Shares of Amazon (NASDAQ: AMZN) have been on an upswing in the past month, up 6% fueled by its Prime Day event. Last week, Amazon declared the Prime Day event on July 12 and July 13, which was a stupendous success and stated that customers purchased more than 300 million items and spent around $3 billion.

According to Evercore analyst Mark Mahaney, this “implies over 20% Y/Y [year-over-year] growth in items sold vs. last year’s two-day Prime Day event.”

The analyst also pointed out that for AMZN, its items sold have grown at a compounded annual growth rate (CAGR) of 20% in the past three years, which was an “intrinsically high growth rate” and better than any other retailer.

Mahaney anticipates that Amazon generated around $8.2 billion in gross merchandise value (GMV) and $4.4 billion in terms of revenues over its two-day Prime Day event, making up 3% to 4% of the analyst’s revenue estimate for the fiscal third quarter.

Other Key Highlights of Amazon’s Prime Day Event

Mahaney highlighted some key trends from Amazon’s Prime Day event that boded well for the Internet retailing giant, which include the addition of three new countries this year. Mahaney believes that the company has been adding two new countries every year since 2019.

The analyst was also upbeat about premium brands on AMZN, including Apple Watch Series 7, beauty brands LANEIGE and NuFACE gaining traction, and the best-selling categories this year, including Amazon Devices, Consumer Electronics, and Home.

Wall Street Is Bullish about AMZN

Although Mahaney acknowledged that the macroeconomic environment remains tough, he remained bullish with a Buy rating and a price target of $180 on the stock. The analyst’s price target implies an upside potential of 56.7% at current levels.

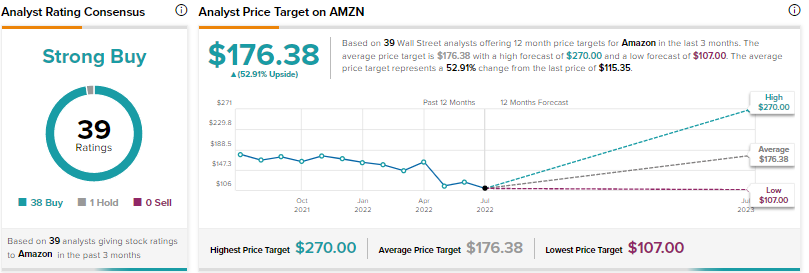

Amazon also scored a Strong Buy consensus rating from Wall Street analysts based on 38 Buys and one Hold. The average Amazon price target of $176.38 implies an upside potential of 52.9% at current levels.

Conclusion

Judging from the success of the Prime Day event, it seems that Amazon is poised well to ride out the current macroeconomic volatility.

Amazon also scores a nine out of 10 on the TipRanks Smart Score system, indicating that the stock is highly likely to outperform the market.

The TipRanks Smart Score system is a data-driven, quantitative scoring system that analyses stocks on eight major parameters and comes up with a Smart Score ranging from 1 to 10. The higher the score, the more likely the stock will outperform the market.