Alibaba has signed an agreement for a strategic partnership with BMW in Beijing to help drive digital transformations across businesses in China.

According to the memorandum of understanding, Alibaba (BABA) and German luxury car maker BMW will work on comprehensive cooperation in branding, marketing, end-to-end operations, services, and information technology. The partnership seeks to digitize BMW’s full business process, and enable dealers to provide an end-to-end and online-to-offline digital experience for customers.

As such, the two companies will jointly launch the first online sales and services businesses engaging dealers among premium auto brands, to create an end-to-end online-to-offline digital service. In the future, online traffic will be directed to BMW dealers to create more business opportunities for them, the companies said.

“BMW is becoming the first auto manufacturer to leverage Alibaba Business Operating System (ABOS),” said Jet Jing, Vice President of Alibaba. “This system will help accelerate the digital operations across BMW’s business segments, aiming to provide end-to-end customer-centric services throughout the product lifecycle and high-quality growth by expanding, connecting and serving customers in a more efficient way.”

In addition, with the help of Alibaba’s membership system, BMW will launch membership services and marketing campaigns on the e-commerce giant’s various online platforms, to drive business growth.

Going forward, BMW and Alibaba will work together with dealers to build BMW’s end-to-end operating system, aiming to provide customers with full-link services, which integrate car-viewing, car purchasing and car maintenance on Alibaba’s multiple platforms such as Taobao, Tmall, Alipay and Amap.

Alibaba has already served investors well during the coronavirus pandemic with its shares surging 46% so far this year as stay-at-home mandates and the work-at-home trend forced more and more people to shop online and change their purchase preferences. (See Alibaba stock analysis).

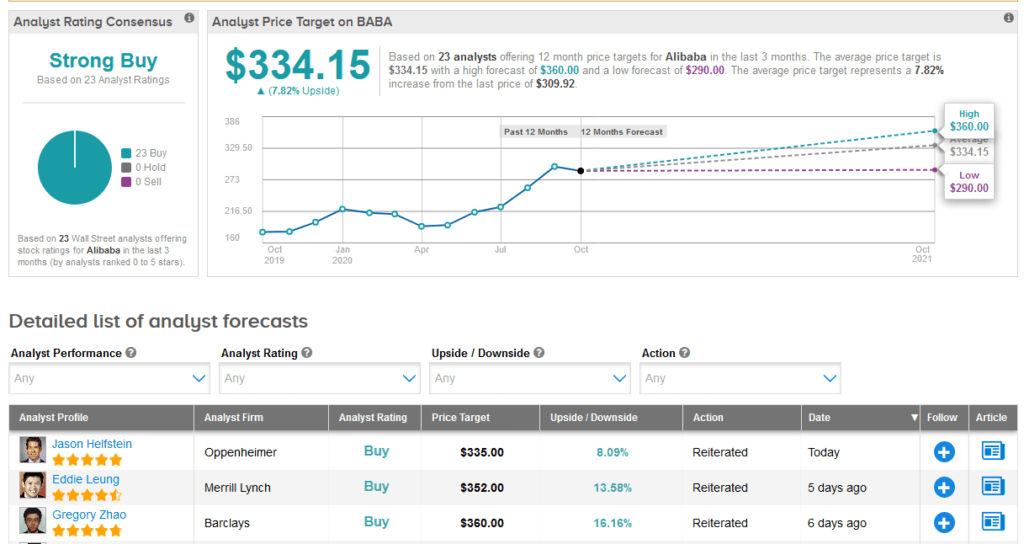

Ahead of BABA’s quarterly results on Nov. 5, Oppenheimer analyst Jason Helfstein today raised the stock’s price target to $335 from $325 and reiterated a Buy rating, citing confidence in cloud profitability and digital transformation opportunities.

“We see cloud’s future growth dependent on ARPU expansion (spending shifting from infrastructure budgets to software budgets), driving continuous margin improvement and rapid revenue growth,” Helfstein wrote in a note to investors. “We believe diverse product supplies are a key advantage compared with peers. The recently launched Dollar Store (both online and offline) and duty-free JV, strategically target both less developed and travel retail markets, the fastest-growing sub-segments in China’s retail industry.”

Turning to other Wall Street analysts, the bulls have it all. The Strong Buy consensus boasts 23 unanimous Buy ratings. That’s with a $334.15 average price target indicating that another 7.8% upside potential lies ahead.

Related News:

Nokia Scores Three-Year 5G Contract With Finnish Shared Network

Blackstone In $1.2B Deal To Buy Simply Self Storage – Report

SAP Slashes 2020 Guidance As Covid-19 Surge Slows Recovery