There is no doubt that the coronavirus driven decimation of the market has presented investors with fresh opportunities out of reach before the outbreak began. Alphabet (GOOGL) is a case in point. The stock is down 16% year-to-date (after today’s 7% pop).

The silver lining for investors has not gone unnoticed by Tigress Financial’s Ivan Feinseth. The 5-star analyst reiterated his bullish stance on Alphabet shares with a Strong Buy rating. (To watch Feinseth’s track record, click here)

The current vote of confidence in GOOGL, which has widespread support all over the Street, is a clear indication of of the company’s resilient business model. The health of GOOGL’s finances has become even more pronounced, especially when you take into consideration it will see a significant slash to its main source of income in the short term. After all, advertising revenue amounted to a massive 83% of Alphabet’s total $162 billion revenue in 2019. As marketing budgets receive extreme haircuts on account of the coronavirus’s sharp impact, the search giant will lose a huge source of income. But along with a shiny balance sheet (almost $120 billion in cash and marketable securities), and what amounts at Alphabet to negligible debt (less than $5 billion), the all-conquering Google has it fingers in so many pies, and is at the forefront of so many technological advancements, that it is more than capable to blunt the short term impact.

The list of “innovations and new initiatives,” goes on and on, as Feinseth notes, “GOOGL continues to build on its strength in all key technology growth areas, including Search, mobile, cloud, data center, e-commerce, entertainment, home automation, and autonomous vehicle technology, as well as health and fitness. GOOGL’s leadership position and strong balance sheet will provide resistance to the coronaviruses’ negative economic impact. The recent coronavirus and market-related pullback represent a major buying opportunity, and believe significant upside exists from current levels.”

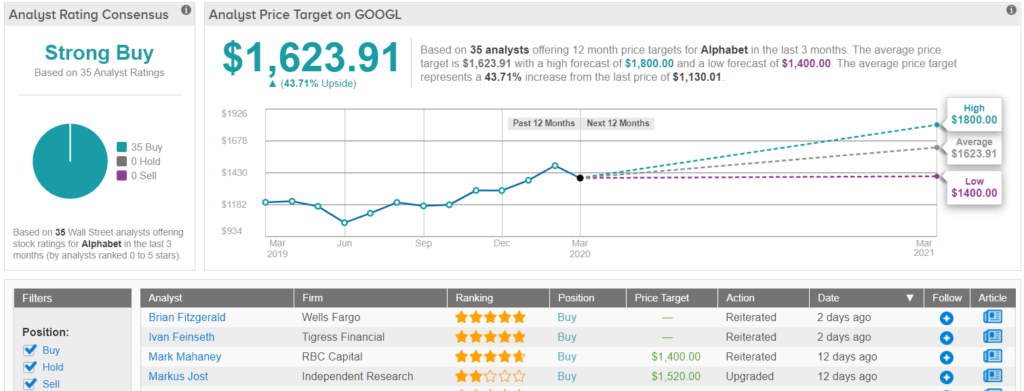

Does the Street agree with the Tigress analyst? It does, with 100% certainty. A unanimous 35 Buy ratings add up to a Strong Buy consensus rating. At $1623.91, the average price target represents upside potential of 54%. (See Google stock analysis on TipRanks)