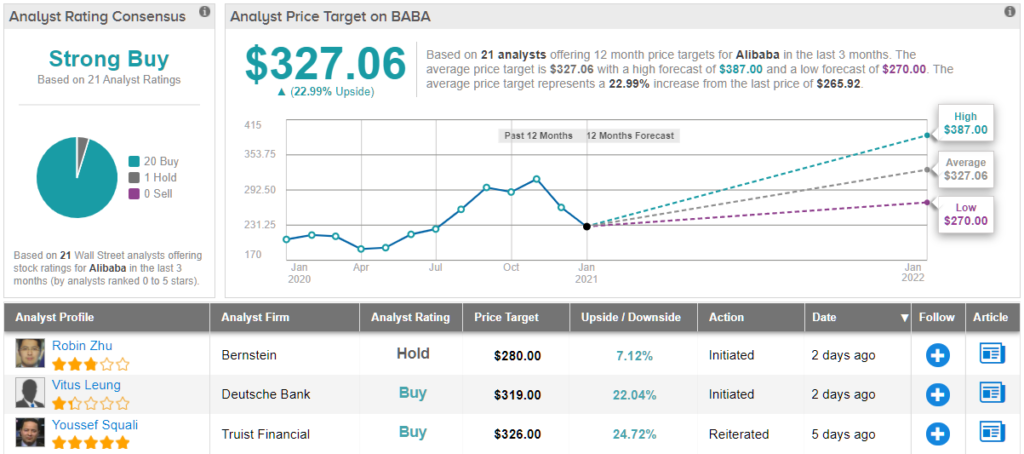

To this end, Squali rates BABA shares a Buy along with a $326 price target. This figure implies a 26% upside from current levels. (To watch Squali’s track record, click here)

Overall, this ‘Strong Buy’ stock is no Wall Street secret. After all, in just three months, BABA has attracted 20 Buy ratings and a single Hold. With a return potential of 23%, the stock’s consensus price target stands at $327.06. (See BABA stock analysis on TipRanks)

To find good ideas for Chinese stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.