Barely a month ago, investors of Amarin (AMRN) were left dismayed following a lost patent trial against two generic drug makers seeking to sell their own versions of Amarin’s high triglycerides treatment, Vascepa. After which, Amarin’s share price was sent tumbling by an almighty 70% in one session.

As Vascepa is Amarin’s sole product, many wondered where the biopharma could go next, with limited commercial opportunities in tow. Although Amarin is expected to file an appeal next week – with hope of a verdict by year’s end or early next year – its whole raison d’etre was bought into question. That said, while some project uncertainty, others see opportunity.

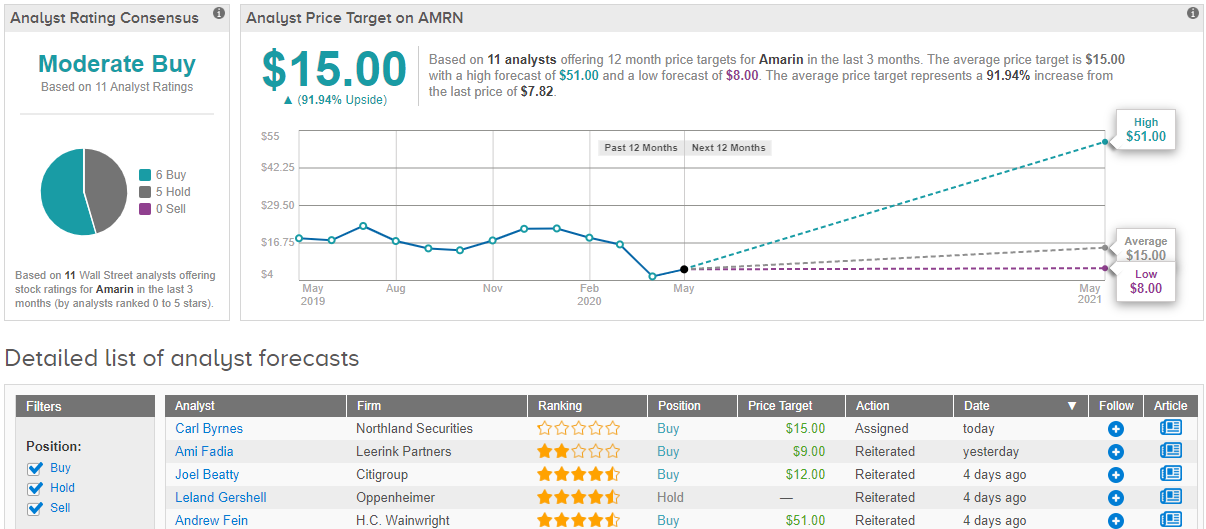

Earlier today, Northland Securities analyst Carl Byrnes initiated coverage of Amarin with an Outperform rating and a $15 price target. Investors could be taking home gains in the magnitude of a blockbusting 92%, should the target be met in the coming months. (To watch Byrnes’ track record, click here)

So, in the midst of such anxious times, what has instigated the glowing assessment?

Although Byrnes acknowledges the patent litigation is still a “major risk,” the analyst maintains the “potential threat from generic competition may prove to be greatly overstated.”

Why? Byrnes explains: “First, it is our belief that Amarin has secured the majority of existing capacity to produce FDA grade icosapent ethyl. Secondly, we estimate the costs associated with building out capacity to produce sufficient quantities of FDA-grade icosapent ethyl could easily exceed $750MM due to the complexity of the separation and purification technologies necessary to insure batch consistency, purity, stability, and other criteria, making it economically infeasible.”

The conclusion for Byrnes is clear, as he forcefully surmises “the potential generic competitors will NOT have access to sufficient quantities of FDA-grade API for commercial purposes.”

Taking a step back from the litigation issues, it should be noted that things looked very different for Amarin at the turn of the year. In December, the FDA approved Vascepa’s label expansion to include patients at risk of a heart attack and other major adverse cardiovascular events (MACE). Following the label’s expansion, Amarin doubled its US salesforce, received “preferred brand status from key payers,” and, consequentially, sales in 1Q20 were up 110% year-over-year and reached $152 million.

Byrnes estimates the TAM (total addressable market) for Vascepa in the US to be more than $24 billion with potential peak sales over $6 billion, while EU sales could surpass $2 billion. Vascepa is currently in development in China with topline data expected by the end of the year, which could act as a further catalyst.

What about the rest of the Street’s take? Based on 6 Buys and 5 Holds, Amarin currently has a Moderate Buy consensus rating. At $15, the average price target is identical to Byrnes’. (See Amarin price targets and analyst ratings on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.