Anything you can do, I can do… just as bad as you? On Thursday, Amazon (AMZN) joined the list of fallen tech giants. After disastrous results for Alphabet, Microsoft and then Meta, the ecommerce leader took its turn to reflect the difficulties faced by the market leaders in the current economic climate.

Shares are taking a hit in pre-market trading after the company said it expects a deceleration in sales growth for the holiday season, with waning demand amidst fears of a recession and the strong dollar all taking their toll. Meanwhile, Amazon also delivered a mixed Q3 report.

First, the bright spot; posting a quarterly profit for the first time in 2022, Amazon delivered EPS of $0.28, coming in ahead of the Street’s forecast of $0.22.

But there was a miss on the top-line as revenue increased by 14.7% year-over-year to $127.1 billion, falling shy of the consensus estimate by $370 million.

Exhibiting the lowest growth rate since the start of 2014, AWS sales increased by 27.5% from the same period a year ago to $20.5 billion, below the analysts’ prediction of $21.2 billion.

And then there was the guide; for Q4, Amazon’s operating income is expected in the region between $0 and $4.0 billion, with sales coming in between $140 billion to $148 billion. That was a big letdown as Wall Street had called for operating income of $5.05 billion and revenue of $155.09 billion.

With the shares hammered and the stock on course to head back below the $1 trillion market cap threshold for the first time since April 2020, Truist’s Youssef Squali has some reassuring words for battered investors.

“AMZN’s results were generally in line with expectations but the linearity of 3Q and the 4Q guide show that demand trends are slowing into October,” the 5-star analyst said. “In addition to macro headwinds, AMZN is also working to regain productivity losses from Covid, which are taking a bit longer to materialize and weighing on margins. That said, we view these challenges as temporary and see AMZN with the power of Prime, AWS leadership and rapidly growing ad business as best positioned to ride these multiple secular growth trends in FY23/beyond.”

To this end, Squali maintains a Buy rating although the price target is lowered from $170 to $160. Still, the revised figure suggests shares will climb 44% higher over the coming months. (To watch Squali’s track record, click here)

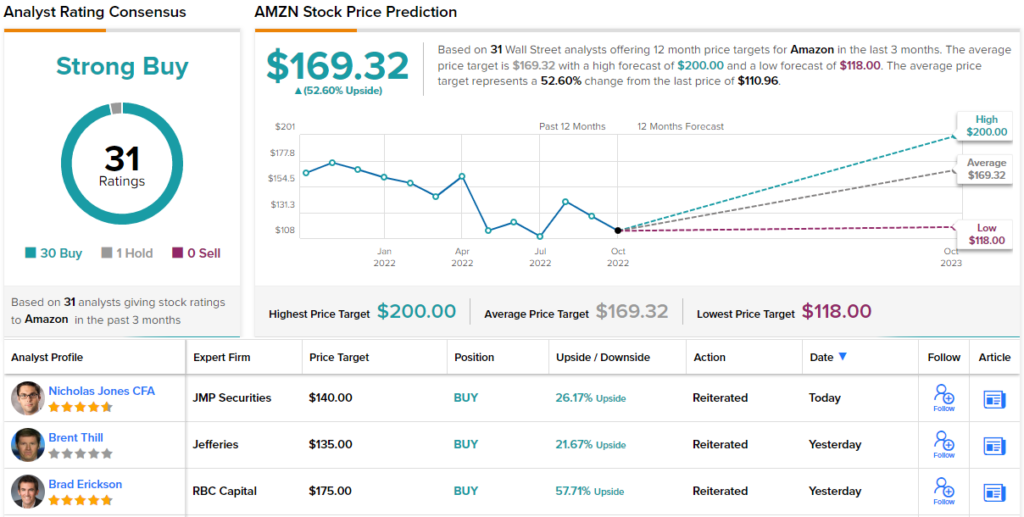

Amazon remains a favorite on Wall Street. While one analyst stays on the sidelines, all 30 other reviews on file are positive, making the consensus view here a Strong Buy. Going by the $169.32 average target, the shares have room for 53% growth in the year ahead. (See Amazon stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.