AMC Entertainment Holdings Inc. (AMC) has struck a potentially precedent-setting deal with Universal Pictures that will see its theatrical releases reduced to 17 days before the movies become available for home-streaming.

Shares were down 3% at market close on July 28 at $4.15.

According to Variety on July 28, the deal allows Universal to stream their movie after a 17-day theatrical-run with the theater chain. The movies can then be streamed at charge of $20 as a “premium rental” for 90 days before dropping to the standard rental price of $3 to $6 dollars.

AMC CEO Adam Aron said in a statement on July 28, “AMC will also share in these new revenue streams that will come to the movie ecosystem from premium video on demand.”

Previously, movies typically saw a 70-90 day period before becoming available for home release. This release model has been the mainstay for decades, going back to when movie rentals became mainstream with VHS. No other theater companies or movie studios have commented on the deal, but the shift could transform how movies are marketed and distributed.

Universal Filmed Entertainment Group Chairman Donna Langely said on July 28, “The theatrical experience continues to be the cornerstone of our business.” She added, “The partnership we’ve forged with AMC is driven by our collective desire to ensure a thriving future for the film distribution ecosystem and to meet consumer demand with flexibility and optionality.”

The agreement with Universal could be a win for AMC as it finds a future revenue stream. With its theaters shuttered in light of the pandemic, the company has tried to avoid a default by making a credit agreement with its lenders. This week Apollo Global Management Inc. (APO) and other top lenders have stepped up with counteroffers to dissuade AMC from moving forward with private equity firm Silver Lake on a debt restructuring offer.

AMC states that it plans to reopen its theaters in mid to late August after recently pushing back its July reopening.

MKM analyst Eric Handler said on July 23 regarding the delays, “We’re in a big holding pattern right now. The industry is at the mercy of the municipalities of the biggest U.S. markets. The problem is in a number of markets, there are rising levels of Covid-19 cases.” He added, “It would be surprising to see theaters able to reopen nationwide before September, at the earliest.” Since May 27, the analyst has maintained a Hold rating and a price target of $5, which implies 22% upside potential.

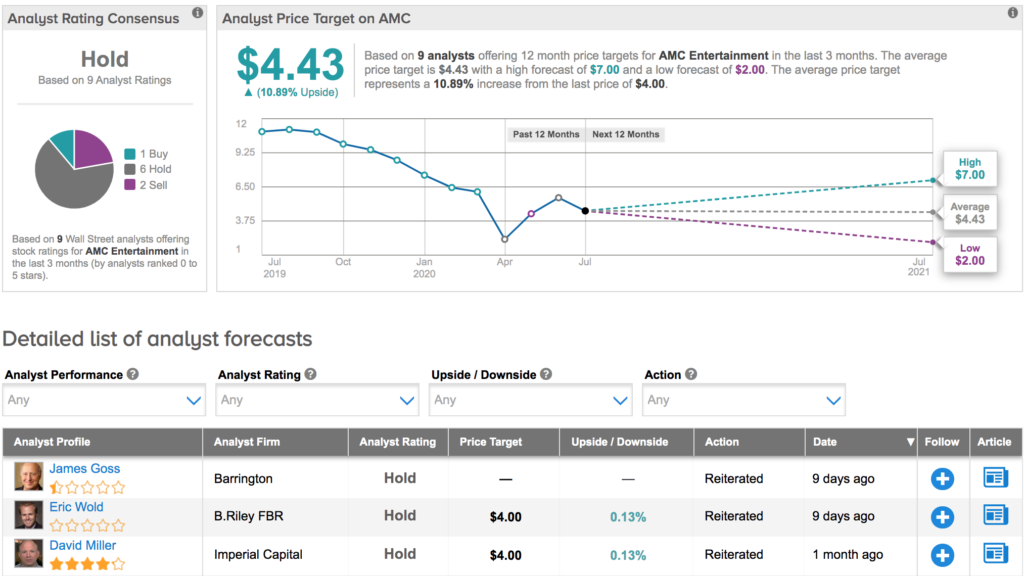

AMC’s stock is down 45% year-to-date with a Hold analyst consensus that breaks down into 1 Buy rating versus 6 Hold ratings and 2 Sell ratings. The $4.43 average price target suggests 11% upside potential for the shares in the coming 12 months. (See AMC’s stock analysis on TipRanks).

Related News:

Hasbro Reports Q2 Earnings Drop; Shares Fall 7%

AMC Postpones Theater Openings Again Following Movie Delays

Are These 3 Apparel Stocks Falling Out of Style? Analysts Weigh In