AMC Entertainment Holdings Inc. (AMC) plans to raise $500 million in debt to build up sufficient liquidity to withstand a global suspension of operations until a potential reopening of its movie theaters ahead of Thanksgiving on Nov. 26, if necessary.

The debt offering is expected to close on April 24, 2020, subject to customary closing conditions. Since mid-March, AMC Entertainment has been forced to close its movie theaters worldwide and temporarily suspend operations through the end of June as a result of the global lockdowns triggered by the coronavirus outbreak. During this period, the cash-strapped U.S. theater chain will generate no revenue, it said.

Shares of AMC which plunged about 60% this year, surged on Friday rising 31% to close at $3.20.

For now, the world’s largest movie theater said its current cash situation was sufficient to withstand a global suspension of operations until a partial potential reopening of its locations in July. As of March 31, AMC had a cash balance of $299.8 million, including borrowings in March 2020 of $215 million under its $225 million senior secured revolving credit facility due 2024 and the £89.2 million from its £100 million revolving credit facility due 2022.

To preserve more cash, the movie theater chain has suspended its dividend payment and share repurchase plans for this year.

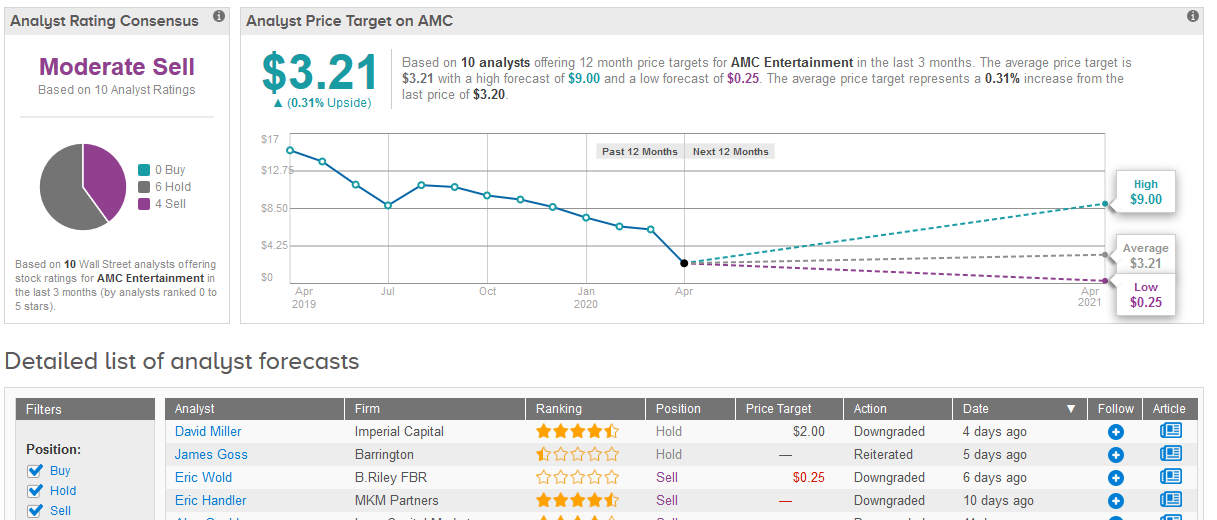

Wall Street analysts are bearish on the company’s stock. Out of the 10 analysts covering the stock in the past three months, 6 have Holds and 4 have Sells adding up to a Moderate Sell consensus rating. The $3.21 average price target implies little room for potential recovery of the shares in the coming 12 months. (See AMC stock analysis on TipRanks).

Related News:

Twitter Loses Six-Year U.S. Legal Battle Over Surveillance Secrecy Disclosure

Verizon Snaps Up Zoom Video-Conferencing Rival BlueJeans

Weekly Market Review: Bulls Looking Past the Curve