After an exceptional performance in the first quarter, bolstered by stay-at-home measures which drove consumers’ demand for Amazon’s (AMZN) products, Amazon has hit a speed bump. The stock tumbled nearly by 8% in Friday’s session following the release of first-quarter earnings.

Amazon’s increased sales in the quarter has come at a cost, as the price for fulfilling the surging demand has taken its toll on profitability.

Amazon reported revenue of $75.5 billion, up 26.5% year-over-year and beating the estimates by $1.41 billion. The additional spending, though, means operating income dropped from $4.4 billion to $4 billion and resulted in EPS of $5.01 missing the estimates by $1.10.

Although the company believes 2Q20 will bring in sales between $75 billion to $81 billion (indicating a year-over-year increase between 18-28%) it expects to shoulder COVID-19 related costs of $4 billion, including paying higher wages, increasing lab testing, and providing more protective personal equipment. Accordingly, Amazon forecasts operating income to come in somewhere between a loss of $1.5 billion to a profit of $1.5 billion.

5-star Monness analyst Brian White believes Amazon’s aggressive investing plan to further grow the company will hurt profits in the short term, however, its “growth path is very attractive across the e-commerce segment, AWS, digital media, advertising, Alexa and more.”

White further noted, “During this crisis, Amazon has proven irreplaceable in delivering the daily necessities to people around the world, a fact that we believe will increase the number of customers on the platform, expand the list of products purchased by existing customers and accelerate the shift to ecommerce at large. Ultimately, we believe Amazon will emerge from this crisis with a stronger brand and even more durable business.”

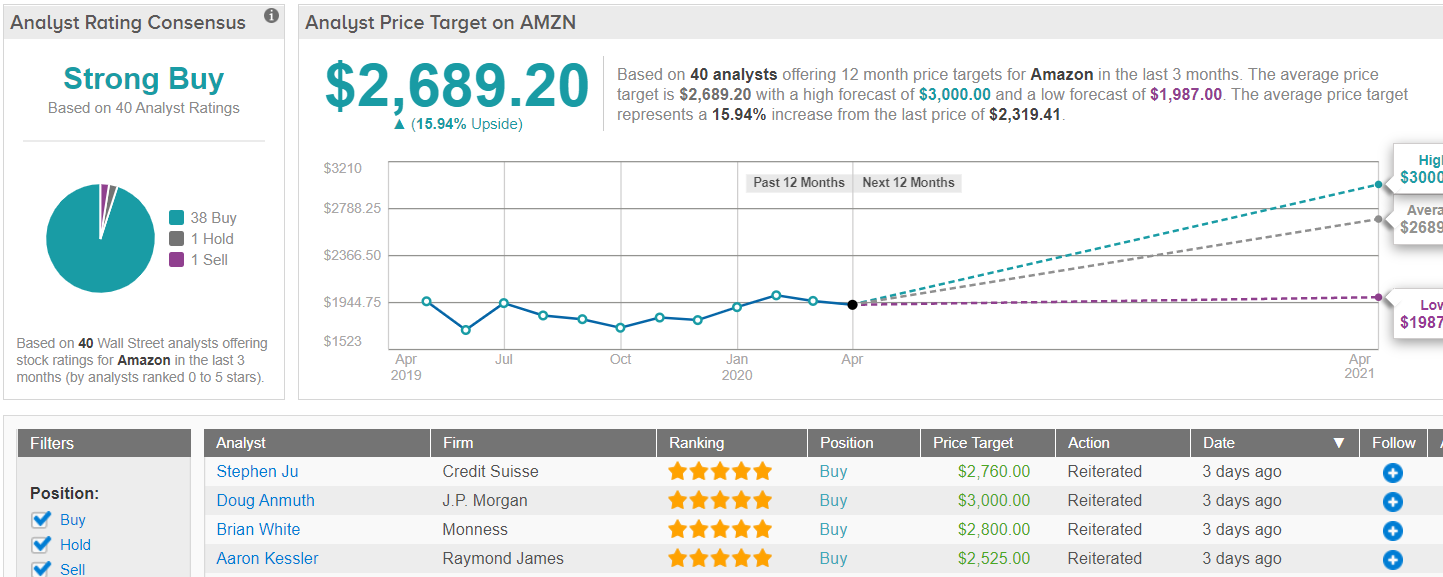

White, therefore, reiterated a Buy rating on Amazon shares, while raising his price target from $2,650 to $2,800, which implies about 21% upside from current levels. (To watch White’s track record, click here)

Overall, the recent sell off hasn’t dampened the Street’s view, as it remains firmly on Amazon’s side. A Strong Buy consensus rating is based on 38 Buy ratings. At $2,689, the average price target indicates possible upside of 16% in the year ahead. (See Amazon stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.