The global coal supply is pretty tight right now and even U.S. production (the U.S. is one of the biggest exporters of metallurgical coal in the world) is not anticipated to increase significantly in the next two years while it still remains below pre-pandemic volumes.

A tough global met coal supply climate with robust demand amounts to a favorable situation for Alpha Metallurgical Resources (AMR).

The company boasts a mining portfolio made up of twenty coal mines and eight preparation plants spread across the Central Appalachia coal basin; this gives Alpha the title of the largest domestic metallurgical coal producer and exporter. After being extracted, blended and shipped, its met coal is finally used to create coking coal, the main source of carbon used in the making of steel.

The healthy demand and pricing environment for coal, as supplies across the world have become scarcer and prices have risen, have all contributed to Alpha’s success, as was evident in its latest quarterly report, for 1Q21.

Revenue rose by 177% from the same period last year to reach $1.07 billion, coming in above the consensus estimate for $945 million. There was a beat on the bottom-line too, as EPS of $20.52 outpaced the $19.04 expected by the analysts.

Given such a strong performance and taking its prospects into account, the company has caught the eye of Cowen analyst Lance Vitanza.

“Alpha stands out as the leading domestic producer and exporter of met coal and is positioned to keep benefiting from the significant tailwinds that have pushed the global met coal industry into high gear. The recent surge in met coal prices support FY22E Adj. EBITDA margin above 50% and a high FCF conversion rate… The company’s leadership position and prevailing dynamics in commodities markets pave the way for Alpha to benefit from what could be the beginning of a new normal in the coal industry,” Vitanza opined.

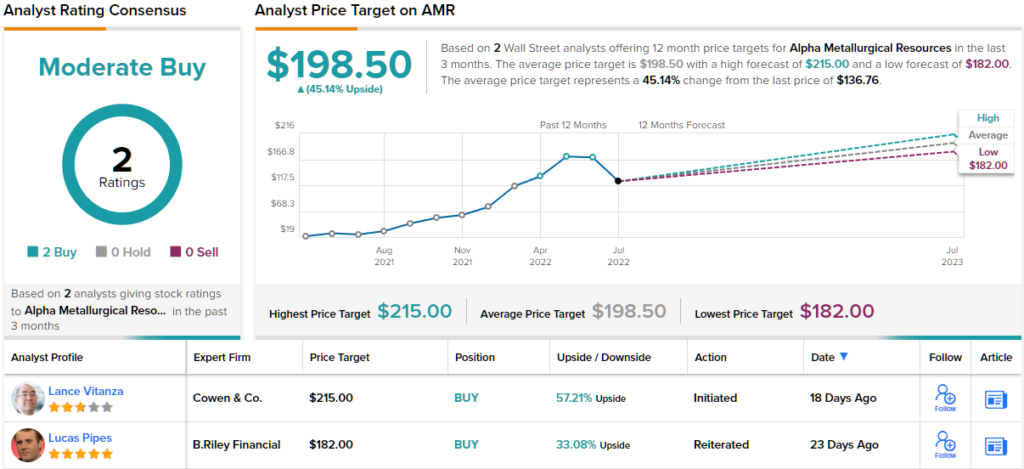

While most stocks have bled profusely in 2022, the same can certainly not be said of Alpha; shares have accrued 125% of gains year-to-date, but Vitanza thinks there’s more room left to run; along with an Outperform (i.e., Buy) rating, he sets a price target of $215, indicative of additional returns of ~57% over the one-year timeframe. (To watch Vitanza’s track record, click here)

Only one other analyst has been tracking AMR’s progress, but they are also in the bull camp, making the consensus view on this name a Moderate Buy. Combined, the average price target stands at $198.50, suggesting 12-month upside of a strong 45%. (See AMR stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.