Alibaba Group Holding Ltd. (BABA) is rolling out three new digital services for shipping, financing and trade shows on its platform as the coronavirus-related restrictions have increased the demand for businesses to navigate their operations through online channels.

The new services added on its platform include Alibaba.com Freight to secure ocean and air shipping orders and Alibaba.com Payment Terms to provide cash flow control. The Alibaba.com Online Trade Shows USA is introduced to connect U.S. manufacturers and wholesalers with business buyers in a live online format as global trade shows have been cancelled due to the coronavirus pandemic.

“Doing business online is the bridge for American small businesses through this crisis and into the next decade,” said Alibaba.com’s John Caplan, President of North America and Europe. “We are accelerating our transformation to get both sellers and buyers quickly set up for success and provide the critical tools and services that are required for growth – access to supply and demand, shipping and logistics, and working capital.”

Caplan added that Alibaba’s goal is to give small and medium-sized businesses (SMBs) access to the “$23.9 trillion global B2B ecommerce opportunity – which is six times the size of the B2C ecommerce market”.

The Chinese e-commerce giant is seeing growing demand for these services for SMBs as maintaining cash flow and ensuring cash on hand have become even more critical during the coronavirus pandemic. Its payment service will allow buyers order goods and pay for them up to 60 days after they are shipped.

“While SMBs often have difficulty getting trade financing from banks, Alibaba.com’s Payment Terms provides the working capital they need to fuel their growth,” said Caplan.

Shares in Alibaba rose 3.8% to $214.33 at the close on Tuesday taking its advance since March 23 to 22% erasing almost all of this year’s losses.

Five-star analyst Scott Devitt at Stifel Nicolaus maintained a Buy rating on the stock with a $230 price target “based on the long-term fundamental position and opportunity exiting the pandemic stemming from the accelerated digital transition”.

However, Devitt believes heightened political risks relating to tensions between the US and China could limit the multiple in the near-term.

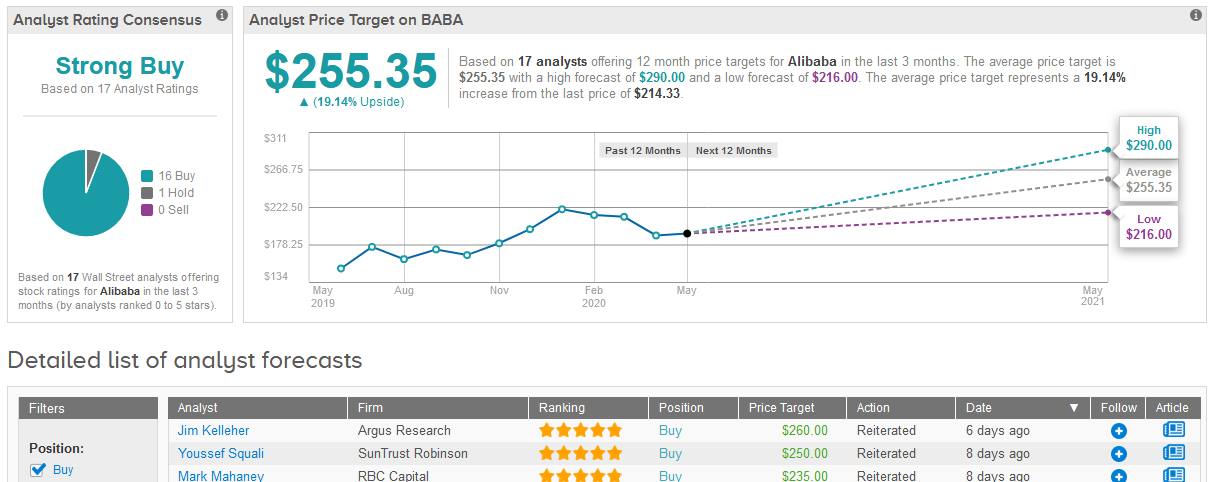

Turning to other Wall Street analysts, the bulls have it. The Strong Buy consensus boasts 16 Buy ratings versus 1 Hold rating. The $255.35 average price target implies 19% upside potential in the shares in the coming 12 months. (See Alibaba stock analysis on TipRanks).

Related News:

Zoom Lifts Full-Year Sales Guidance As Quarterly Revenue Balloons 169%

Billionaire Ackman Exits Berkshire Hathaway, Blackstone To Fund Opportunities

Starbucks Back To Business In Japan