Amazon (AMZN) stock took a huge hit on the chin amid the market sell-off as retail stocks slid over fears of a potential consumer recession. Undoubtedly, the “roaring 20s” seems to have ground to a slowdown, with some fearful that an economic downturn could cause even more pain in the sinking retail stocks.

Undoubtedly, the recent quarter Amazon dealt to investors was brutal. The company missed the mark and appeared to have overinvested in the face of a consumer slowdown.

After shedding more than 42% of its value from peak to trough, many may question the firm’s ability to grow under the Andy Jassy era. Jassy may be in the early innings of his tenure, but it has not been an impressive start for the man who took AWS to the next level. Whether or not ex-CEO Jeff Bezos is inclined to return to the helm, Amazon’s growth days are likely far from over.

Sure, the consumer hasn’t been as strong this earnings season. However, don’t group Amazon with other fallen FAANG stars like Netflix (NFLX) or Meta Platforms (FB), which are facing tremendous pressure on their business models. If anything, Amazon is navigating through temporary pressures that should subside once macro conditions normalize and consumers get ready to spend again.

Many consumers likely have balance sheets that are more swollen than they were before pandemic-era lockdowns. I’d look for consumers to put that money to work in discretionaries once confidence has a chance to improve, perhaps after the worst of inflation is over with.

As shares of the e-commerce behemoth heat up again, heading into its big 20-to-1 stock split scheduled for June 6, I remain incredibly bullish.

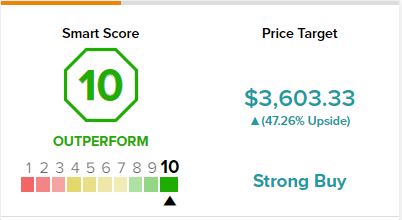

Likewise, on TipRanks, AMZN receives a ‘Perfect 10’ Smart Score rating, indicating a high potential for the stock to outperform the broader market.

Fallen FAANG Play Likeliest to Recover? My Pick Would be Amazon Stock

Though stock splits generate no value, they could incentivize smaller retail investors to give the fallen FAANG stock a second look. In essence, the move could shine a bright light on the undervaluation of a company that’s still firing on all cylinders.

Amazon was the priciest FAANG stock heading into the brutal tech-focused market sell-off. Arguably, it still is, as it is trading near 60 times trailing earnings. That said, many of the headwinds facing the firm seem to be more transitory in nature. Most notably, the impact of inflation and labor pressures are not factors that will weigh down Amazon forever. Things could drastically improve on both fronts over coming quarters. There’s a chance that Amazon’s prominent profitability pressures may dissipate far quicker than expected.

Inflationary headwinds have proven difficult for any retailer to dodge and weave past. However, the overinvestment in excess capacity exacerbated Amazon’s margin woes for its latest quarter. The company can’t point the finger at the macro environment for such a fumble.

In any case, such overinvestment may be a part of its long-term plan to ramp up its “Buy with Prime” service for other retailers. The service aims to better compete with traditional logistics-service providers like FedEx (FDX) and UPS (UPS). Undoubtedly, such a service could grow to become yet another colossal segment for the firm.

Such investments aren’t likely to be appreciated by investors anytime soon. Rate hikes are fuelling demand for nearer-term profitability prospects and hurting firms investing heavily in forward-looking growth initiatives.

Longer-term investors have a lot to get excited about as management looks to navigate through harsher waters, even with the seemingly stretched price-to-earnings multiple and a waning consumer. As inflationary headwinds pass and consumer sentiment heals, Amazon stock could easily find itself right back to its all-time highs.

Indeed, the timely stock split may be the catalyst that gets investors excited again.

Amazon CEO Andy Jassy Has a Lot to Prove

Andy Jassy has some pretty big shoes to fill. Thus far, the stock price action suggests Jassy may not be able to fill them. Still, the horrific macro environment is mostly to blame for the meager performance over the past two years.

Despite recession fears and investor distaste for pricier stocks, don’t expect Amazon to steer too far away from its roots. The company has its foot on the gas and is willing to sacrifice some of its near-term margins to improve its longer-term fundamentals. The company is still very much in growth mode. Nonetheless, it could take another year for the firm to get its margins back on track. Of course, this is assuming rate hikes can stamp out inflation without triggering too severe a recession.

For now, Jassy deserves the benefit of the doubt as Amazon stock looks to bounce back from one of its worst plunges of the modern era.

Wall Street’s Take

Turning to Wall Street, AMZN stock comes in as a Strong Buy. Out of 38 analyst ratings, there are 36 Buys, one Hold, and one Sell recommendation.

The average Amazon price target is $3603.33, implying upside potential of 47.3%. Analyst price targets range from a low of $2,800.00 per share to a high of $4,250.00 per share.

The Bottom Line on Amazon Stock

Though stock splits don’t create value, they can reignite interest and help investors rediscover value in a name that’s been neglected. As one of the fastest-growing FAANG companies, I’d argue that Amazon stock looks very interesting ahead of its massive 20-to-1 split. This is despite all the macro storm clouds.

Discover new investment ideas with data you can trust.

Read full Disclosure